Shiba Inu’s price has been stuck in limbo, unable to make a decisive move higher even after a 15% monthly gain. Over the past week, SHIB barely moved 2%, in line with the broader market pullback.

Despite a bullish wedge pattern suggesting an eventual breakout, fresh data shows big holders and weak buyer activity are holding the token back.

SponsoredBig Holders Send Tokens To Exchanges; Add To The Selling Pressure

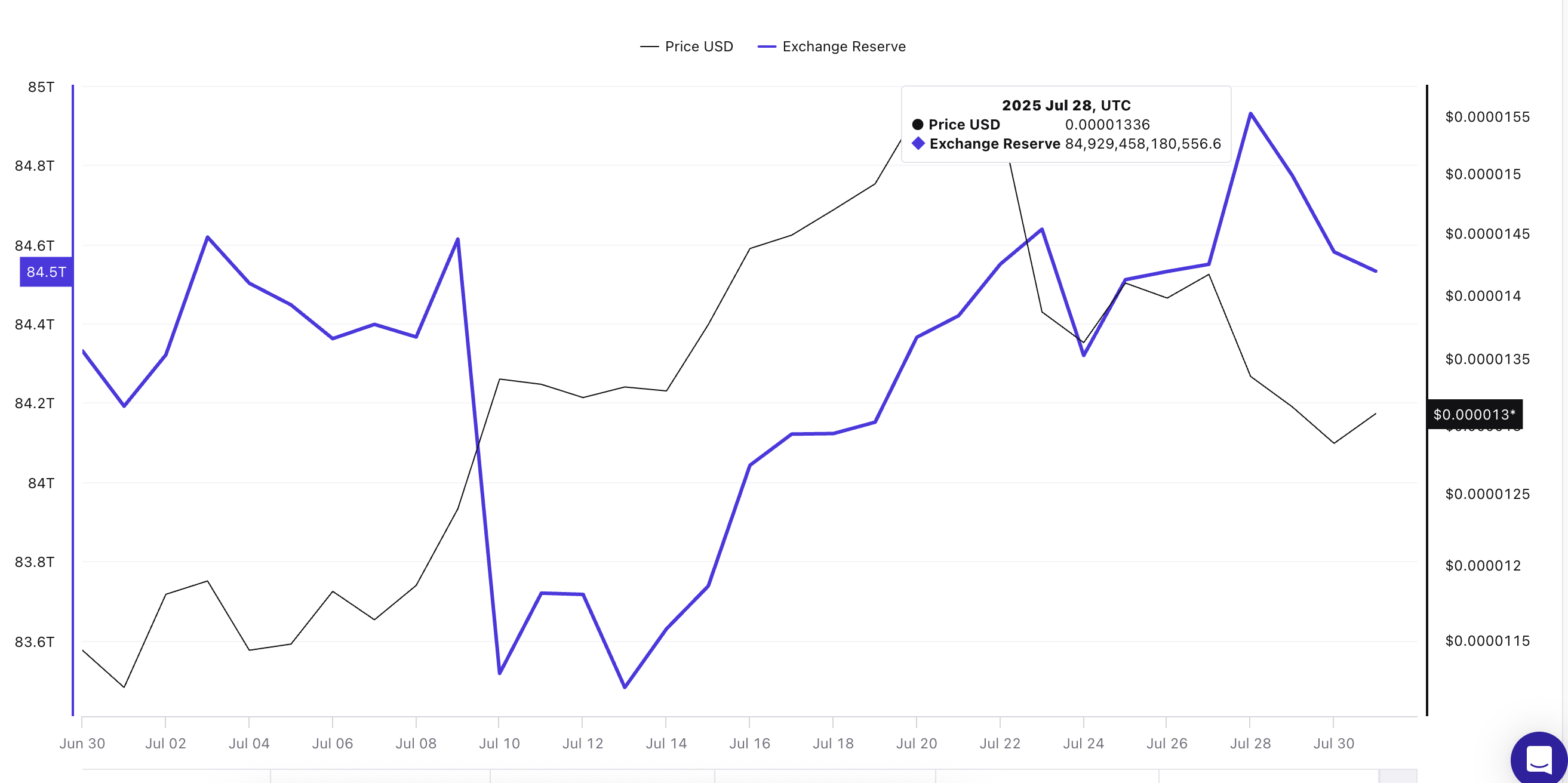

One key sign that explains SHIB’s struggle is the spike in exchange reserves. On July 28, exchange wallets hit a monthly high of 84.9 trillion SHIB. This means big holders have been sending more of their tokens to exchanges, likely preparing to sell.

Even though the reserves have dropped marginally at the time of writing, there are still a lot of tokens on exchanges to cascade a deeper correction.

This matches what was seen in earlier data showing large holder net flows turning negative. Whales are dumping tokens into the market instead of holding them in private wallets, creating extra supply and making it harder for SHIB’s price to rally.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Money Flow Index Shows Fading Buyer Strength

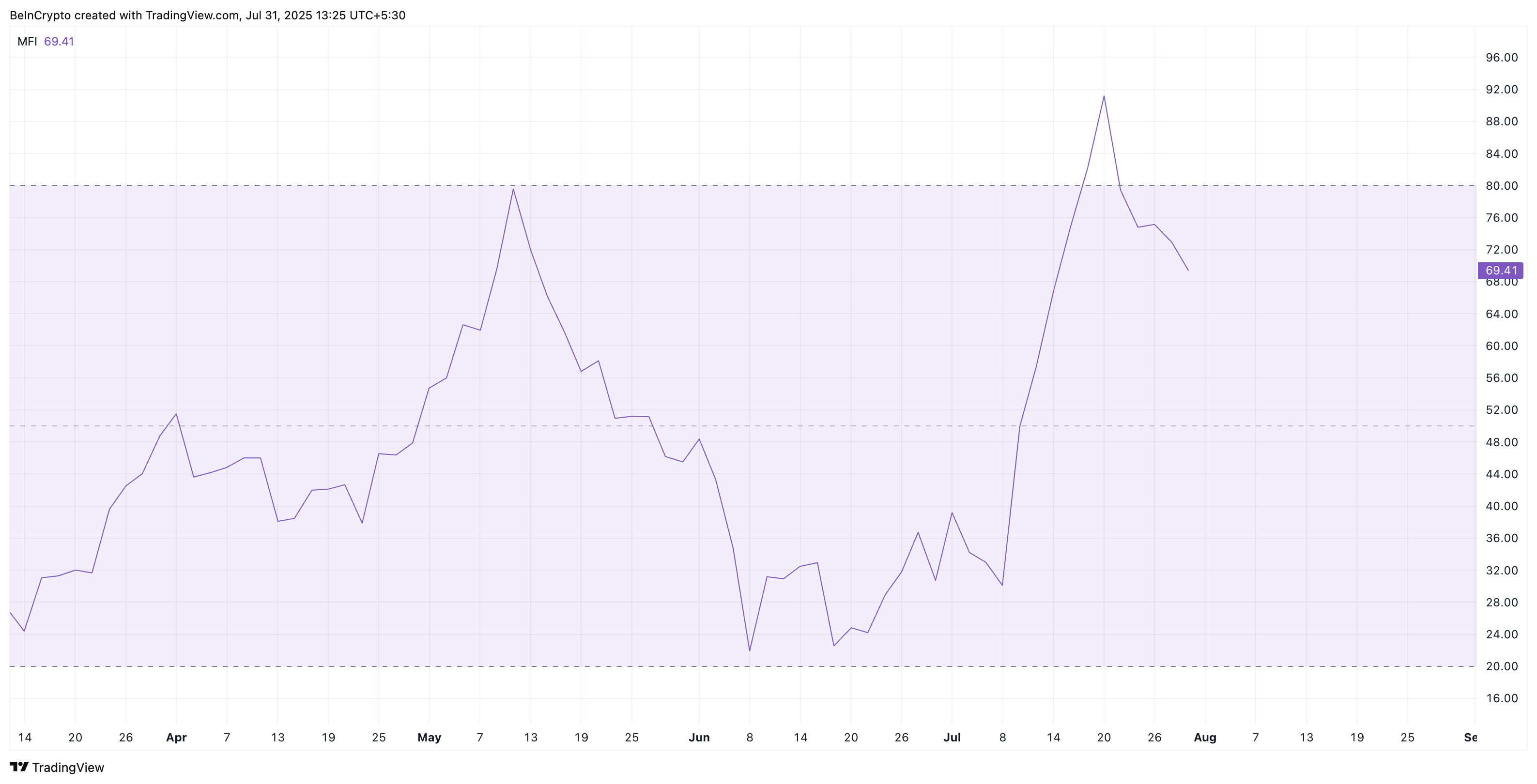

The Money Flow Index (MFI) tells us how much money is flowing in or out of a token, based on price and volume. In SHIB’s case, MFI has fallen sharply from 91 to 69 in just 10 days. This shows buyers are no longer putting in strong capital despite cheaper prices.

Sponsored

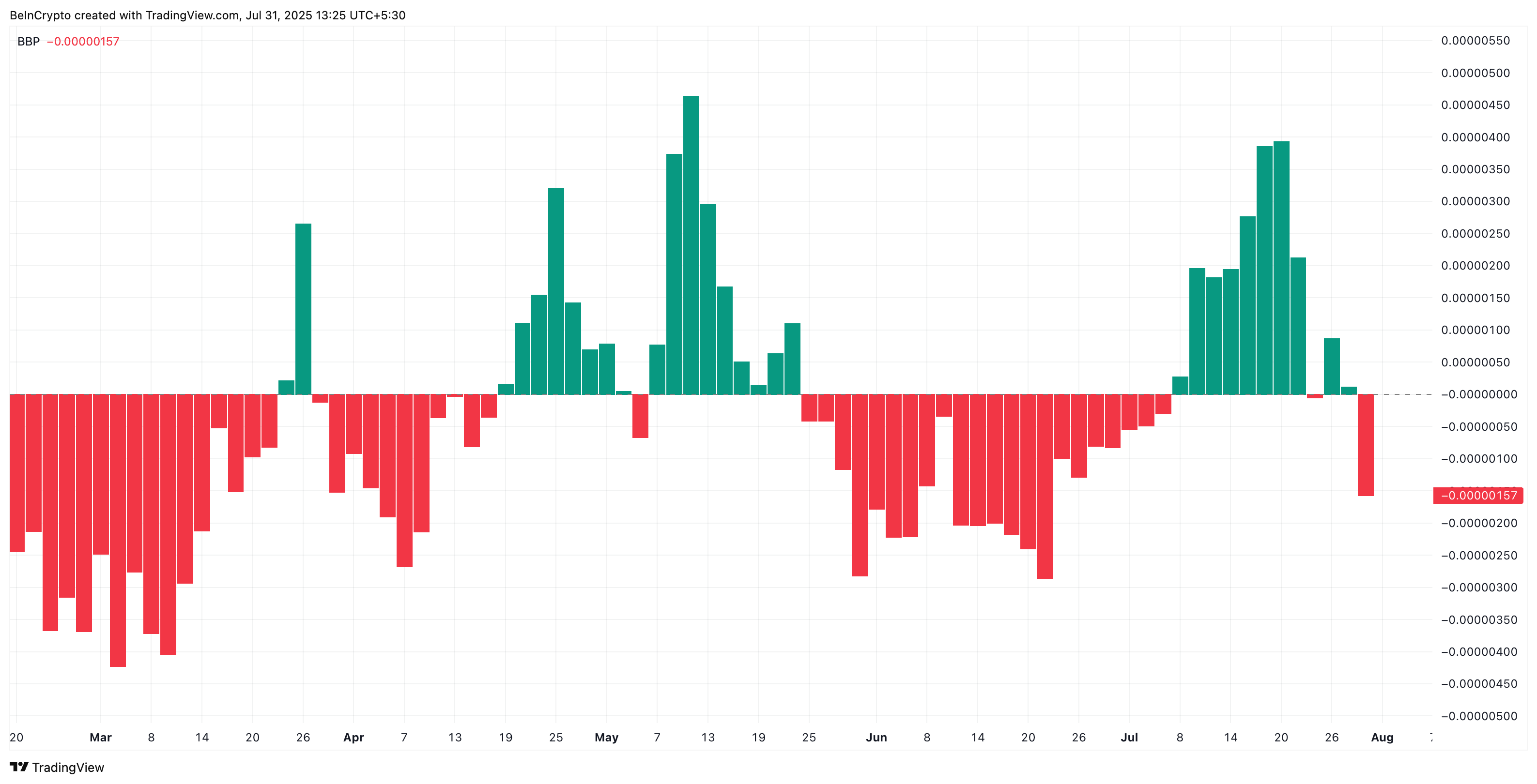

The Bull-Bear Power indicator (BBP) backs this up, showing that sellers have gained control of recent price action. While the bullish momentum kept weakening for a while, the long red bar clearly shows who is in control of the SHIB price action at the moment.

Even with SHIB trading inside a bullish wedge, the dip in MFI and stronger bear signals suggest buying demand is weak for now.

The Bull-Bear Power Indicator measures the strength of buyers versus sellers. It does that by comparing price action to a moving average. Positive values mean bulls are stronger, whereas negative values show bears are in control.

Shiba Inu (SHIB) Price Still Stuck In Wedge; Key Levels To Watch

SHIB’s price is holding inside a falling wedge pattern in the 2-day timeline. This setup often leads to a bullish breakout. But for now, the token is trapped near $0.0000130, with strong support at $0.0000128. If this level breaks, the next downside stops are $0.0000122 and then $0.000010. A dip below $0.000010 would completely invalidate the bullish setup.

As SHIB’s price has moved sideways during the past few days, having a 2-day chart to keep the noise out makes sense.

On the other hand, a breakout above $0.0000158 (but $0.0000146 first) could finally give bulls control. And this could trigger a bigger rally, aligning with the wedge’s expected breakout direction.