Ripple (XRP) is at it again. This time, the price of the token is not pumping to the surprise of the broader market like it did some days back.

But for the first time since March, two key metrics have reached a high level that could strengthen XRP’s potential to hit a higher value. Are other happenings on-chain heading in a similar path?

Ripple Stunning Activity Level Hints At Price Boom

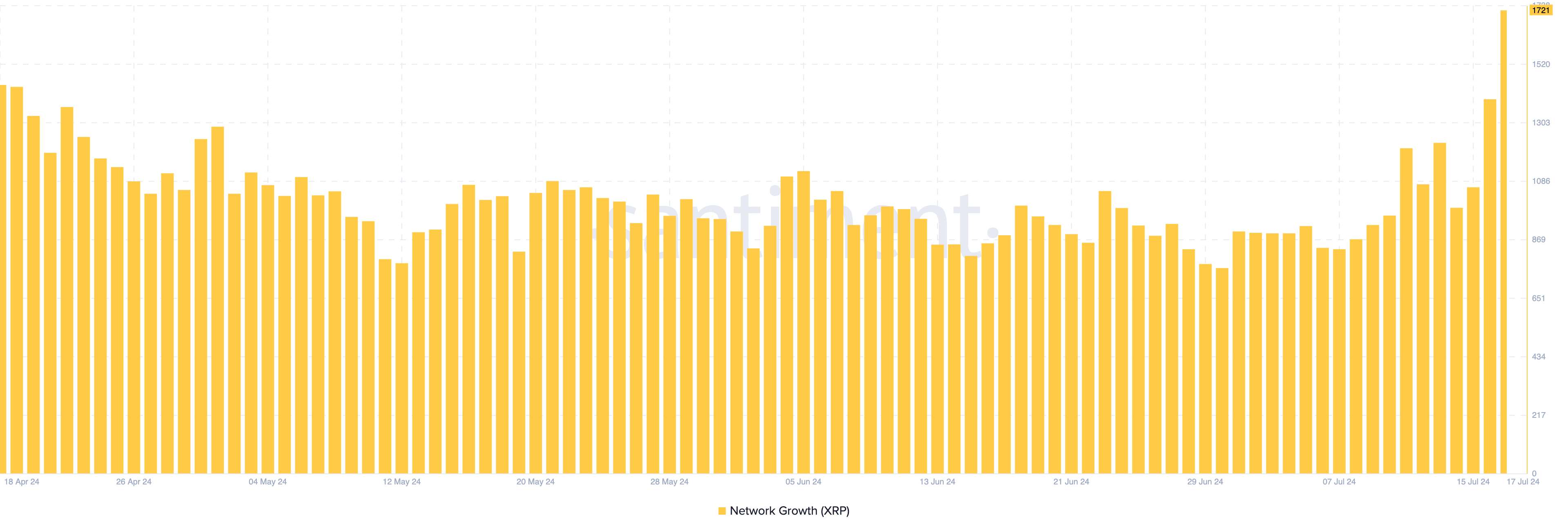

To start with, BeInCrypto examines the Network Growth. This metric measures the number of new addresses interacting with a network. By interaction, we mean the number of new entrants making their first successful transaction.

An increase in this figure is bullish for the network since it indicates an improvement in adoption. A decrease implies the opposite.

Information observed on the XRP Ledger (XRPL) shows that Network Growth reached 1,721, indicating a surge in the token’s adoption and improved traction on the ledger. However, it does not end there.

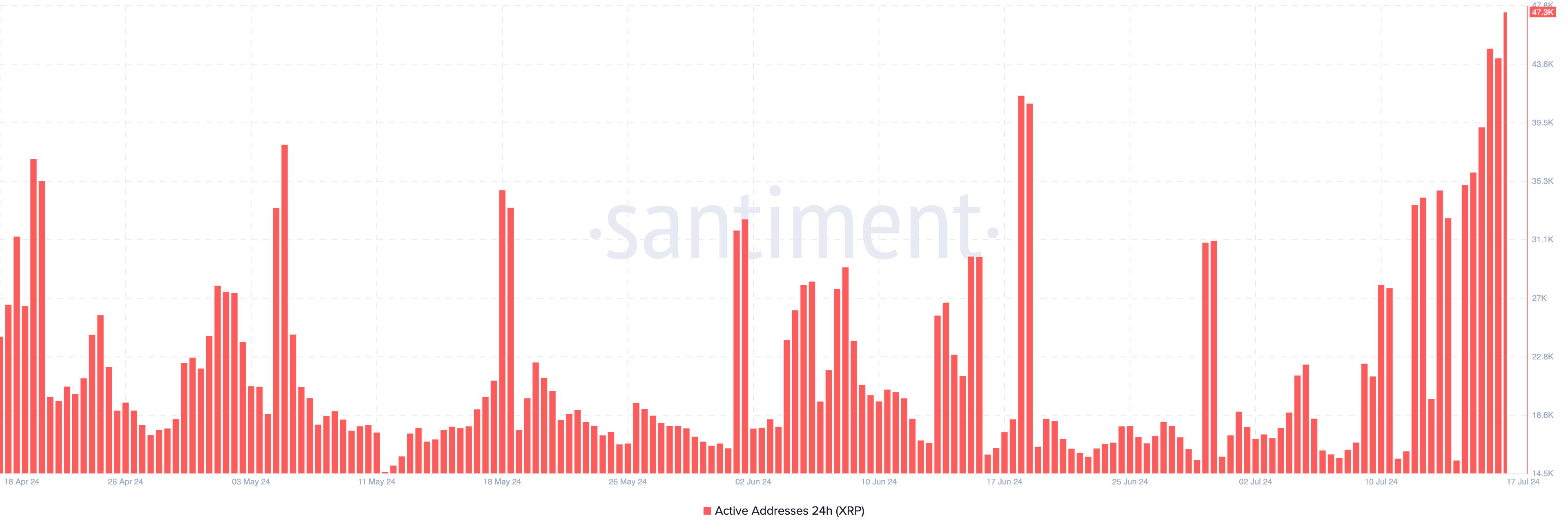

Another metric with a similar jump is active addresses. In simple terms, active addresses track the number of distinct users involved in transactions.

Usually, this metric does not count the new cohort participating in the network. Instead, it looks at the market participants who are both senders or receivers and have previously interacted with the network.

For the ledger, on-chain data from Santiment showed that 47,300 active addresses made successful XRP transactions between July 17 and 18.

Like the surge in Network Growth, this is also the first time the metric has hit a high number since March 30. Typically, when things like this happen, it means that a major upgrade or development is coming up.

Read More: How To Buy XRP and Everything You Need To Know

But for Ripple, that is not the case. Hence, it is not out of place to infer that XRP holders are gearing up for another bullish run similar to or much more than what the token did in the last few weeks.

XRP Price Prediction: After the Dip Comes the Pump

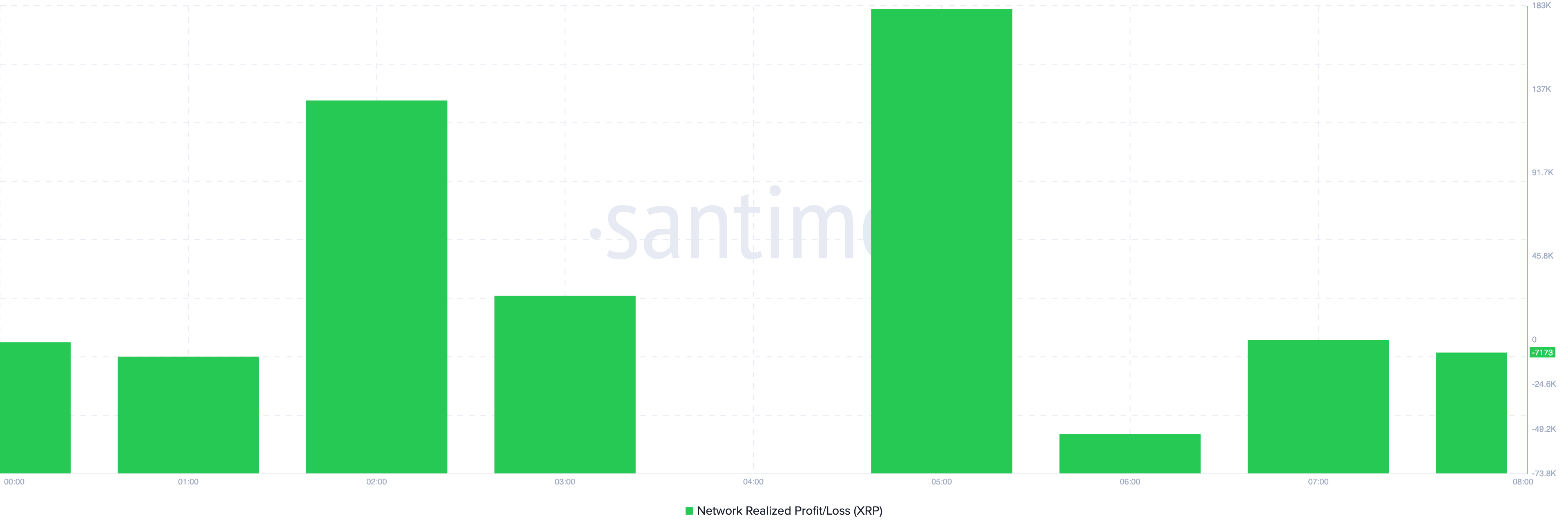

At press time, XRP trades at $0.55, representing a 4.74% decrease in the last 24 hours. The price decrease can be linked to a surge in realized profits.

According to Santiment, the Network Realized Profit/Loss reached 183,000 on July 19. Spikes in this metric indicate increased profit-taking. After the price decreased, BeInCrypto observed that holders of the token were now realizing losses as the metric plunged into a negative region.

Even though XRP has erased some of its gains, the price remains above the 200-day (yellow) and 50-day (blue) EMAs. This acronym stands for Exponential Moving Average, and it measures trend direction over a period of time.

When the EMA is above the price, the trend is bearish. But since it is the other way around, it reaffirms XRP’s underlying bullish potential and positive strength.

If this continues, XRP’s price may recover to $0.57 in the short term, as indicated by the 0.236 Fibonacci Retracement level. The Awesome Oscillator (AO), which is positive at press time, reinforces the prediction.

With increasing green histogram bars, the AO suggests that the token’s momentum may continue to increase.

Once validated by a rebound, XRP can head to $0.57. If the market condition gets extremely bullish, the price can surpass the $0.60 psychological resistance and reach $0.63.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, this prediction may be invalidated if cryptocurrency holders continue to realize losses. If this happens, XRP’s price may drop to $0.53.

The outcome of the case between Ripple and the U.S. SEC is another factor that could hinder the upswing. Recently, both parties have been pushing for a settlement, but nothing has come out of it yet. If the regulator pulls out and demands a huge fine, XRP’s price could consolidate and trend downwards.