Solana’s (SOL) price reacted to the broader market crash as the altcoin registered a massive decline in the last ten days.

This created panic among the institutional investors who opted to pull their money out of the asset.

Solana Institutions Turn Skeptical

Solana’s price is at $137, trying to bounce back from yesterday’s lows. SOL made a low of around $110 due to selling pressure, which has been evident in institutions’ behavior for over a week.

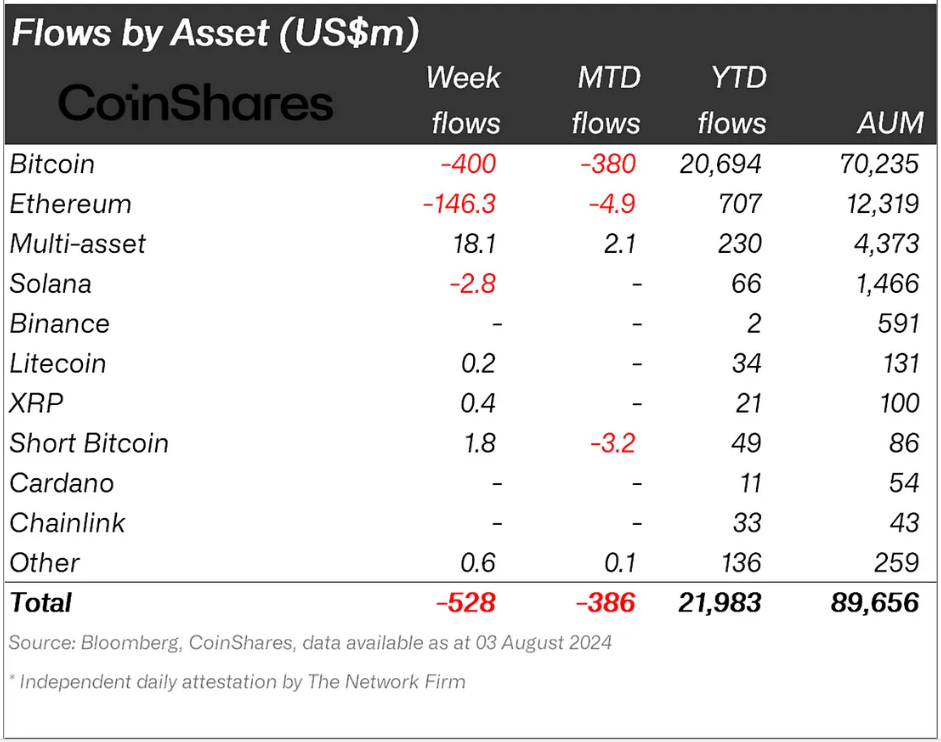

According to the CoinShares report, for the week ending August 3, institutional investors withdrew over $528 million from crypto assets. While most of it came from Bitcoin (BTC), Solana also registered $2.8 million worth of outflows.

Read more: Solana ETF Explained: What It Is and How It Works

Other altcoins did not witness any outflows, which shows that investors are significantly more involved with SOL, which shares the same stage as BTC and Ethereum (ETH).

Even though institutional data for the last three days has yet to be released, selling pressure is clearly intensifying. The Relative Strength Index (RSI) highlights this, sitting below the neutral line at 50.0.

The RSI measures the speed and change of price movements to identify overbought or oversold conditions. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 suggesting oversold conditions.

The decline in the indicators shows that the selling pressure is still active and heavily influences the token’s price. This pressure will have to dissipate for the altcoin to note a recovery again.

SOL Price Prediction: Failure After Failure

Solana’s price erased the recent 44% gains and also completely invalidated the bullish double-bottom pattern. The pattern had suggested a potential 31% rally that would have sent SOL to $245.

However, the altcoin failed the breakout and is currently trading at $137 at the time of writing. However, despite the drawdown, SOL did not fall through the critical support floor of $126. Thus, a bounce back is likely, which might struggle to breach past $156.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

Nevertheless, if the institutional investors were to pour money back into the asset, Solana’s price could push past $156. This would send the crypto asset to $180, invalidating the bearish thesis.