Solana (SOL) has been on a downtrend since May 21 and has formed a descending channel. Exchanging hands at $146.91 at press time, the altcoin currently trades at its lowest level in the last month.

With its price trending close to the lower line of the descending channel, if the bulls fail to defend that support level, SOL’s price might plummet further.

SponsoredSolana Bulls Have Support to Defend

Since Solana began its downtrend on May 21, its value has fallen by 18%. It has since formed a descending channel, a bearish signal suggesting sustained selling pressure.

The upper line of this channel acts as resistance, while the lower line represents support. SOL’s decline in the past few weeks has caused it to trend toward support at $139.54 When an asset’s price nears a level where it previously found support, the bulls may step in to defend it.

If the bulls succeed and the support level holds, the asset’s price could rebound toward the upper line at resistance. However, if the support line is breached, it indicates a continuation of the bearish trend, leading to a further decline in the asset’s value.

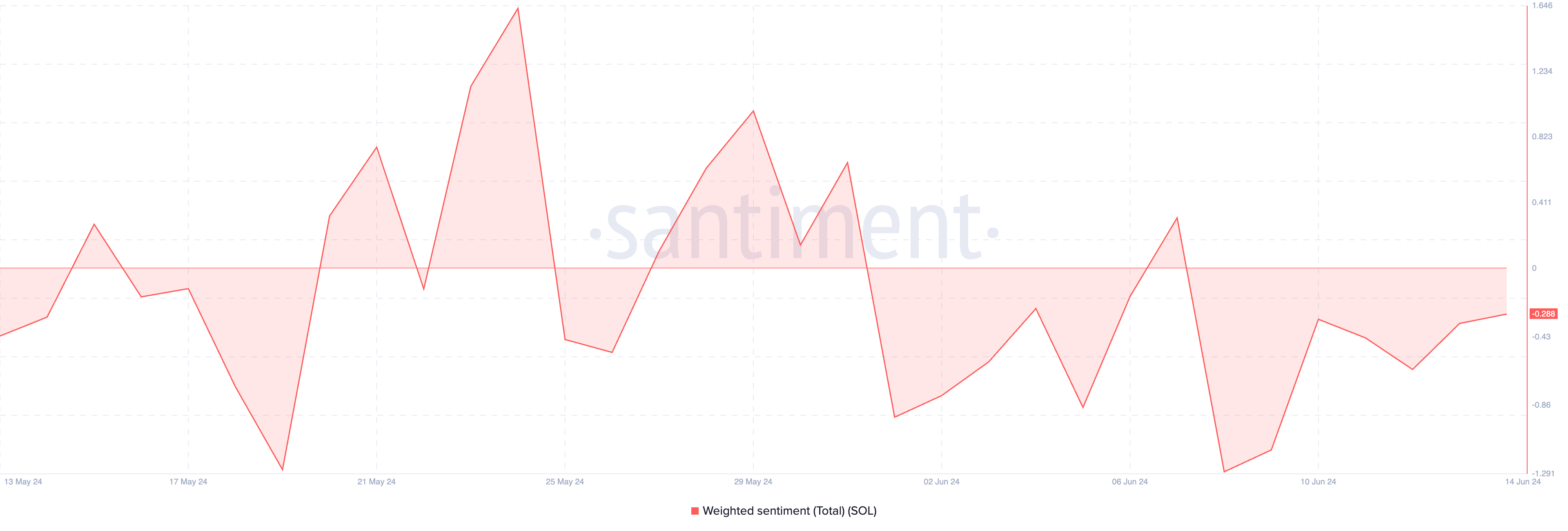

The sentiment trailing SOL has remained significantly bearish, making it unlikely for the bulls to successfully defend the support. Since June 1, SOL’s weighted sentiment has been negative. As of this writing, the coin’s weighted sentiment is -0.28.

This metric measures the overall positive or negative sentiment toward an asset. When its value is negative, it suggests that the negative bias toward the asset is significant.

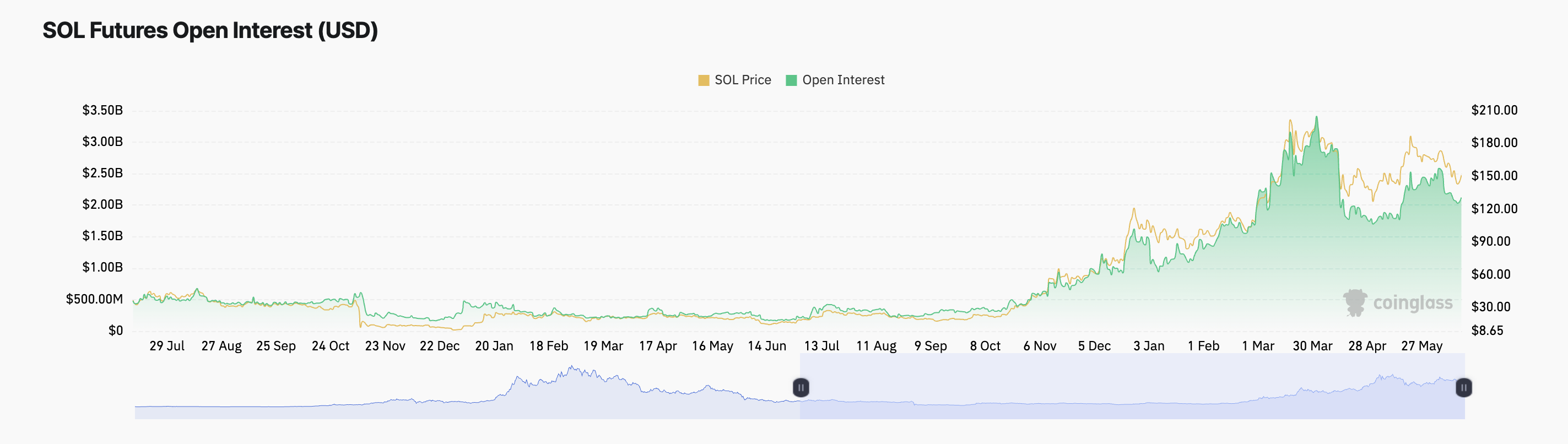

Further, SOL’s declining futures open interest confirms the negative sentiment among market participants. At press time, SOL’s futures open interest is $2.12 billion. It has fallen consistently by 18% in the past ten days.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

SOL’s futures open interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled. When it declines, more traders are closing their positions without opening new ones.

SponsoredSOL Price Prediction: Selling Must Be Kept at Bay

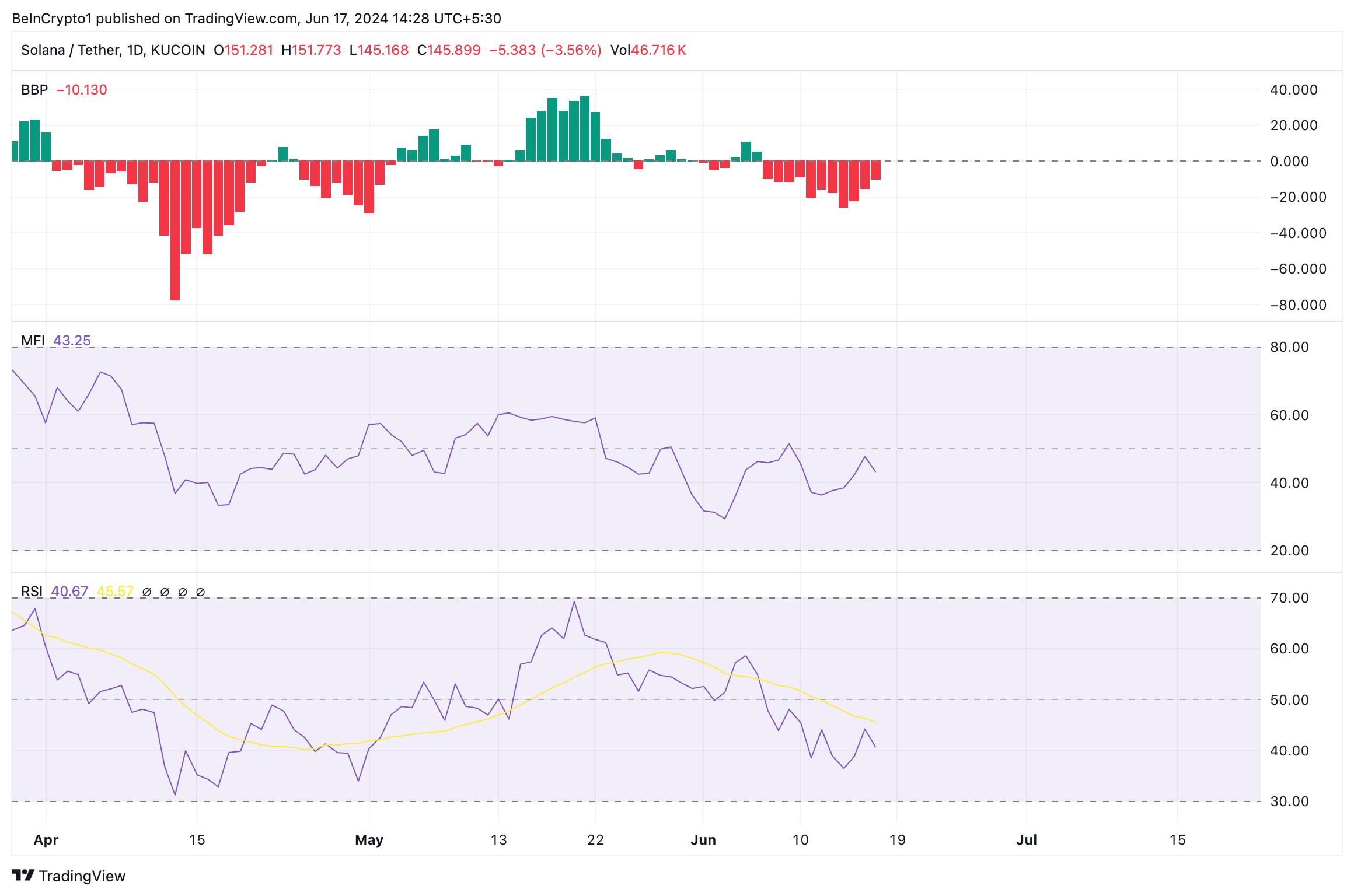

Readings from SOL’s key momentum indicators show an uptick in coin sell-off among market participants. For example, its Relative Strength Index (RSI) was 41.07, while its Money Flow Index (MFI) was 41.07.

These indicators measure an asset’s price momentum and identify potential buying and selling opportunities. At these values, they signal that buying activity is low.

Also, its Elder-Ray Index has been negative since June 7. This indicator measures the strength of bulls and bears in the market. When its value is negative, bear power is dominant in the market. As of this writing, SOL’s Elder-Ray Index is -9.8.

Sponsored

If bears continue to dominate the SOL market and selling pressure remains high, the altcoin’s value might fall under $140 to trade at $139.54.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

However, if the bulls re-emerge and buying activity returns to the SOL market, its price might climb toward $149.85.