Signaling resilience and adaptability, Robinhood, the renowned online investments app, announced its plan to launch in the UK in early 2024. This marks the company’s ambitious third attempt at international expansion.

Aiming to cater to a diverse range of investors, Robinhood’s UK platform will offer an extensive selection of 6,000 US stocks and the convenience of 24-hour trading five days a week.

Robinhood Finally Ready to Expand Into UK

The initiative represents a strategic pivot as Robinhood seeks to broaden its global footprint. Jordan Sinclair, Robinhood’s UK chief, emphasized the platform’s alignment with the dynamic nature of modern trading:

“Customers actually can make a trade and choose their investment strategy and actually act on that market news.”

This feature is particularly significant, as it empowers users to respond promptly to market fluctuations, a capability not commonly found in traditional trading environments.

Read more: Coinbase Vs Robinhood: Which Is The Best Crypto Platform?

While the UK platform initially excludes local stocks and derivatives, Robinhood has plans to integrate these offerings as it evolves. This approach reflects the company’s commitment to expanding and refining its services in response to market demands and customer needs.

Robinhood’s previous attempts at UK expansion were met with challenges. A notable episode in 2019 saw over 300,000 people signing up for a waiting list, only for the company to retract its plans due to increasing domestic demand amid the COVID-19 pandemic. Additionally, its venture to acquire British crypto-trading app Ziglu fell through, resulting in a considerable financial setback.

Prepping Crypto Services for the EU

Despite these hurdles, the firm remains undeterred. Robinhood CEO Vlad Tenev expressed confidence in the company’s preparedness for this endeavor. He told CNBC:

“We’ve made sure we taken care of all of the details, the platform is much more robust.”

Robinhood’s licensure from the Financial Conduct Authority bolsters this optimism. This underscores its compliance with stringent regulatory standards.

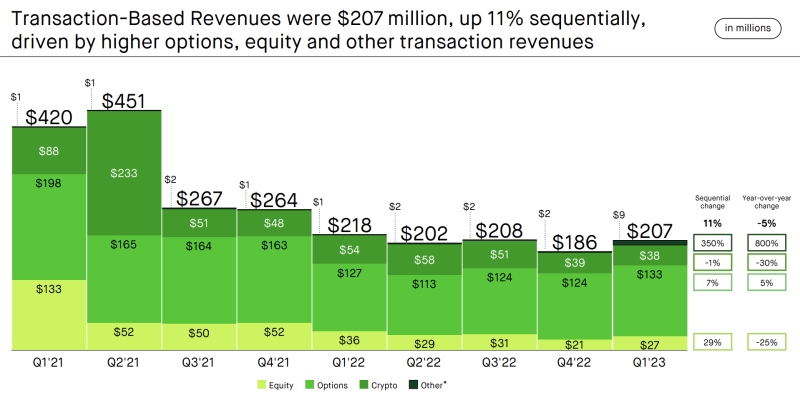

Parallel to its UK expansion, Robinhood is eyeing the European Union for its crypto services. This decision comes amid a 30% decline in crypto trading revenue year-over-year.

The company’s proactive stance in diversifying its offerings and exploring new markets exemplifies its commitment to staying relevant and competitive.

As Robinhood gears up for its UK launch, it is poised to offer unique trading opportunities to its users and also redefine the boundaries of retail investing.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.