Solana’s price has faced significant volatility over the past week due to recent market troubles. This has led to a sharp decline in its futures market sentiment as leveraged traders appear reluctant to take bullish positions.

This lack of confidence increases the risk of a further price drop, with SOL eyeing a dip below the $130 level in the near term.

Solana Struggles as Traders Exit

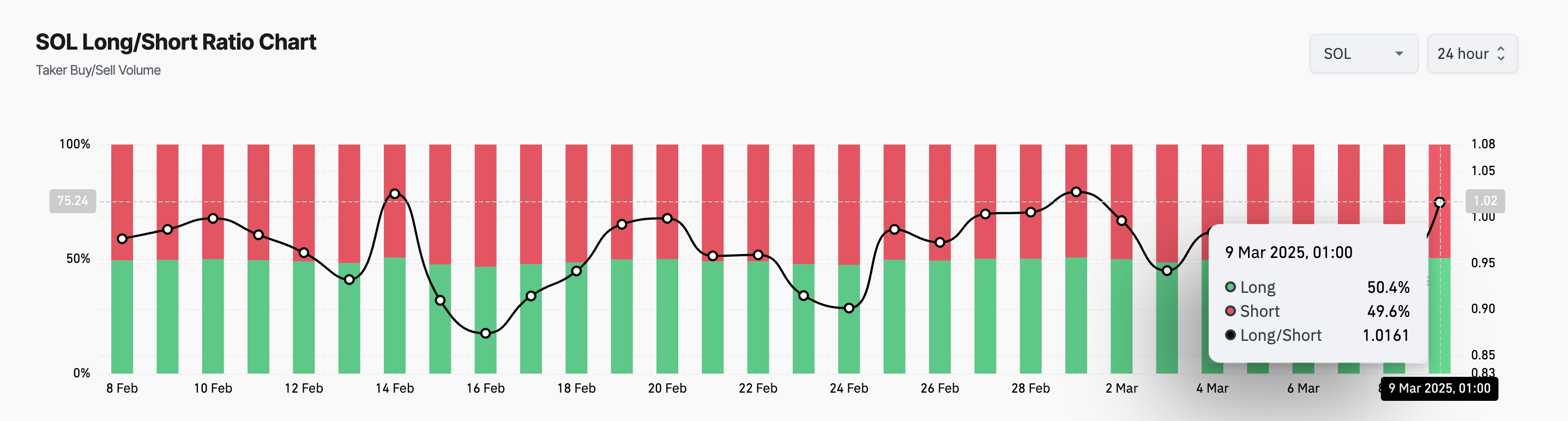

SOL’s negative funding rate is an indicator of the waning bullish bias among its futures traders.

According to Coinglass data, SOL perpetual futures have maintained a negative funding rate for the past three days, indicating that short sellers are paying to hold their positions. At press time, this stands at -0.0060%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot market.

As with SOL, when this rate is negative, it means that short sellers (those betting on a price decline) are paying fees to long traders, indicating a bearish sentiment in the market.

Therefore, more traders are positioned for a price drop, reinforcing the downward pressure on the coin’s price.

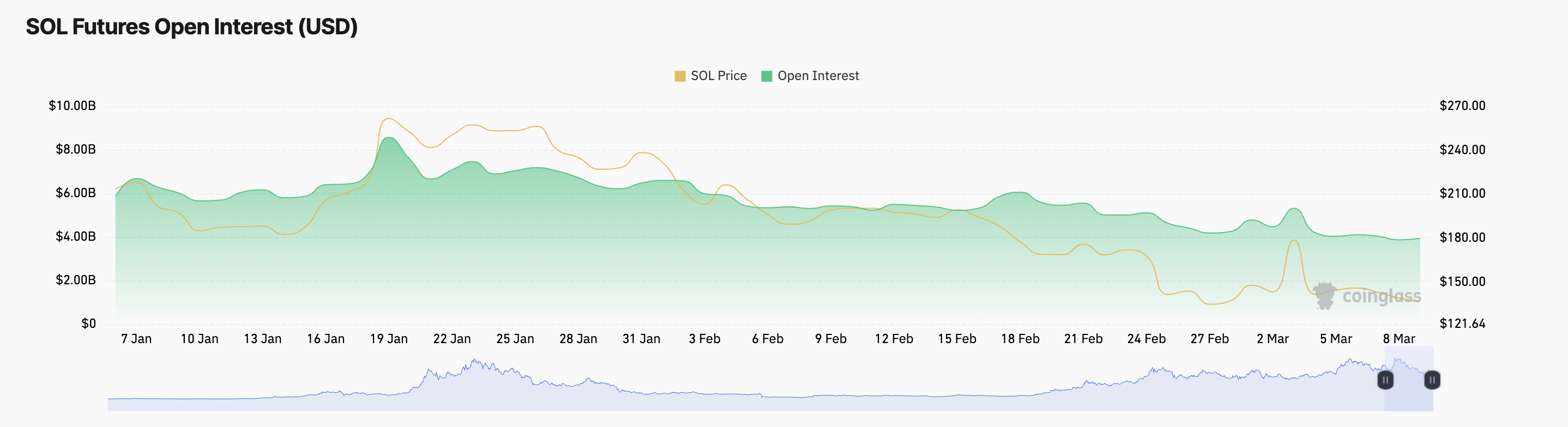

Moreover, the lack of confidence among SOL futures traders is reflected by its plummeting open interest. At press time, this is at $3.94 billion, falling 19% since the beginning of March.

An asset’s open interest tracks the total number of active futures contracts that have not been settled.

When this falls, especially during a period of price decline, it suggests that traders are closing positions without opening new ones. This confirms the reduced conviction in a short-term SOL price recovery among its futures traders.

Solana Bulls Weaken—Can They Prevent a Drop Below $130?

At press time, SOL trades at $137.70, resting just above the support floor of $136.62. As bullish sentiment tapers, this level risks being flipped into a resistance zone.

Should this happen, SOL’s price could slip below $130 to exchange hands at $120.72.

On the other hand, if bullish momentum returns to the SOL market, this bearish projection will be invalidated. In that scenario, new demand could drive the coin’s price to $182.31.