Solana Telegram bot ecosystem hit a new milestone yesterday, with trading volume reaching $211 million, as reported by Dune Analytics.

The Trojan bot led this surge, recording a trading volume of $93.7 million, which accounts for nearly 44.4% of the total. The bot was launched earlier this year as a rebranded version of Unibot.

Solana Bots Continue to Dominate the DEX Trading Market

In terms of lifetime trading volume, BonkBot still holds the largest share of the DEX bot market. BonkBot’s lifetime trading volume currently stands at $8.69 billion, followed by Maestro and Trojan.

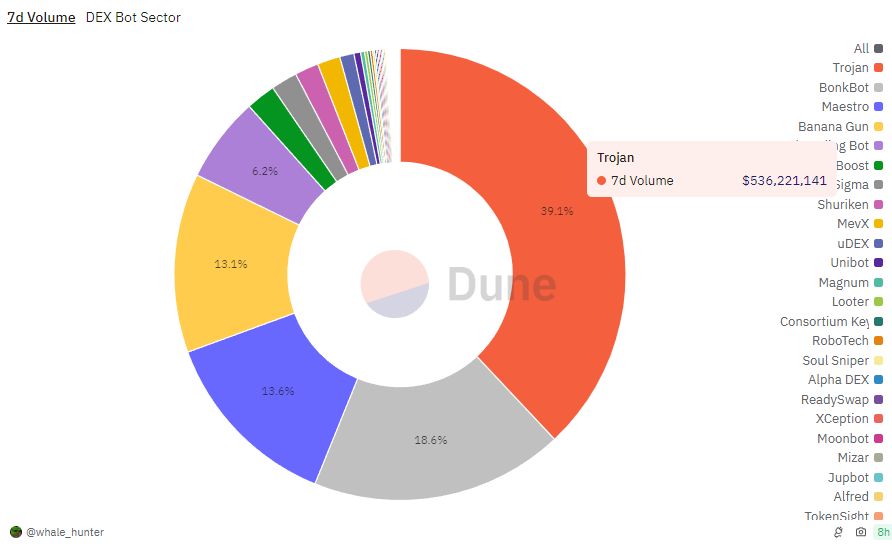

However, Trojan has recently dominated the market in terms of average weekly volume. Data from Dune shows that Trojan’s weekly volume accounts for 39% of the entire DEX bot sector trading. This is followed by BonkBot, which accounts for 13.6%.

Read more: Do Crypto Trading Bots Work?

Solana’s network activity surged to a peak as its Real Economic Value (REV) — a key measure of blockchain revenue — hit a record $11.1 million on October 24, likely driven by a recent spike in meme coin trading.

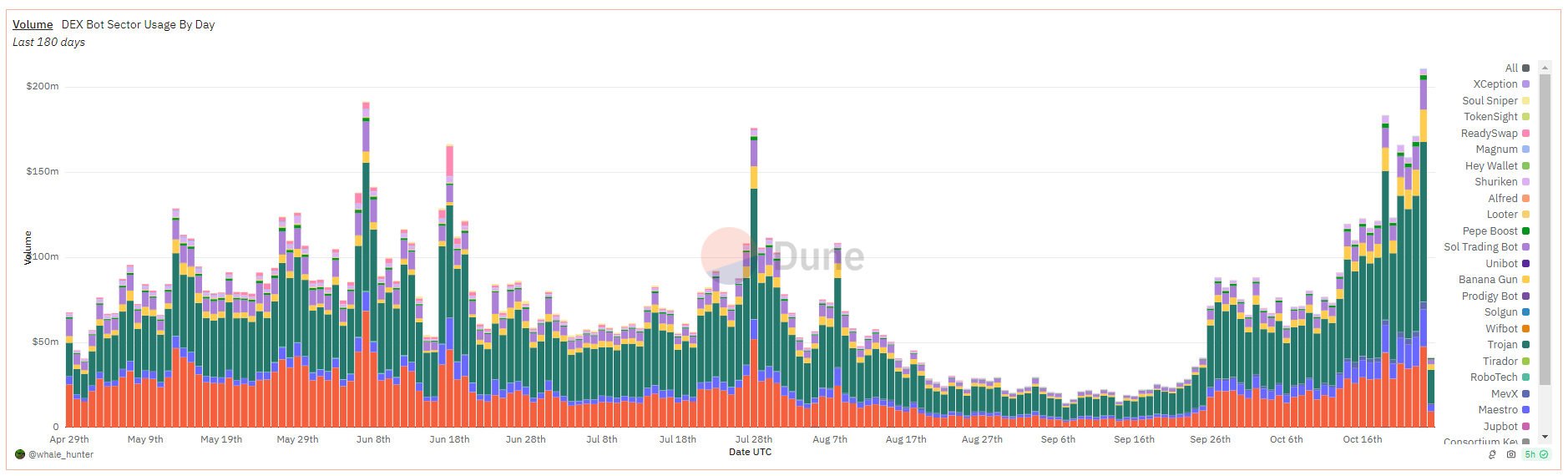

Since October 19, Solana’s economic activity has consistently outpaced Ethereum’s, marking a notable shift in the market. Additionally, DEX bot activity on Solana has skyrocketed, with daily bot trading volumes soaring nearly 70-fold in two months, from around $30 million in September.

This trading momentum has positively impacted SOL, which is up by 15% this week. Additionally, Solana’s DEX Raydium recently surpassed Ethereum in daily fees collected. Fees on Raydium, primarily from swap transactions, mirror the heightened activity on the platform.

The current liquidation map reveals a bullish sentiment among SOL traders, with a higher volume of long positions compared to shorts. While this optimism aligns with Solana’s recent growth, it also introduces a potential risk if market conditions shift unexpectedly.

Read More: Solana ETF Explained – What It Is and How It Works

Solana’s exchange-traded products also saw notable developments this month. Investment giant VanEck recently introduced staking rewards to its Solana ETNs in the European market. However, the future of a Solana ETF in the US remains uncertain. Both VanEck and 21Shares have filed separate ETF applications, but a decision is unlikely before the upcoming election.