The Render Token (RNDR) price has increased over the past six days, reclaiming a crucial horizontal support area in the process.

Due to this movement, the previous breakdown is considered invalid. So, it is likely that bulls are in control, and a sharp trend will transpire soon.

Render Token Price Reclaims Key Level After Deviation

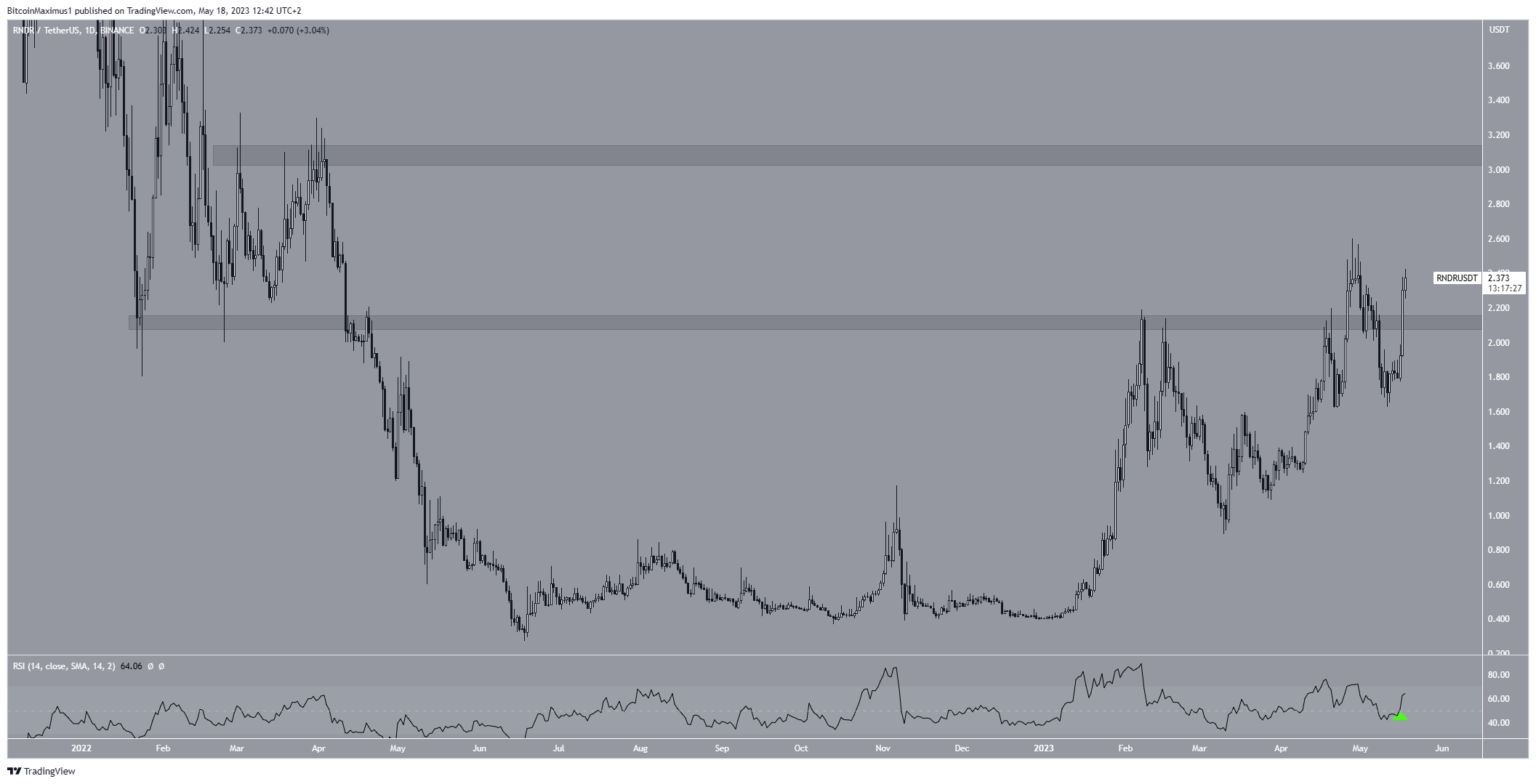

The RNDR price has increased since the beginning of the year. On April 28, it reached a new yearly high of $2.41. This seemingly caused a breakout above the $2.10 horizontal resistance area and took the price to the $3.10 resistance area.

However, the price failed to sustain the increase, falling below the $2.10 area shortly afterward. At the time, this seemed like a deviation above the resistance.

This is considered a bearish sign that often leads to sharp downward movements since the bulls did not sustain the price increase.

However, RNDR reversed its bearish trend on May 12 and reclaimed the $2.10 area five days later. Now, the area is expected to provide support again.

The weekly Relative Strength Index (RSI) provides a bullish reading. When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The indicator is above 50 (green icon) and moving upwards, a sign of a bullish trend.

RNDR Price Prediction: Wave Count Supports Increase

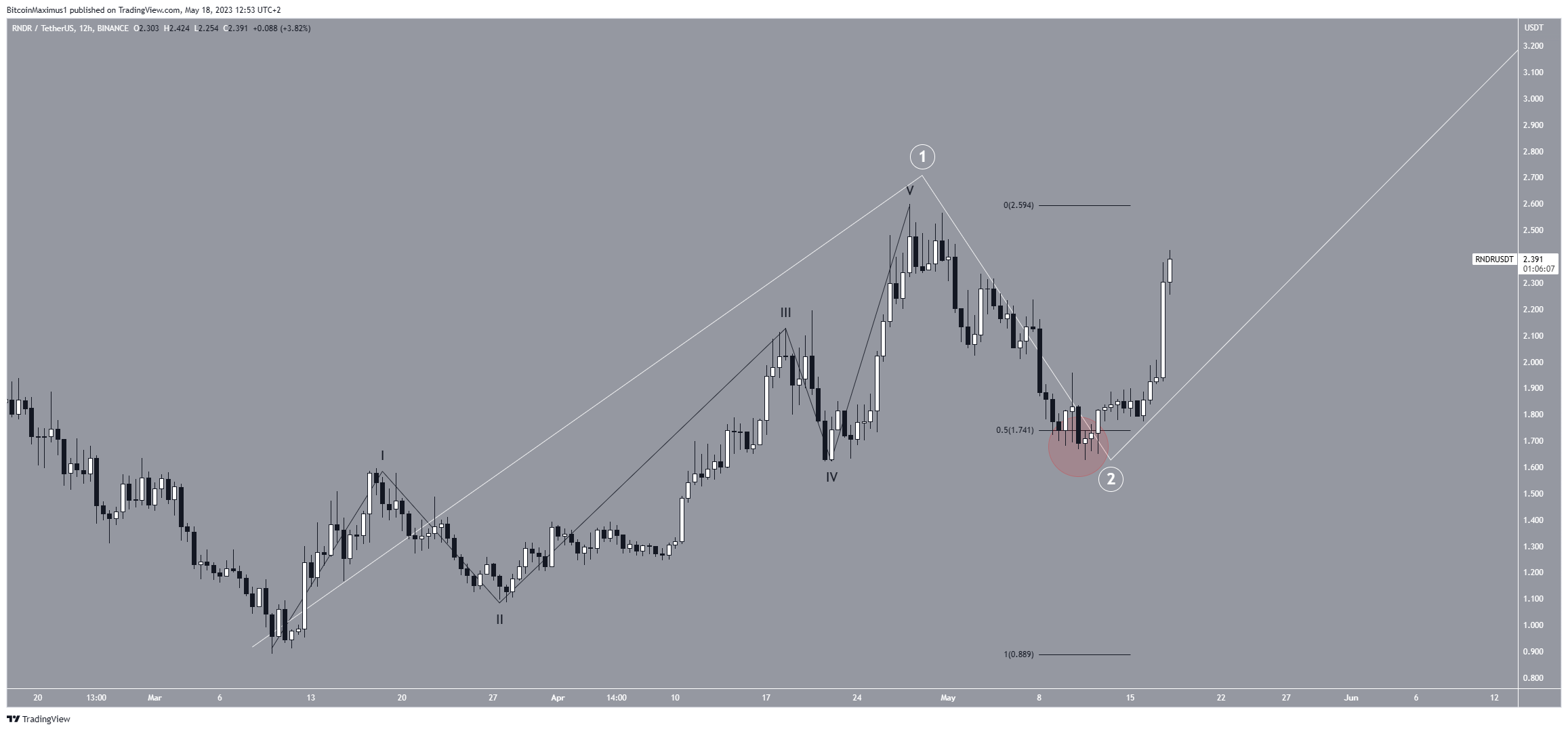

The technical analysis from the 12-hour time frame provides a decisively bullish outlook. The main reason for this is the wave count.

By studying recurring long-term price patterns and investor psychology, technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction.

Since the beginning of March, RNDR has completed a five-wave upward movement (black). Afterward, the ensuing decrease ended at the 0.5 Fib retracement support level and in the territory of wave four (red circle).

After sharp increases, this is one of the most common levels where corrections come to an end.

Afterward, the price began another sharp upward movement. So, it is possible that it is now in a long-term wave three. If so, the RNDR price will likely reach the $3.10 resistance area.

However, a RNDR price drop below the wave two low of $1.58 will invalidate this bullish RNDR price prediction.

In that case, a drop to $1.10 will be on the cards as the most likely future price outline.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.