Solana’s (SOL) price could be on the path of recovery, provided it can sustain the bullish cues being flashed across the market.

One benefit of SOL is that the altcoin could break away from Bitcoin, the biggest crypto asset in the world.

Solana Investors Hope for Gains

Solana’s price could take after the investors’ optimism as they continue to boost the network. Evidence of their bullishness is visible in SOL’s Open Interest (OI). Open interest (OI) represents the total number of outstanding futures or options contracts that have not been settled.

Over the past two weeks, this OI has risen by more than $700 million, from $1.7 billion to $2.4 billion. This sharp increase shows that investors are still pining for a price rise.

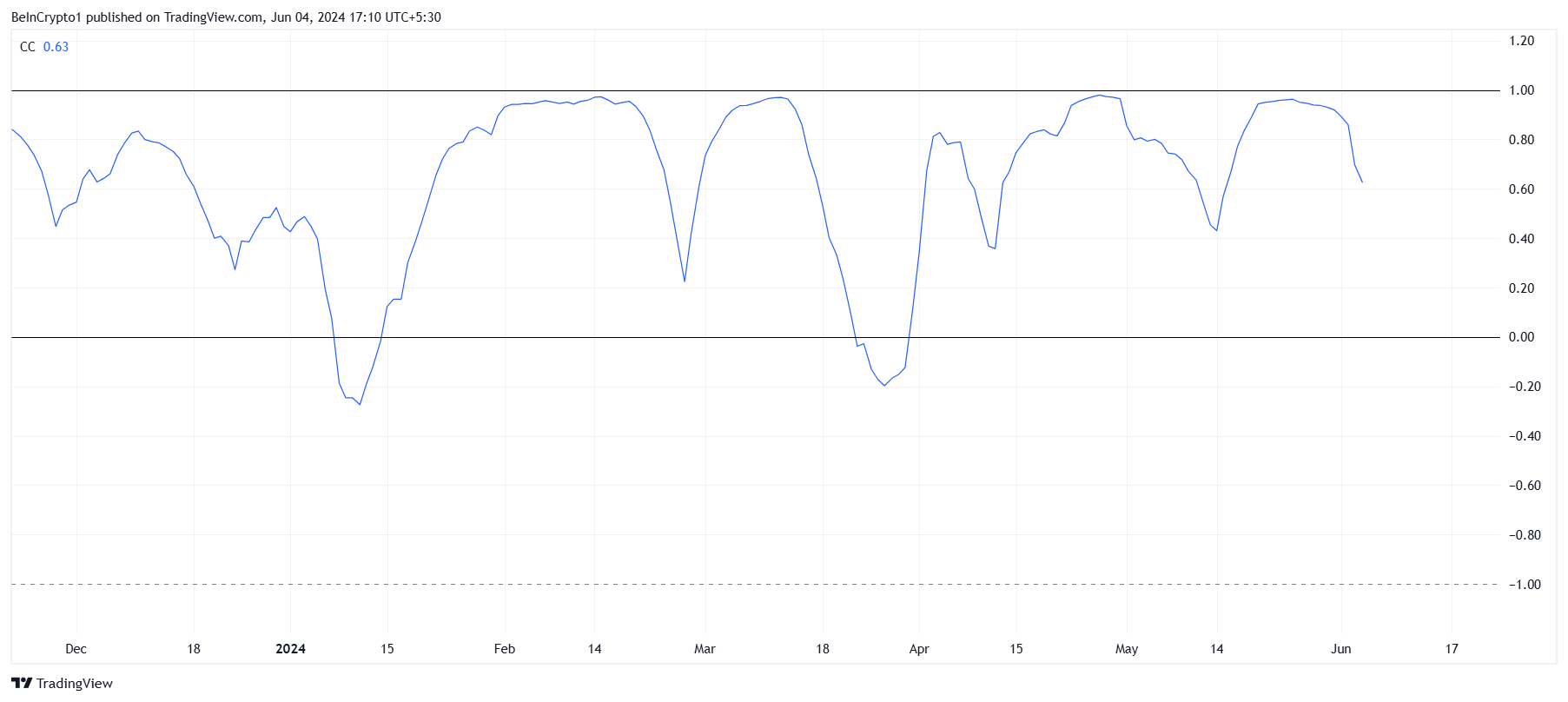

Secondly, the correlation between Solana and Bitcoin is also actively dropping. A drop in the correlation is generally considered to be a bearish sign since BTC’s rise helps the altcoin rise, too.

However, at present, this breakaway is a boon for SOL. The reason behind this is the historical instances where the altcoin rallied every time its correlation to BTC fell. At the moment, this correlation stands at 0.63, falling lower.

Read More: What Is Solana (SOL)?

Since Bitcoin’s price too is observing consolidation and slow recovery presently, SOL could benefit by charting its own path.

SOL Price Prediction: Can It Climb Back?

Solana’s price failed to close above the $190 barrier again and has since declined. The altcoin is currently changing hands at $165 back under the resistance of $169. A bullish outcome seems possible if the aforementioned cues are to be considered.

This would require SOL to first cement $170 as a support floor, then flip $175 into support as well. Subsequently, a rise to $190 and a test of the resistance would be considered a successful recovery.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

However, if securing $170 and $175 as support floors fail, it would not be surprising to see SOL fall to $156. Losing this support would invalidate the bullish thesis for Solana’s price, sending it to $137.