The US Securities and Exchange Commission (SEC), led by Gary Gensler, is making headlines with its request for a $2.6 billion budget for the 2025 fiscal year. This substantial sum aims to enhance the SEC’s oversight of the crypto sector.

The proposed budget highlights the agency’s commitment to expanding its workforce, targeting over 5,000 positions to better police digital assets and emerging technologies.

Why the SEC Wants to Attack Crypto?

Gensler has emphasized that the budget will be offset by transaction fees, ensuring a deficit-neutral approach. Specifically, the SEC plans to bolster its Division of Examinations with 23 new roles in 2025. This move directly addresses the complexities of the crypto market.

“We’ve seen the Wild West of the crypto markets, rife with noncompliance, where investors have put hard-earned assets at risk in a highly speculative asset class. Such growth and rapid change also mean more possibility for wrongdoing. As the cop on the beat, we must be able to meet the match of bad actors,” the SEC wrote.

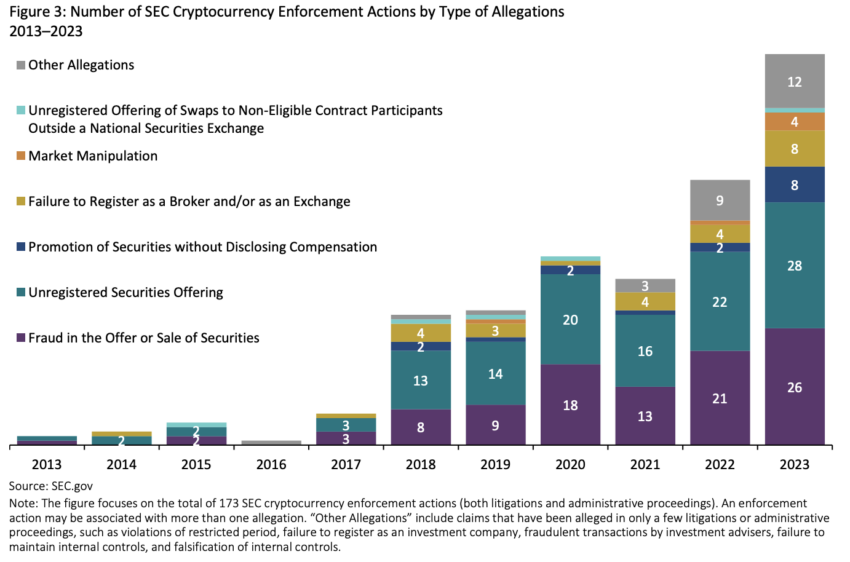

Under Gensler’s watch, the SEC has adopted a stringent regulatory stance. It has also initiated high-profile lawsuits against prominent crypto exchanges like Binance, Kraken, and Coinbase, focusing on the trading of unregistered securities.

Consequently, the SEC’s rigorous actions have led to a record number of enforcement measures, intensifying the regulatory atmosphere in the crypto industry.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Moreover, the SEC is actively engaging in a legal effort to classify Ethereum, the second-largest cryptocurrency, as a security. This endeavor has involved extensive demands for documentation from companies interacting with the Ethereum Foundation. As a result, the SEC’s aggressive strategy aims to deepen its understanding and control over the crypto environment.

However, the crypto industry is not standing idly by. It is actively seeking regulatory clarity and pushing back against the SEC’s stringent measures.

For instance, organizations like the Crypto Council for Innovation (CCI), Paradigm, and the Chamber of Digital Commerce are advocating for precise regulations that accommodate the unique aspects of cryptocurrencies.

In response to these challenges, the political clout of the crypto sector is on the rise. Increased lobbying efforts and significant financial contributions to pro-crypto political campaigns reflect the industry’s determination to foster a regulatory environment that supports innovation and ensures consumer protection.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The legal battles continue, with Texas-based cryptocurrency firm Lejilex and the Crypto Freedom Alliance of Texas taking a stand against the SEC. Specifically, they contend that the SEC’s broad classification of digital assets as securities overstep its regulatory authority and stifle innovation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.