This analysis explores Ripple’s (XRP) recent price activity and network engagement, providing valuable insights into the underlying dynamics and potential future directions.

Can XRP bounce back from its recent price decline as active addresses decline?

Ripple Daily Technical Outlook

On Friday, June 7, XRP saw a significant 13% decline, highlighting the critical role of the Ichimoku Cloud in assessing support, resistance levels, and trend direction.

Despite attempts, XRP failed to breach the daily Ichimoku Cloud, underscoring its importance. XRP was also unable to surpass the 100 EMA (blue line) and 200 EMA (green line), falling short of the upper boundary of the Ichimoku Cloud. The baseline (red) acted as a strong support level.

The rejection from the cloud and the breakout below the baseline are crucial indicators for determining price direction.

Read More: How To Buy XRP and Everything You Need To Know

Following this drop, XRP stabilized around $0.49, which served as support, with the baseline acting as resistance. However, XRP broke below the $0.49 support level, reaching $0.48.

Currently, XRP is stabilizing around this mark, with $0.49, and the daily Ichimoku Cloud baseline is now likely to serve as strong resistance levels.

If XRP rises above $0.49, the outlook will significantly change. The key support level to watch is the Ichimoku baseline; a break above this level could signal a bullish rise on the horizon.

XRP On-Chain Analysis: Active Addresses

This analysis focuses on the activity of XRP’s active addresses over the last 30 days, highlighting significant changes and trends.

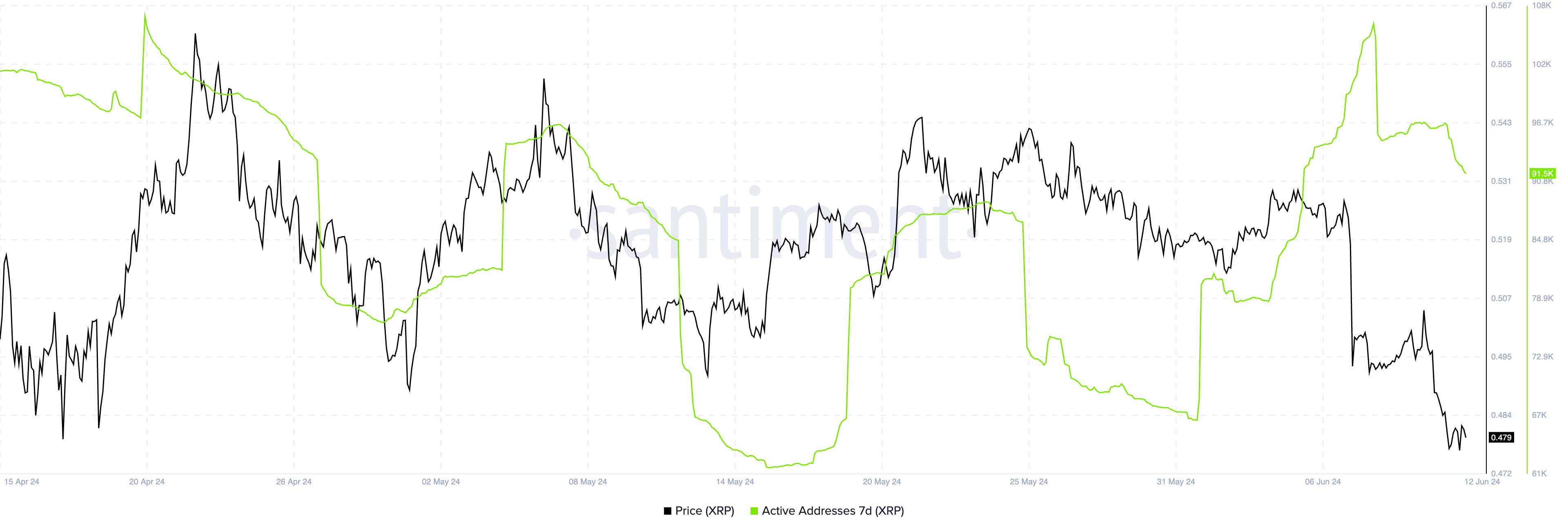

The dataset includes hourly data on the price of XRP and the number of active addresses over a 7-day period, allowing for a detailed examination of market behavior and participant engagement.

The data indicates a healthy level of activity within the XRP network. The rolling 7-day change metric smooths out the hourly volatility and highlights a steady growth trend in user engagement.

This is a positive sign for the network as it demonstrates growing interest and participation, which are essential for the ecosystem’s vitality and long-term success.

Active addresses increased from 66,000 to 107,000 between June 1 and June 8, then sharply declined from 107,000 to 92,000, resulting in a decrease of 14.02%.

Despite the sharp decline in active addresses, the current level of active addresses remains relatively high.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

This sustained activity has likely contributed to the stability of XRP’s price, preventing it from experiencing the drastic drops seen in other top 20 altcoins by market cap.

If the number of active addresses were to fall back to 60,000 or lower, it could generate significant selling pressure.

This is because many trading algorithms incorporate active addresses as a key indicator of a blockchain network’s health and activity. Therefore, maintaining high levels of active addresses is crucial for supporting XRP’s price and overall market confidence.