Solana (SOL) price is attempting to recover the $200 level after recently dipping below $190. This rebound comes as its market cap nears $97 billion, reflecting renewed investor interest.

Technical indicators suggest that SOL could gain further momentum if a golden cross forms, potentially pushing the price toward $209 and beyond. However, if buying pressure weakens, SOL could face another pullback, with key support levels at $187 and $175.8.

Solana Whales Are Attempting to Recover

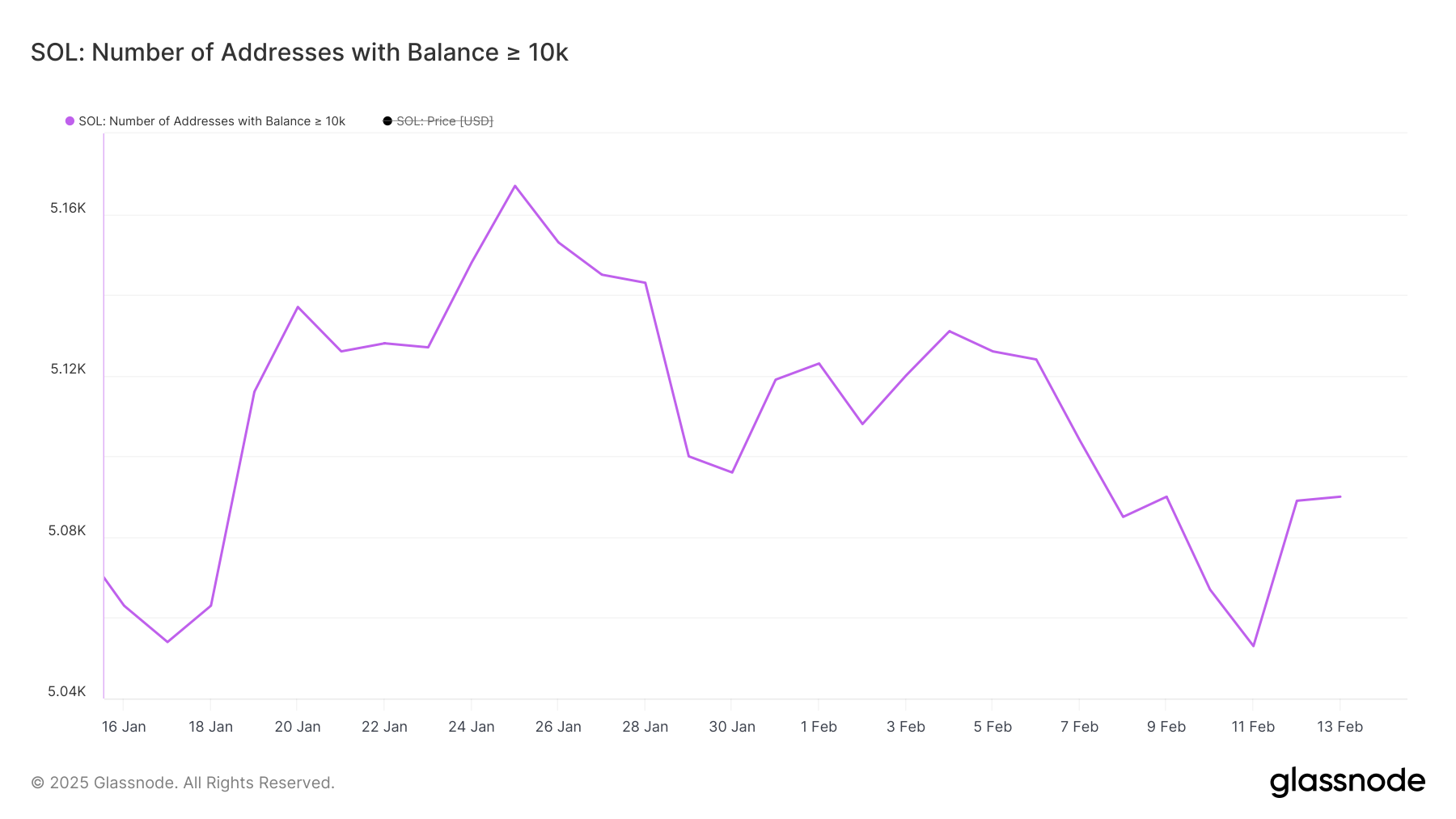

The number of SOL whales – wallets holding at least 10,000 SOL – has seen a significant decline in recent days, dropping from 5,131 on February 4 to 5,053 on February 11.

This follows an all-time high of 5,167 on January 25, after which whale holdings began decreasing. Such a decline suggests that some large holders were offloading their positions, potentially creating selling pressure on SOL price.

Tracking whale activity is crucial as these large holders play a key role in market movements. After hitting 5,053, the number of whales has started rising again, currently at 5,090.

This slow recovery could indicate renewed confidence among big investors, but the overall trend remains uncertain. If whale accumulation continues, it could support Solana price, while stagnation or another decline may signal further weakness.

Solana DMI Shows the Buyers Are Trying to Take Control

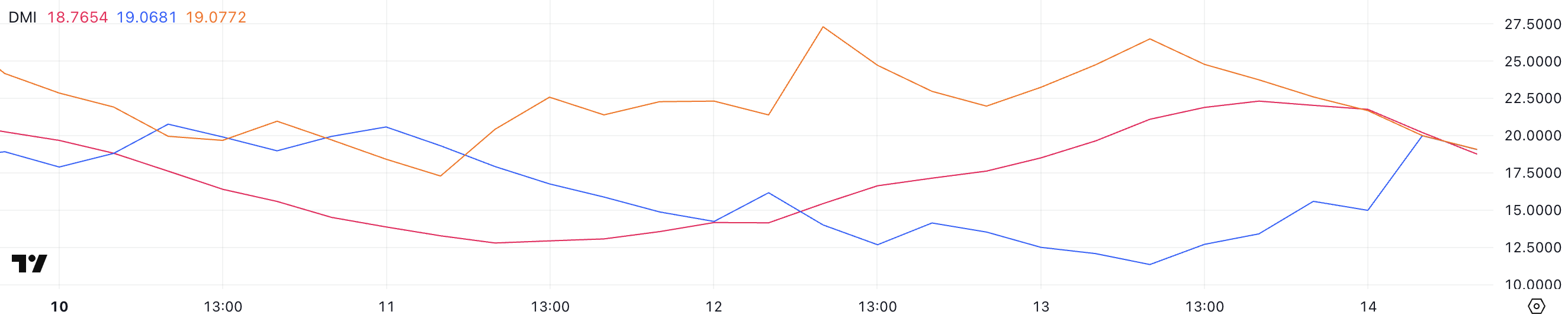

Solana Directional Movement Index (DMI) chart shows its Average Directional Index (ADX) at 18.7, down from 22.2 yesterday. A declining ADX suggests weakening trend strength, indicating that the previous downtrend may be losing momentum.

Meanwhile, the +DI has risen from 11.3 to 19, while the -DI has dropped from 26.4 to 19, signaling a shift in buying and selling pressure.

The ADX measures trend strength on a scale from 0 to 100, with values above 25 indicating a strong trend and values below 20 suggesting weak or indecisive movement.

With ADX declining and +DI rising while -DI falls, Solana appears to be attempting a trend reversal. If buying pressure continues to increase, SOL could establish a new uptrend, but if ADX remains low, the market may stay in consolidation before a clearer direction emerges.

SOL Price Prediction: Can Solana Sustain Levels Above $200?

Solana price is attempting to reclaim the $200 threshold after recently dipping below $190. One of its short-term moving averages is close to crossing above another, which could lead to a golden cross.

If this bullish signal materializes, SOL could rise to test $209, and a breakout above that level may push it toward $219.9. If momentum from the previous month returns, SOL price could even rally to $244, marking its highest level since late January.

However, if SOL fails to establish an uptrend, it could face renewed selling pressure.

A drop to the $187 support level is possible, and if that fails to hold, SOL could decline further to $175.8.