The Solana (SOL) price is awaiting solid bullish cues to break out of the consolidation it is currently in.

This might come with the support of the institutional investors whose interest is reigniting.

Solana Sees Large Inflows

While 2023 was a good year for Solana’s price, it was also a good year for the asset in terms of investment, particularly from large wallet investors who made SOL their favorite asset. However, since the beginning of the year, this changed.

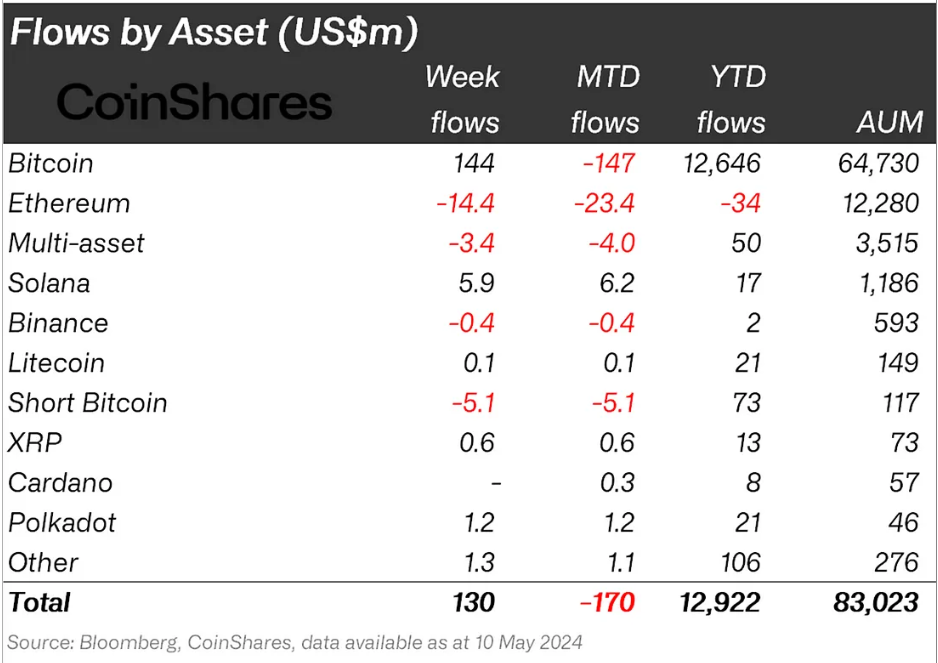

SOL noted fewer inflows than other altcoins such as Litecoin, Polkadot, and XRP. This is now changing, as Solana’s institutional inflows have risen considerably in the past two weeks.

For the week ending May 10, SOL emerged as the altcoin with the highest inflows, amounting to nearly $6 million. This bumped the net flows year to date, bringing it up from $11.1 million to $17 million.

Although other assets have noted much larger year-to-date flows, Solana’s price could likely catch up if this interest does not fade.

At the same time, a shift from bearish to bullish is close to being confirmed as well, looking at the Relative Strength Index (RSI). The RSI measures the speed and change of price movements. It’s used to identify overbought or oversold conditions in a market.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

The presence of the indicator above the neutral line at 50.0 can be observed, and testing this level as support would confirm the bullishness. This would aid SOL in observing and continuing any recovery that initiates in the coming days.

SOL Price Prediction: Key Level to Watch

Solana’s price, trading at $147, has been between $126 and $156 for nearly a month now. Three attempts at breaching the upper limit have failed, but with the help of institutions, the fourth attempt could succeed.

This would enable SOL to cross $160 and head towards $169, which is a key support level based on historical price action.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

However, another failed breach could lead to a drawdown with Solana’s price testing the local support at $137. Falling through this would result in a dip to $126, invalidating the bullish thesis.