The Independent Reserve’s Cryptocurrency Index for Singapore reveals that the country’s citizens are enthusiastic about the crypto market, with 43% owning some.

A new report released by the Australian exchange Independent Reserve shows that approximately 43% of Singaporean citizens hold some cryptocurrency. The exchange also operates in Southeast Asia, which is one of its faster-growing markets.

The report, called the Independent Reserve Cryptocurrency Index (IRCI) Singapore, is a cross-sectional research survey examining the “nation’s awareness, adoption, trust, and confidence in cryptocurrency.” The IRCI scored Singapore a 63 out of a 100 on this scale.

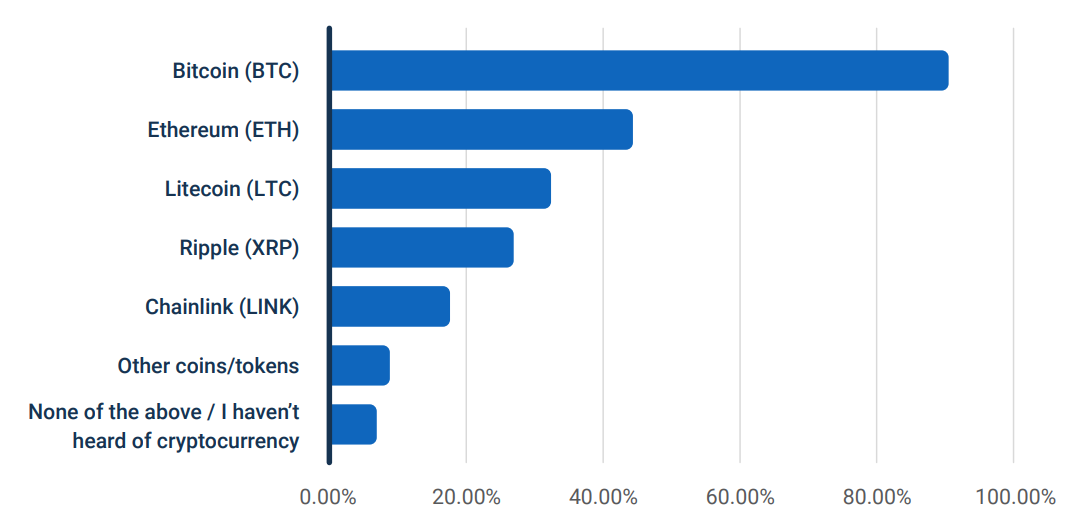

The report highlights that 93% of Singaporeans are aware of cryptocurrencies, with bitcoin being the most recognizable. Ethereum and Litecoin follow with 44% and 33%, respectively.

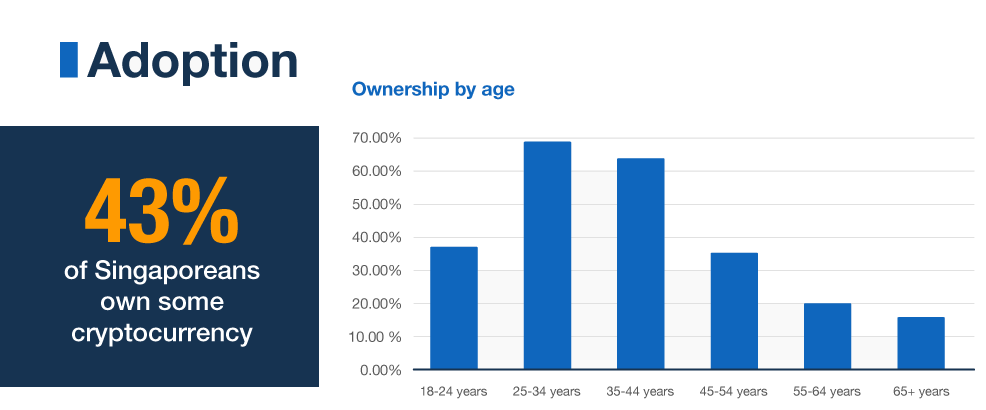

Noticeably, however, is the fact that 43% of Singaporeans own cryptocurrency, which is higher than most other countries. The report notes that the main motivation for investment in cryptocurrencies is increased clarity with respect to regulation and taxation.

The vast majority of investors fall into the 25–44 age group, which is in keeping with the trend that younger investors are more likely to invest in crypto. 76% of investors under the 26–35 age group also believe that cryptocurrencies become widely accepted by businesses and the general public by 2030.

Furthermore, 40% of respondents believe that bitcoin to be an investment, as opposed to a means of exchange. 25% consider it a store of value, and 7% consider it a scam.

Asian crypto market still looking strong

The results from the survey are overall quite optimistic about the future of crypto. The general public has become much more aware of crypto during the 2021 bull run, especially of niches like DeFi and NFTs. This is occurring despite a global trend towards regulation.

Cryptocurrencies are quite popular in Southeast Asia, even as an ongoing regulatory crackdown by several governments is playing out. China, India, Japan, and South Korea are all either implementing or planning to implement regulations to tackle the growing asset class, with exchanges being the main focus in 2021.

Singapore has not, though it is home to some crypto projects and is something of a hub of cryptocurrency activity. The country’s banking giant DBS is reportedly working on launching an exchange, while the Singaporean government has approved a $9 million blockchain research and development fund.

The country’s central bank is also collaborating with the central bank of France on cross-border CBDC transactions. The test will conclude in the fall season, at a time when many banks will be piloting and releasing results of CBDC tests.

On the regulatory side, the Monetary Authority of Singapore has begun reviewing Binance. This makes Singapore yet another country that is scrutinizing one of the world’s most popular exchanges.