The US Securities and Exchange Commission (SEC) appears to be inching closer to the potential approval of an Ethereum ETF (exchange-traded fund).

SEC Commissioner Hester Peirce’s recent comments have fueled this speculative fire, hinting at a possible shift in the regulatory environment for ETH and other cryptocurrencies.

SEC Commissioner Talks Ethereum ETF Approval

Hester Peirce, often called “Crypto Mom” for her positive stance on cryptocurrencies, has highlighted the correlation between futures and spot markets in cryptocurrencies, which could influence the SEC’s decision-making process. Her insights come at a crucial time when the crypto community eagerly awaits the SEC’s verdict on several Ethereum ETF applications, with deadlines looming.

Although the SEC recently delayed several Ethereum ETF applications, Peirce pointed out that the agency’s approach to approving these products does not necessarily hinge on whether the underlying asset is a security.

Instead, the focus is on applying a consistent framework to these products, similar to other exchange-traded products. This approach suggests a broader, more inclusive attitude towards cryptocurrency ETFs, moving beyond Bitcoin-centric policies.

“We shouldn’t need a court to tell us that our approach is arbitrary and capricious in order for us to get it right. I certainly hope that won’t be the case. People will look to precedent in making arguments for other products and we, looking at the facts and circumstances, will presumably apply that precedent,” Peirce said.

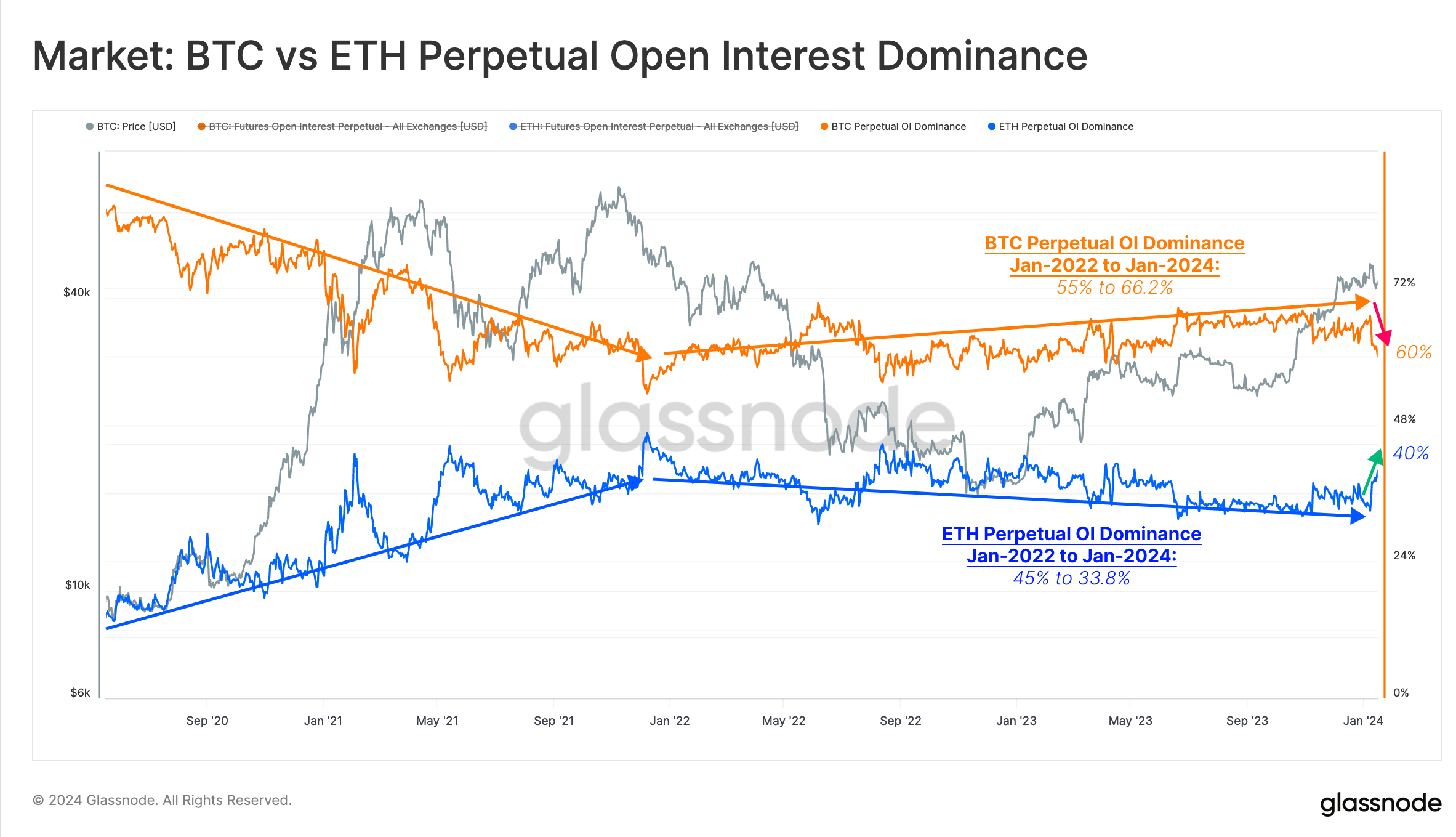

The significance of this development is underscored by Glassnode’s recent report, which highlights Ethereum’s derivative market activity. Despite a sluggish momentum relative to altcoins, Ethereum has seen a notable uptick in the derivatives market, which mirrors the growing interest in its potential ETF.

“[Ethereum] has seen a burst of outperformance, emerging as the short-term winner. ETH investors have recorded a multi-year high in net realized profits, suggesting there is some willingness to sell the speculation on a potential [Ethereum] ETF capital rotation,” analysts at Glassnode wrote.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The market is closely watching the SEC’s moves as the May deadline for the decision on Ethereum ETFs approaches. Peirce emphasized a need for consistency and fairness in the SEC’s approach. Hence, these comments offer a ray of hope for proponents of Ethereum ETFs.

An Ethereum ETF approval could mark a significant milestone. Indeed, it could lead to greater mainstream adoption and investment in Ethereum and other digital assets.