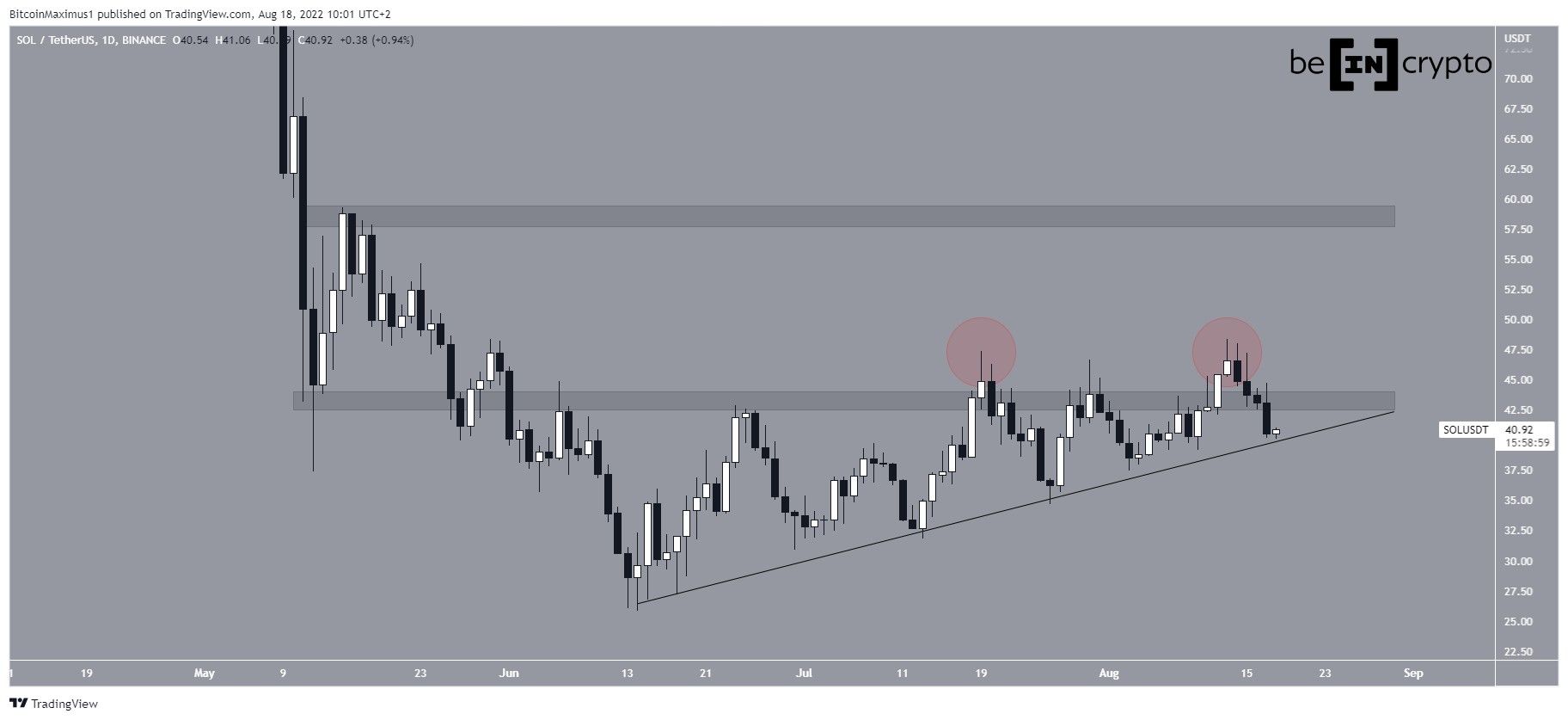

Solana (SOL) is trading close to the support line of a corrective pattern, a breakdown below which could greatly accelerate the rate of decrease.

SOL has been increasing alongside an ascending support line since June 14. The line has been validated numerous times, most recently on July 26.

While following the line, the price seemingly broke out above the $43.50 area twice. However, since neither of the breakouts could be sustained, they both turned to be deviations above the horizontal area. Such deviations are usually followed by sharp movements in the other direction.

If this occurs, the price would break down from the ascending support line.

Mixed indicator readings

A closer look at the daily RSI fails to provide definitive clues as to the direction of the trend. While the indicator has broken from an ascending support line (black), it is still following another longer-term line, which is created by a bullish divergence that preceded the entire upward movement (green line).

Furthermore, the RSI is right at the 50 line, which is considered a sign of a neutral trend.

The six-hour chart is more bearish, since it shows that SOL could have been trading inside an ascending parallel channel since its June lows. If so, it reached the resistance line for the final time on July 19 (red icon).

In this possibility, the Aug 13 high (red circle) failed to reach the resistance line and the price subsequently decreased below the middle of the channel. This is a very bearish sign since it suggests that the price did not even have sufficient strength to reach the top of the pattern.

So, the readings from this time frame indicate that a breakdown from the channel is expected. If it occurs, SOL could fall towards its June lows.

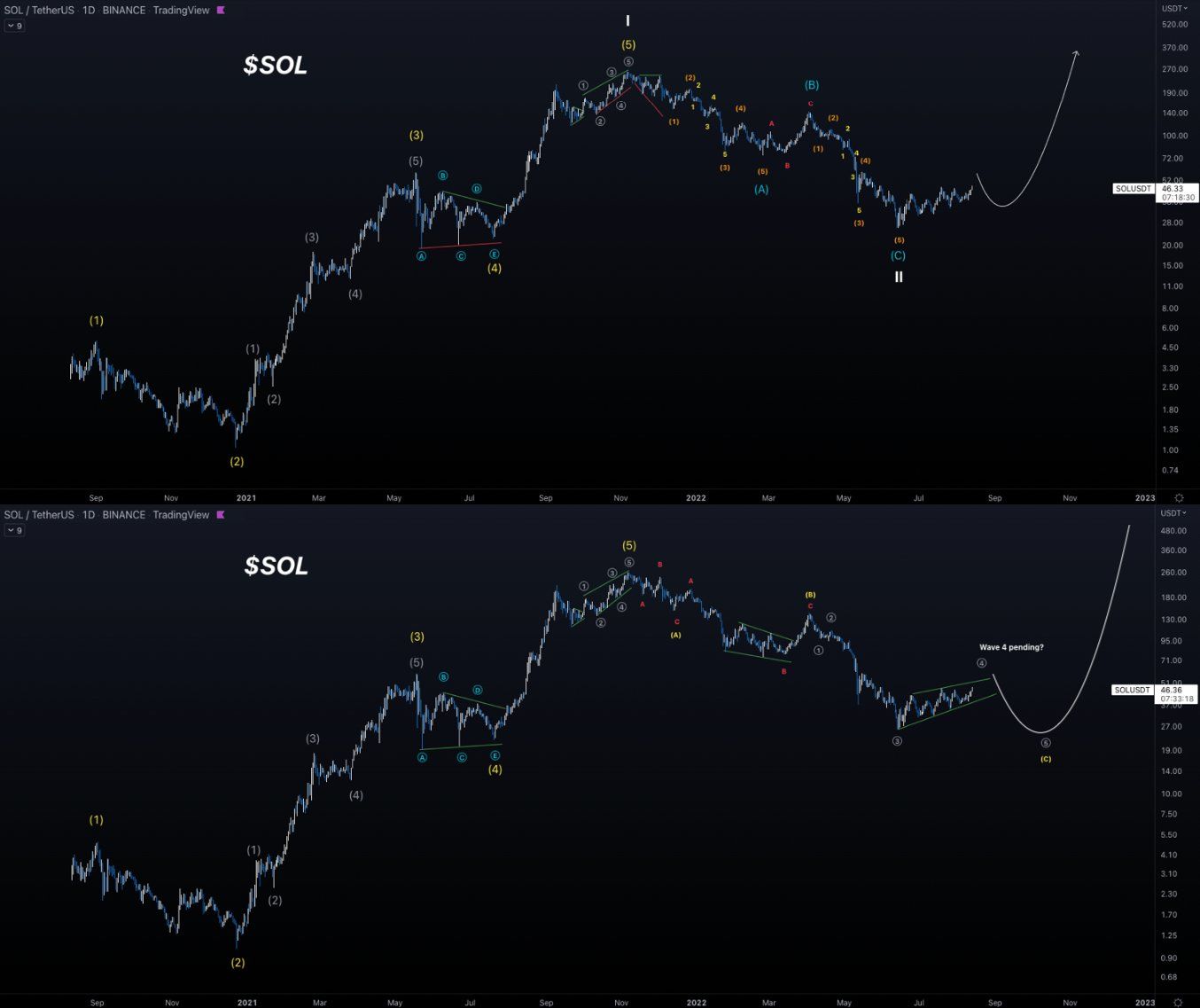

SOL wave count analysis

Cryptocurrency trader @Xforceglobal tweeted a chart of SOL, stating that the price has either begun a new bullish wave or has one more drop prior to the continuation of the upward movement.

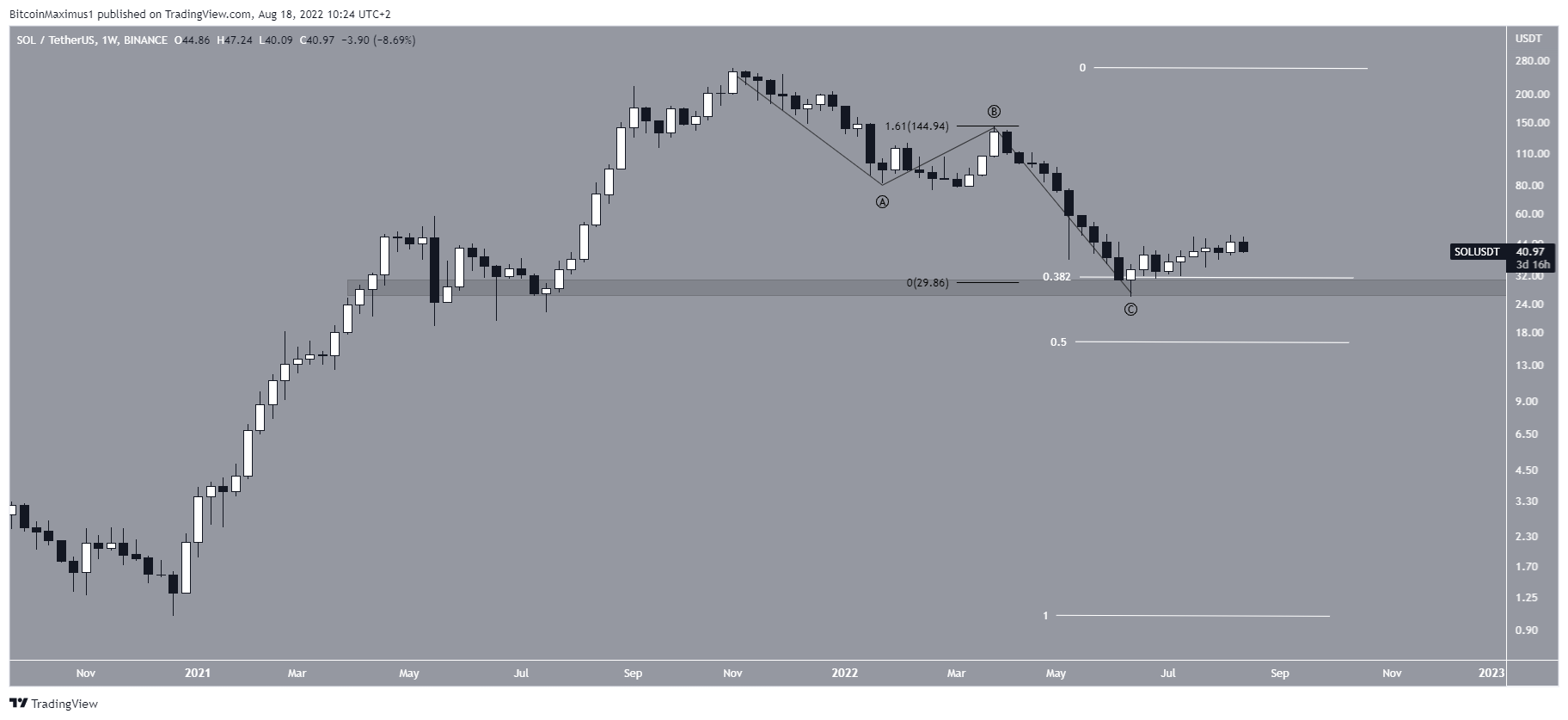

Due to the proportion of the movements, more specifically between the corrective waves A and C, the first count seems more likely, meaning that SOL has begun a new bullish movement. Waves A:C have had a 1:1.61 ratio, which is the second most common in such structures.

Furthermore, the price has bounced at the 0.382 Fib retracement support level when measuring the entire upward movement. This also coincided with a bounce at the $26 horizontal support area.

A decrease below the June low of $25.85 would invalidate this particular wave count. In this possibility, SOL could decrease towards $16, the 0.5 Fib retracement support level.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.