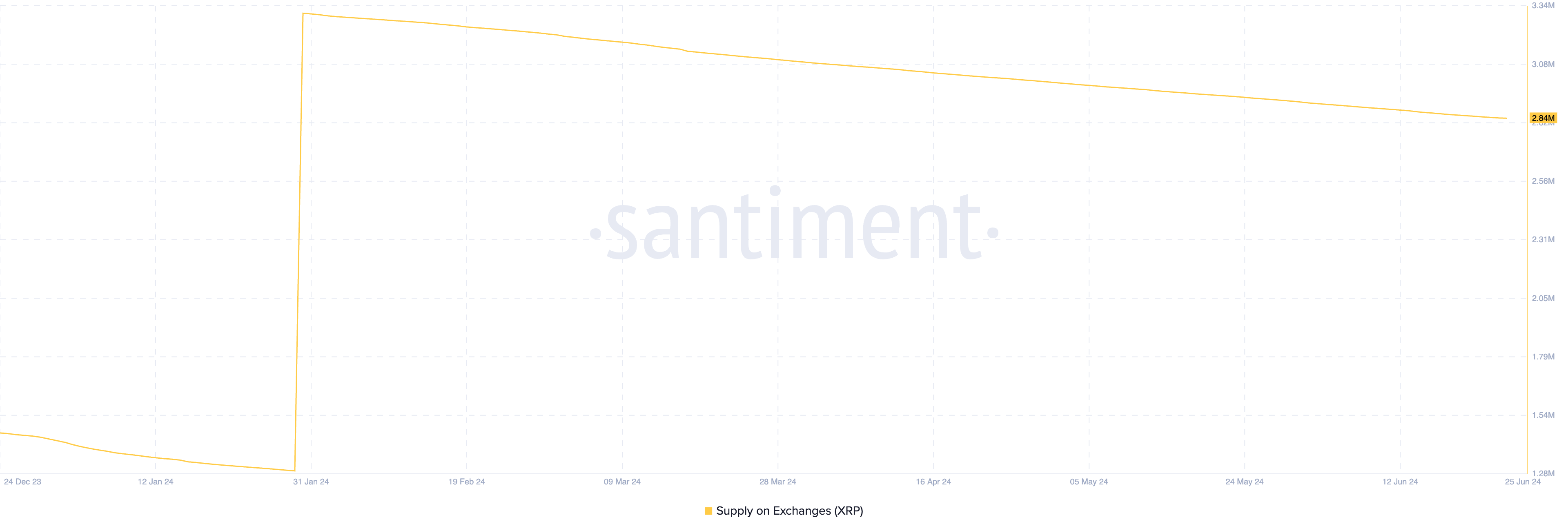

The number of Ripple (XRP) tokens held across cryptocurrency exchanges totals 2.84 million XRP, which is valued at $1.34 million at current market prices.

This represents the lowest amount of XRP tokens held on exchanges since the beginning of the year.

Ripple Records Low Sell-offs

At press time, the token’s supply on exchanges was 2.84 million XRP, the lowest level since January 1. When an asset’s supply on exchanges drops, its total amount held on cryptocurrency exchanges decreases.

This may be due to investors holding their tokens in a hardware wallet, staking on decentralized finance platforms (DeFi), or generally refraining from selling their holdings in expectation of a future price rally.

However, XRP’s recent price action has not shown any potential for a significant rebound in the near term. As of this writing, XRP trades at $0.47. In the last month, the altcoin’s value has plummeted by 12%.

Read More: Everything You Need To Know About Ripple vs SEC

For context, the altcoin revisited its year-to-date low of $0.46 on June 24, marking its second time this month alone.

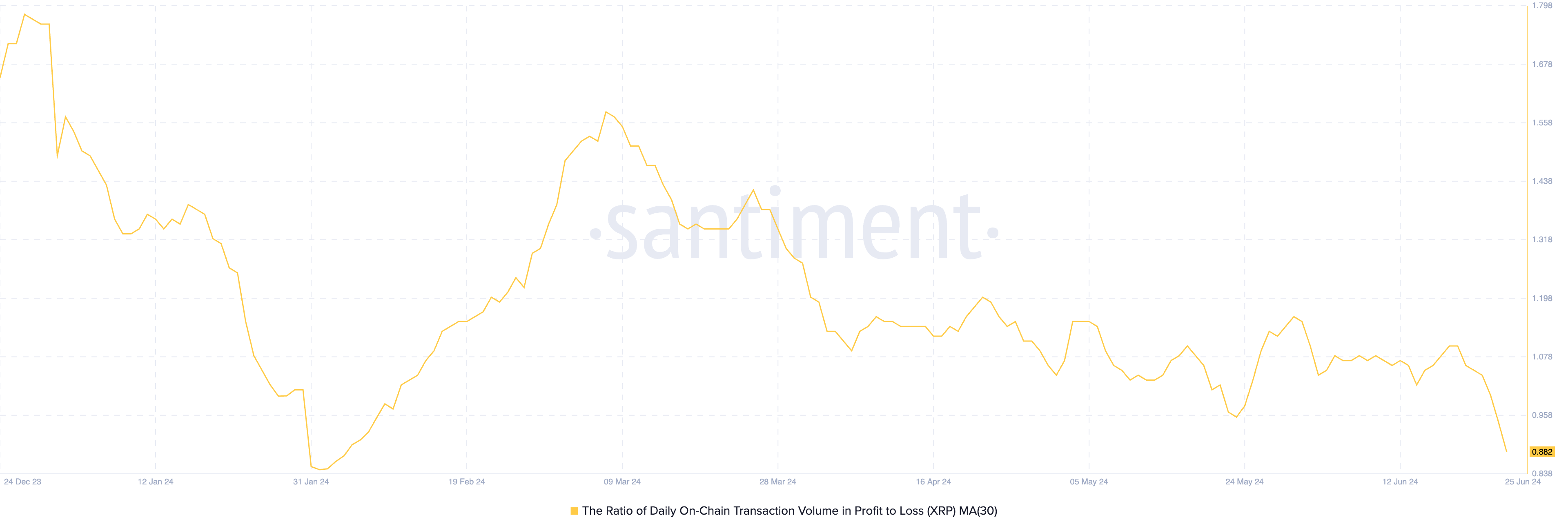

The consistent decline in XRP’s value is partly attributable to how much losses its holders have incurred recently. For example, its daily ratio of transaction volume in profit to loss (assessed using a 30-day moving average) is 0.88 at press time.

This means that for every XRP transaction ending in a loss, only 0.88 transactions return a profit.

XRP Price Prediction: The Bears Are in Control

Readings from XRP’s price performance on a daily chart show the decline in the demand for the altcoin. For example, its Chaikin Money Flow (CMF), which measures money flow into and out of its market, is currently 0.06.

A negative CMF value is a sign of market weakness. It is a bearish signal that suggests liquidity exit from the market. Traders often interpret it as a signal of a further decline in an asset’s value.

XRP’s Moving Average Convergence Divergence (MACD) setup confirms the bearish sentiment. As of this writing, the token’s MACD line (blue) rests under the signal (orange) and zero lines.

The indicator identifies changes in an asset’s strength, price direction, and momentum. When the MACD line falls under the signal line, it is a bearish signal, which suggests that selling pressure is more significant than buying activity.

If the demand for XRP continues to plummet, its price will fall to $0.42.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if sentiment shifts from bearish to bullish, the token’s price will rise to $0.49.