Despite rising interest in crypto exchange-traded funds (ETFs), BlackRock’s head of digital assets, Robert Mitchnick, has signaled a cautious approach. Mitchnick hinted that BlackRock might not file for a Solana ETF anytime soon.

Speaking at a Bitcoin conference in Nashville, he remarked on the unlikelihood of BlackRock launching ETFs for crypto assets like Solana, citing the substantial market cap and maturity differences between leading cryptos and smaller assets.

Why BlackRock Does Not Plan More Crypto ETFs

The crypto community had harbored high hopes for a Solana ETF, especially after the launch of Ethereum ETFs. However, Mitchnick indicated that the firm might not have plans for more crypto ETFs for the time being.

“I don’t think we’re going to see a long list of crypto ETFs. If you think of Bitcoin, today it represents about 55% of the market cap. Ethereum is at 18%. The next plausible investible asset is at, like, 3%. It’s just not close to being at that threshold or track record of maturity, liquidity, and etc.,” Mitchnick said.

In contrast, Nate Geraci, President of the ETF Store, highlighted the existence of Solana, XRP, and Cardano (ADA) exchange-traded products (ETPs) in Europe. He suggested a potential path forward might emerge under a revised regulatory framework.

“Surprised BlackRock would say this. It will definitely require a meaningful crypto regulatory shift/framework. But I think that will happen,” Geraci said.

Read more: Solana ETF Explained: What It Is and How It Works

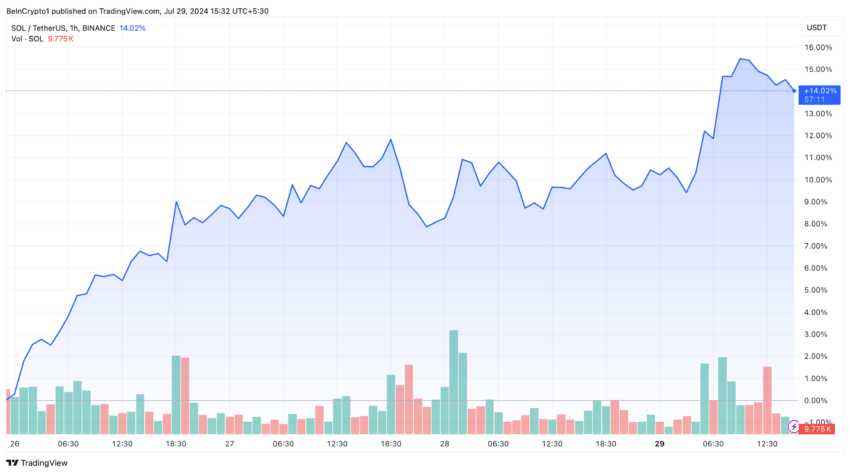

Despite these varied perspectives, Solana (SOL) has seen a substantial increase in market value. Currently trading at $191, it reflects a 14% rise since Friday. This surge propelled Solana to overtake BNB, becoming the fourth-largest crypto asset based on market capitalization.

Meanwhile, crypto analyst Miles Deutscher offered a balanced perspective. Although not optimistic about the immediate prospects of a Solana ETF, Deutscher acknowledged the rapid pace at which the crypto market evolves.

“I dont think we are getting a Solana ETF very soon. But then again, earlier in the year, people were saying that about Ethereum and because of the exponential effect of how quickly crypto grows and how much traction things get in a short amount of time, the Ethereum ETF was actually sped up. So we could see a similar thing with the Solana ETF, where it actually happen sooner than people think,” Deutscher suggested.

OpenEden co-founder Jeremy NG suggested Mitchnick’s skepticism about the approval of additional crypto ETFs beyond Bitcoin and Ethereum merely reflects the concerns of the SEC, and broadly, other traditional financial institutions.

“We don’t have to speculate since the SEC already highlighted several key issues previously in their approval decision such as: Detecting fraud/manipulation: Under Section 6(b)(5) of the Exchange Act, and Investor protection/market integrity: Under Section 11A(a)(1)(C)(iii) of the Exchange Act,” NG told BeInCrypto.

Nick Smart, intelligence & security director at Crystal Blockchain Analytics, shares this stance.

“I believe we need to take a bit of stock and look at where we have come, and how long it took to get here with BTC and ETH ETFs; these are well established and well documented chains, with large market caps and which regulators are familiar with now (at long last). I would not say never, nor would I say it is inevitable, but certainly not for the short or even medium term can we see regulators agree to list SOL or MATIC any time soon — they simply aren’t there yet,” Smart explained BeInCrypto.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

While BlackRock remains hesitant, other asset managers have taken more favorable stances toward Solana. Last week, Franklin Templeton, managing a colossal $1.64 trillion, highlighted Solana’s potential. The firm praised Solana for its major adoption and technological maturity.

“Besides Bitcoin and Ethereum, there are other exciting and major developments that we believe will drive the crypto space forward. Solana has shown major adoption and continues to mature, overcoming technological growing pains and highlighting the potential of high-throughput, monolithic architectures,” Franklin Templeton stated.

Meanwhile, asset managers like 21Shares and VanEck have already filed for spot Solana ETFs. Despite BlackRock’s reservations, this indicates a growing interest in diversified crypto investment products.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.