The Securities and Exchange Commission (SEC) keeps looking for ways to broaden the reach of its enforcement powers. On Tuesday, the agency announced charges against Archipelago Trading Services Inc. (ATSI), a Chicago-based broker-dealer.

The firm needed to scrutinize trading more closely, the regulators believe. Hundreds of reports of suspicious activity reports (SARs) should have been forthcoming from 2012 to 2020.

ATSI Neglected Its Duty to File Suspicious Activity Reports

According to the SEC, ATSI failed to file at least 461 Suspicious Activity Reports (SARs) related to over-the-counter (OTC) securities trades executed on ATSI’s alternative trading system Global OTC.

The unfiled SARs involved mostly microcap and penny stock securities, which the SEC considers risky investments.

Specifically, ATSI’s sole business is operating Global OTC, an alternative trading system used by broker-dealers to trade OTC stocks.

Although thousands of daily trades in risky microcap and penny stocks occurred on Global OTC, ATSI did not establish an anti-money laundering surveillance program until September 2020, the SEC said.

This failure violates Section 17(a) of the Securities Exchange Act and Rule 17a-8, which require broker-dealers to file SARs on questionable transactions.

Learn to invest like the best and manage your portfolio with as little fuss as possible: 11 Best Crypto Portfolio Trackers in 2023

Hence, ATSI allegedly failed to detect and report potential manipulative and suspicious trading activities. These include activities like spoofing, layering, wash trading, and pre-arranged trading.

To settle the charges, ATSI agreed to pay a $1.5 million penalty, without admitting or denying the SEC’s findings.

Submitting SARs Is a Legal Must

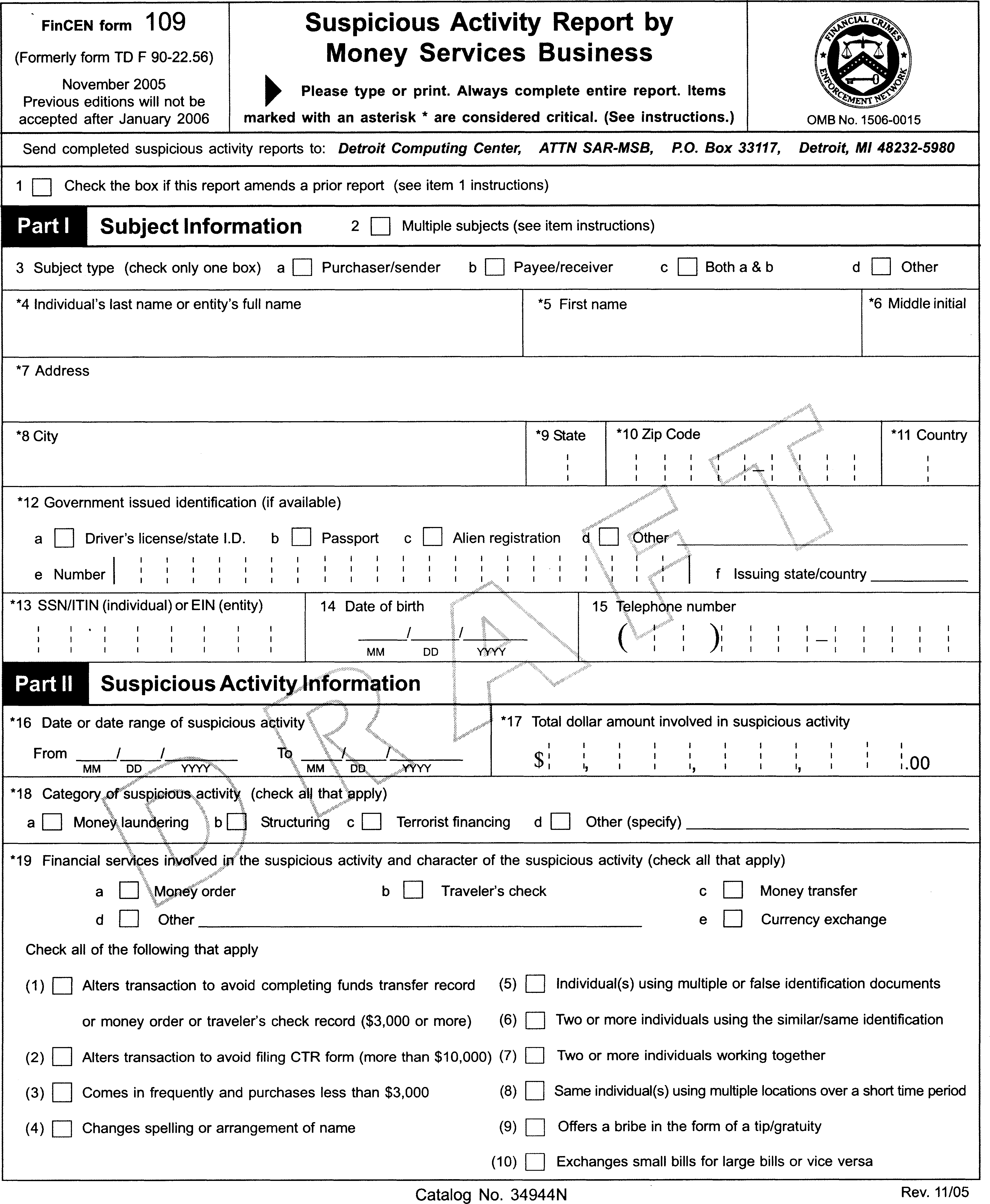

In the United States, Suspicious Activity Reports (SARs) are documents that financial institutions use to alert authorities to potentially unlawful transactions. SARs first came on the scene in 1970, as part of the Bank Secrecy Act (BSA). Their use helps prevent money laundering, terrorist financing, and other financial crimes.

A compliance and surveillance department can be a significant burden for a business to maintain. But filing SARs is a legal requirement all the same.

“All SEC-registered broker-dealers must comply with the Bank Secrecy Act, including filing SARs,” said Daniel R. Gregus, Director of the SEC’s Chicago Regional Office, in an SEC statement.

“When firms like ATSI fail to investigate red flags, especially in higher-risk microcap and penny stocks, they expose investors to unnecessary risks.”

Financial institutions and regulators use SARs all over the world to help detect financial crimes. In most jurisdictions, sending a SAR is distinct from making a criminal complaint. Authorities will review the report and decide whether a full investigation is needed.

In the United States, firms must send SARs to the Financial Crimes Enforcement Network (FinCEN).

For more information about filing SARs, visit the FinCEN official website here.