The Securities and Exchange Commission (SEC) is holding another closed-door meeting with Ripple on Thursday as the market hopes for a possible settlement of the legal battle between both entities.

However, the cryptocurrency market remains relatively bearish, with XRP’s price and trading volume declining over the past 24 hours.

Ripple Holders Are Not Taking Any Chances

At press time, XRP trades at $0.60. The altcoin’s price has declined by 6% in the past 24 hours. During that period, trading volume totaled $27 million, falling by 27%.

The SEC earlier met with the digital payment company on July 25. While the outcome of that meeting remains unknown, the Sunshine Act Notice for Thursday’s meeting includes an additional item for discussion from the July 25 Closed Meeting: the institution and settlement of injunctive actions. This has led market participants to speculate on whether a settlement is imminent.

In an exclusive meeting with BeinCrypto, Ryan Lee, Chief Analyst at Bitget Research, noted that:

“This meeting will discuss potential settlement options for the Ripple lawsuit. The founder of Ripple Labs mentioned that a legal settlement might be announced soon. If an official settlement plan is released, it could positively affect XRP’s price movement.”

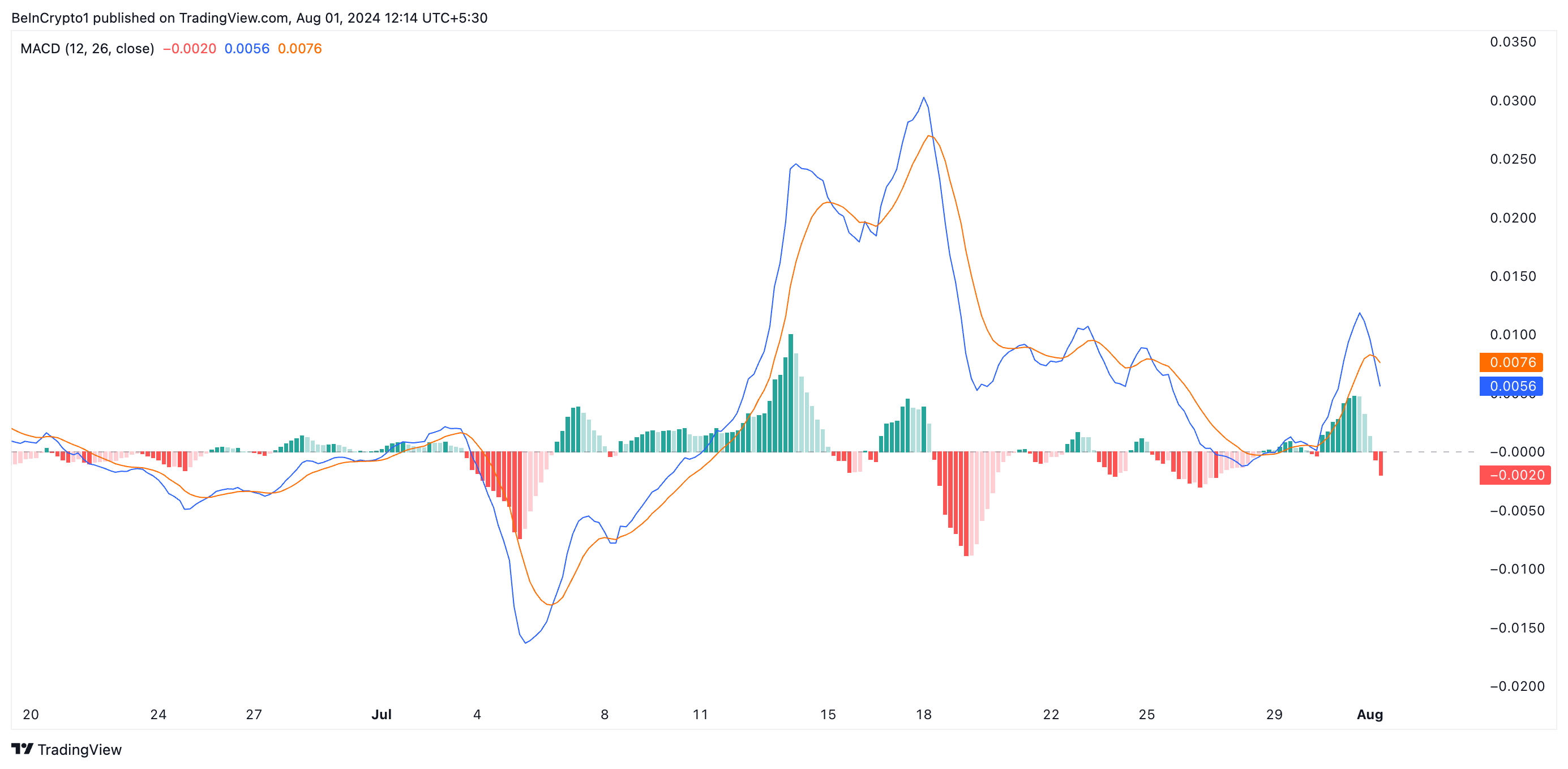

However, an assessment of XRP’s price movements on a 4-hour chart shows a spike in bearish bias as the market awaits the outcome of this crucial meeting. Readings from its Moving Average Convergence/Divergence (MACD) indicator show that its MACD line (blue) has crossed below its signal line (orange).

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD is set up this way, it is a bearish sign that suggests that selling activity outweighs buying momentum.

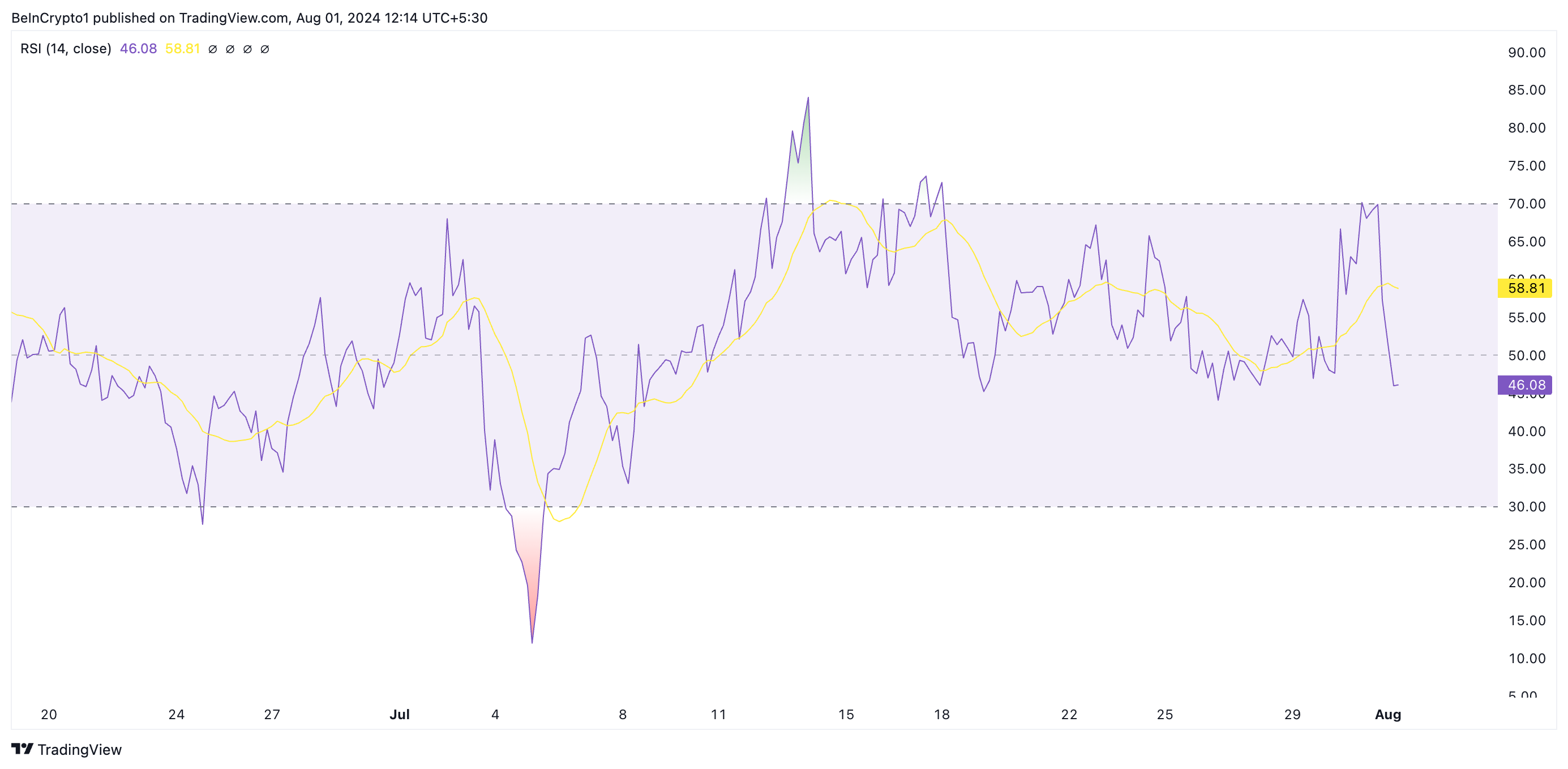

Further, the altcoin’s Relative Strength Index (RSI), at 46.08, is currently below its 50-neutral line and in a downtrend. This indicator measures an asset’s overbought and oversold market conditions.

Read More: How To Buy XRP and Everything You Need To Know

At 43.83 as of this writing, XRP’s RSI suggests a growing preference among market participants for token distribution.

XRP Price Prediction: Derivatives Traders Exit the Market

XRP’s derivatives market has also witnessed a drop in trading activity over the past 24 hours. According to Coinglass, derivatives trading volume plunged by 18%, and open interest fell by 10% during that period.

Open interest refers to the total number of outstanding derivative contracts, such as options or futures, that have not been settled. When it declines, traders close out their positions without opening new ones. This is a bearish sign that mirrors the lack of confidence in any potential positive price movements.

According to Lee, the outcome of the meeting with the SEC “significantly impact the token’s price movement.” If the result is favorable, the token’s price may rally toward $0.75 in August.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, if no favorable resolutions are reached, it may plummet to the $0.50 price range.