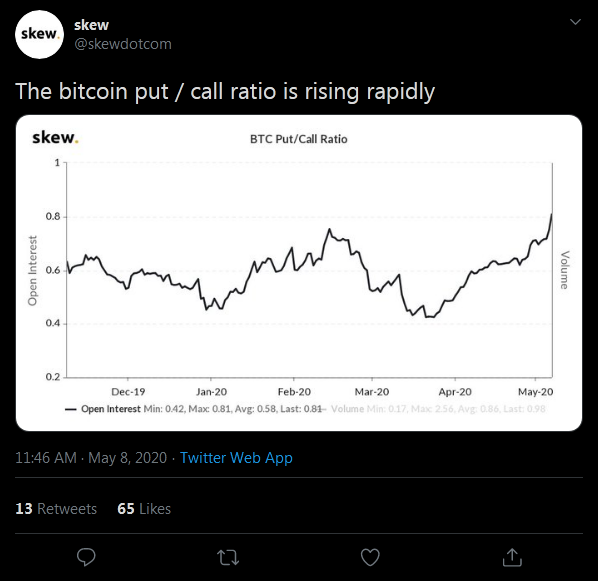

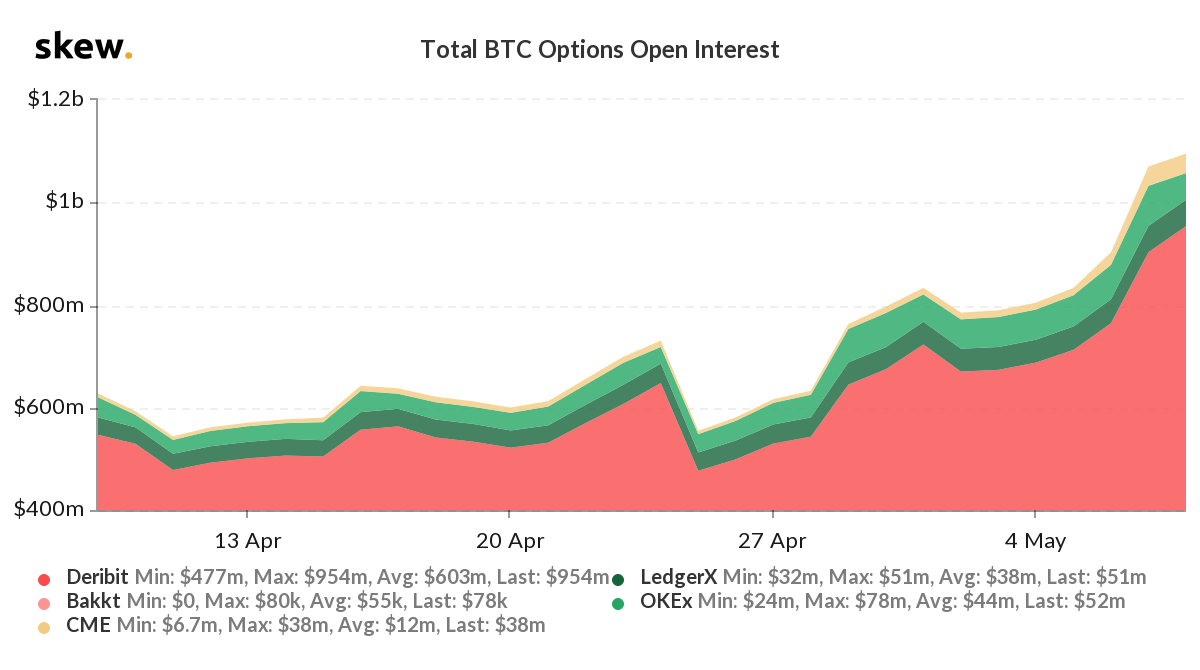

The Bitcoin Options put/call ratio (PCR) is rising rapidly and could indicate an expectation of another flash crash for the price of the leading cryptocurrency immediately after the upcoming halving. This comes as the open interest in BTC Options trading crossed the $1 billion milestone for the first time.

Despite being a relatively younger segment of the crypto derivatives scene, Bitcoin Options trading appears to be growing in size — with Deribit still controlling the greater majority of the market.

According to data from the cryptocurrency derivatives analytics platform Skew, the PCR for Bitcoin Options has been steadily rising rise since mid-March 2020. The latest figures show the ratio at a new high of 0.81 — with the trend indicating a possible move above the 1.0-level.

What Happens to BTC Price Post-Halving?

A temporary retrace for BTC in the immediate aftermath of the halving probably does little to dampen enthusiasm for the long-term price trajectory. Going by historical precedence, Bitcoin prints a new all-time high in the year following a block reward halving event. Currently, the top-ranked crypto by market capitalization is down by almost three percent since temporarily topping $10,000. The move above the $10k price mark was the first Bitcoin was in the five-figure zone since February.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored