Solana’s price has maintained an upward trend in recent days, fueled by increased demand for the popular altcoin. Currently trading at $148.06, SOL has risen by 2% in the past week despite broader market stagnation.

This uptrend has brought SOL to a key resistance level at $148.16, which it is now attempting to break. If Solana manages to surpass this resistance, it could spark a rally toward $210 and beyond. But how soon can this breakout occur?

Solana Witnesses Uptick In Demand

Solana’s Relative Strength Index (RSI) is in an upward trend at 53.93 as of this writing. This indicator measures the coin’s oversold and overbought market conditions.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. On the other hand, values below 30 indicate that the asset is oversold and may soon witness a rebound.

An RSI reading of 53.93 indicates that SOL buyers are gradually gaining strength, which could cause its price to maintain its uptrend.

Read more: Solana vs. Ethereum: An Ultimate Comparison

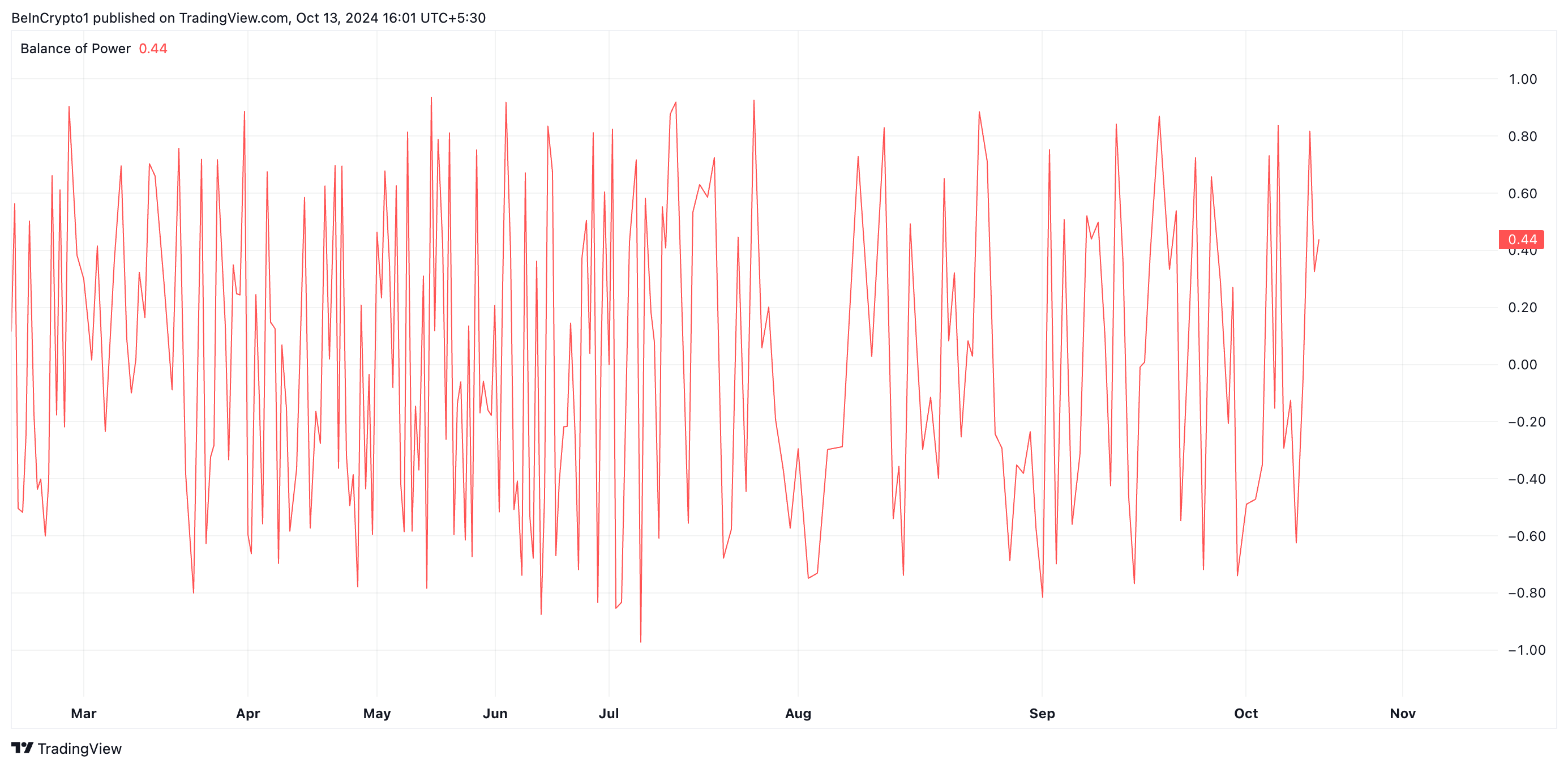

Moreover, SOL’s positive Balance of Power (BoP) supports this bullish outlook. This indicator measures the strength of buyers versus sellers in the market. At press time, SOL’s BoP is 0.44, suggesting buyers are in control and attempting to push the price higher.

SOL Price Prediction: A Succesful Retest Is Key

Solana is trading at $148.06, just below the resistance at $148.16. Since early August, this price level has seen significant selling pressure, with SOL attempting to break above it several times. Despite these efforts, each retest has failed to hold.

If the ongoing demand for SOL persists, the coin may rally beyond this resistance. A successful retest could trigger a surge toward $209.90, a high Solana’s price last reached in March.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, a failed retest of this resistance line could send Solana’s price plummeting toward $110.