Cryptocurrency analyst Jack Niewold said Friday that “war could be good” for bitcoin (BTC) prices. He touted Russia’s invasion of Ukraine as a buying opportunity for long-term crypto investors.

Niewold, 24, is also the founder of Crypto Pragmatist, which aims to provide institutional-grade altcoin research for retail investors, references “market bottoms” to help support his argument.

“I haven’t attempted to call the bottom of the pullback until now, but I’m a buyer here,” he said, after BTC prices slumped more than 9% to $34,700 following Thursday’s attack by Russia on the nation of Ukraine in what the nuclear power called a “special military operation.”

Buying the invasion?

“Shots fired have historically signaled a market bottom,” Niewold argued.

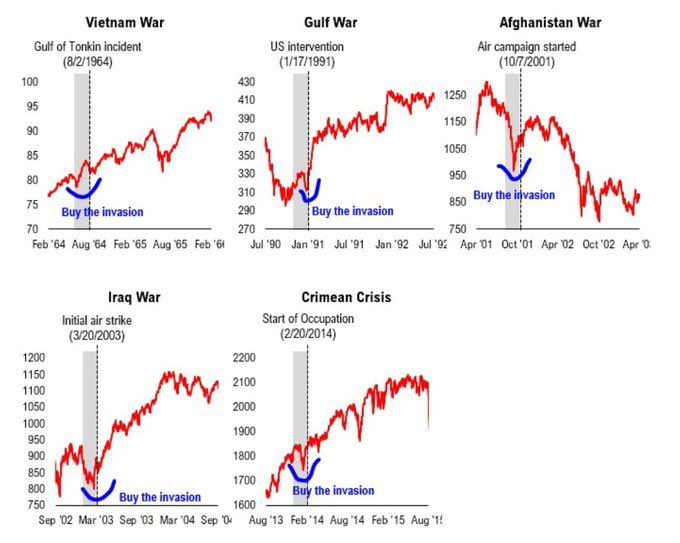

He pulled charts of previous war periods, including the Vietnam War (1964), Gulf War (1991), and Afghanistan War (2001), pointing to bitcoin’s supposed correlation with U.S. stock markets – specifically, the Nasdaq.

He stated that history “shows that market bottoms have coincided with war.”

“So if the Nasdaq and BTC are correlated, perhaps we can use historical stock market data to understand where the markets are headed,” Niewold tweeted.

“This data [chart below] assumes that Ukraine will be the only country invaded…but buying the invasion seems to be a strong investment strategy.”

‘War is good for crypto prices’

Niewold did not respond to a request for comment from Be[In]Crypto.

In his thread, however, he argues that the Russia-Ukraine “war could be good for crypto prices”.

Niewold said the war may lead to central banks printing more money, which causes inflation, while economic sanctions – such as those imposed by the U.S. and the European Union on Russia so far – may also prompt nation-states to adopt cryptocurrencies.

During periods of war, displaced people are more likely turn to bitcoin “as a store of value and a financial rail when banking infrastructure is unreliable.” All these factors will combine to push crypto asset prices higher, Niewold says, adding:

“I think there’s interesting geopolitical game theory around crypto adoption: If Russia begins to adopt bitcoin to get around sanctions, then I see other big nation-states having to adopt as well.”

Niewold spoke of how he was bullish toward DeFi as well:

“…if American hegemony is in question, international equities are uncertain, precious metals continue stagnating, what do you invest in?” he quipped, at the same time answering himself:

“…decentralized, non-nation-affiliated protocols that can fulfill financial services regardless of nationality. One striking difference I see this cycle is that no one is really permanently leaving crypto, we’re just kind of waiting for some type of confirmation/certainty to get back in.”

At 24-years old, the crypto analyst avers he is not a war monger and believes that a third world war will not “look good for financial markets…but it’s okay to speculate around these events and consider how they affect financial markets.”

Markets shaken

Crypto markets fell sharply on Thursday after Russia began its military invasion of Ukraine. Bitcoin tanked 8.6% to $34.745 and Ethereum (ETH) dropped more than 10% to $2,342, as per CoinGecko data.

In total, cryptocurrencies lost more than $200 billion in value on the day.

At the time of writing, BTC prices have recovered to above $39,000 and ETH to $2,700, as economic sanctions against Russia underperformed expectations in terms of severity.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.