The United States Securities and Exchange Commission (SEC) opposes the use of crypto exchange Coinbase by the now-bankrupt crypto lender Celsius for distributing crypto assets to creditors.

“There appears to be an additional agreement with Coinbase, which the Debtors seek to file under seal, but it has not been made available to the SEC staff,” the filing noted.

SEC Alleges Lack of Clarity In Coinbase Agreements With Celsius

In a recent court filing, the SEC expressed its disapproval of Celsius Debtor’s recent proposal for Coinbase to assume the role of the distribution agent for international customers.

This implies that Coinbase would be responsible for supervising the return of crypto assets to customers on behalf of Celsius.

However, the SEC argues that the contract lacks sufficient information, and it remains unclear what role Coinbase plays.

“The Coinbase Agreements go far beyond the services of a distribution agent.”

Despite Celsius’ claim, it will not use Coinbase for brokerage services, the agreements allegedly imply otherwise.

The SEC asserts that there is an undisclosed agreement with Coinbase that the debtors intend to file under seal. The SEC staff has not had access to this contract.

This comes amid Coinbase’s efforts to have its lawsuit against the SEC dismissed, claiming that Coinbase functioned as an unregistered broker since 2019.

In the lawsuit, filed on June 5, it also claimed that Coinbase combined three roles, usually separate in traditional markets: broker, exchange, and clearing agency.

However, the SEC argues that the court should not be expected to approve an agreement lacking essential or consistent terms:

“The SEC reserves its rights to object if the Debtors do not adequately address Coinbase’s role in the confirmation order and in an amended agreement that, in material part, is made available for review.”

Celsius Creditors Strongly Back Bankruptcy Plan

Paul Grewel, Coinbase’s chief legal officer, expressed bewilderment at the SEC’s objection to Coinbase assuming the distribution role.

Nevertheless, Grewel asserted Coinbase’s intention to challenge the objection in court.

“I wonder, why would the SEC object to a trusted US public company taking on this role? We look forward to addressing this with the bankruptcy court and undertaking our important role to make Celsius customers whole.”

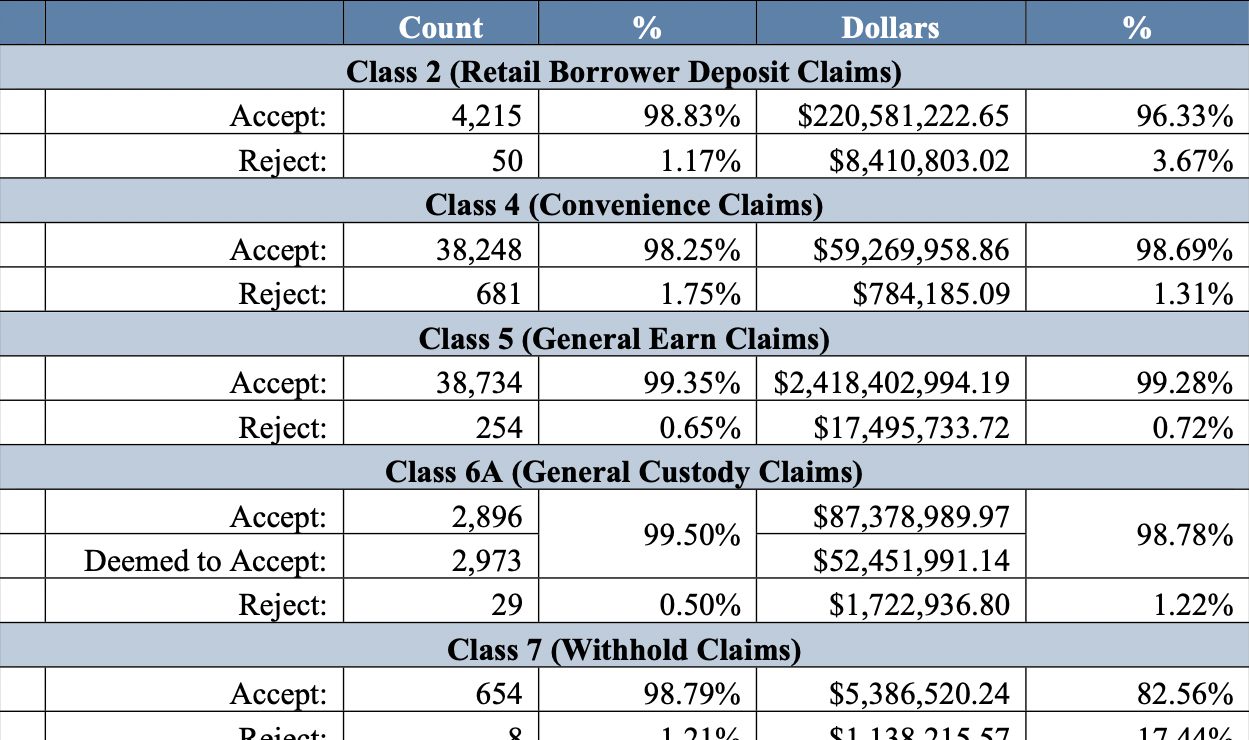

In a separate court filing on September 25, it was revealed that most creditors support the bankruptcy plan. The Celsius Retail Borrower and General Earn creditor votes showed strong support, with 98.83% and 99.35% in favor, respectively.

Meanwhile, Michael Arrington, founder of Arrington Capital, has resigned from the board overseeing the bankruptcy plan for Celsius. Arrington pointed to differences in the board’s configuration as the primary reason.

He stated that Ravi Kazi, a partner at Fahrenheit, will assume his position.