Solana price has been struggling to find a lasting footing. It’s up 1% in the past 24 hours but still down nearly 31% over the past month. The early-November crash briefly pushed SOL near $146 before a minor rebound followed — only to lose strength again.

This pattern has become familiar: each attempt to recover fades quickly. The reason is simple — the balance that drives sustainable recovery still isn’t there.

The Market Balance Tilts Towards Bears as Selling Pressure Returns

Solana’s technicals and on-chain data both show an uneven setup between buyers and sellers. The Exponential Moving Average (EMA), which smooths price data to show trend direction, now indicates that a bearish setup is forming.

The 50-day EMA is approaching a crossover under the 100-day EMA, a move that typically signals that buyers are losing control.

Adding to this imbalance, the On-Balance Volume (OBV), which measures whether trading volume supports price direction, remains trapped under a descending trendline.

Each time OBV touched or neared that line, Solana saw only short-lived rebounds before sellers regained control. The last few examples occurred between October 12 and November 2, none of which were successful.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

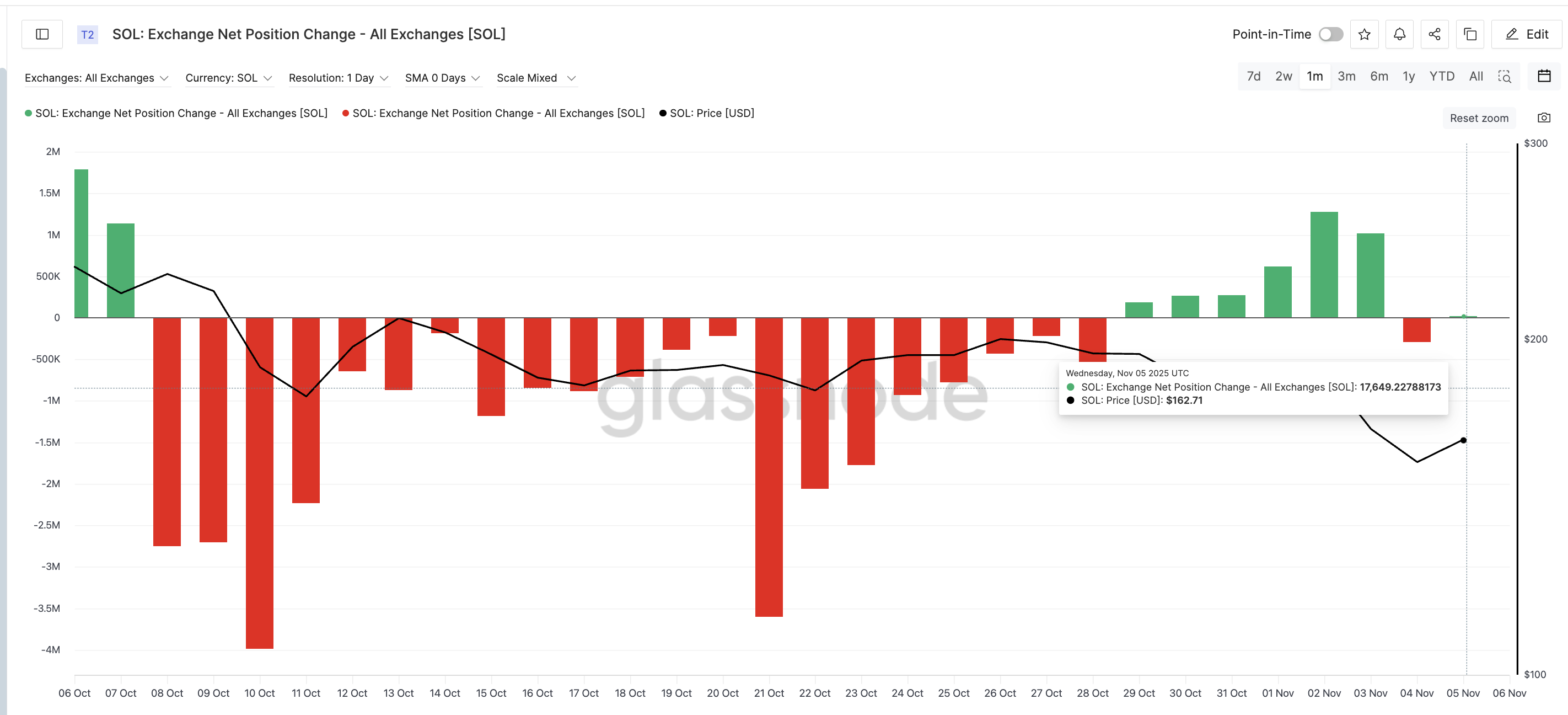

Exchange data also points to this shift in balance. On November 4, net exchange flows were –293,015 SOL, meaning tokens were being moved off exchanges.

By November 5, the figure had flipped to 17,649 SOL flowing back in — a 106% shift from outflows to inflows, signaling renewed selling pressure.

The return of exchange inflows means that retail and traders are once again offloading tokens. Until this dynamic flips, with sustained outflows and rising OBV, Solana’s balance stays tilted toward the bears.

Solana Price Validation Above $168 And Breakdown Below $146

Solana trades near $159, hovering around the 0.236 Fibonacci retracement level from the October 27 to November 4 swing. The next strong support lies at $146. If that level breaks, SOL could test $126, confirming further weakness.

For any recovery to hold, Solana must restore its technical balance. It needs OBV to break above its descending line and the EMA crossover to flatten.

However, the exchange netflow metric should point to outflows for those positives to surface. That would tilt the balance towards the Solana bulls.

If that happens, the first key resistance sits at $168. Above that, the next major barriers lie near $182 and $192.

Until then, Solana’s rebound attempts may keep failing — not because of a lack of effort, but because the market’s balance between inflows, outflows, and volume is still off and in favor of the bears.