The recent crypto market crash brought Ripple investors’ hopes down along with the price after XRP charted a massive run early this month.

Many in the market are of the opinion that Ripple is on the cusp of winning the regulatory battle that has worn down XRP price action.

Amid heightened anticipation of news of a win against the U.S. Securities and Exchange Commission (SEC), Ripple price rallied by nearly 15% from Oct. 4 to Oct. 9.

However, larger market blues and the recent FTX collapse significantly affected XRP price, bringing it down to $0.3436 at press time.

XRP Traders Anticipate Pump

Even though price was down 89.62% from its all-time high price, investors and traders have not given up hope on the coin. At the time of writing, the global crypto market was trading in red, with Bitcoin, Ethereum, and most altcoins showing losses on the daily chart.

Ripple, too, much like its counterparts, was down in terms of price, but an interesting phenomenon was the heightened trader interest. XRP trade volumes, as per data from CoinMarketCap, were up by 118% over the last 24 hours from press time.

The seventh-ranked coin by market capitalization was trading near its long-term support at the $0.3200 mark.

Despite price action looking largely bearish, there were some bullish deviations in on-chain metrics for Ripple.

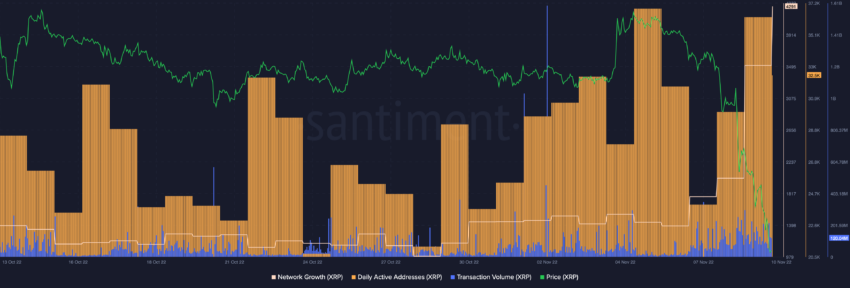

Daily active addresses (DAA) noted a major spike, rising to 48,666 on Nov. 13 alongside high transaction volumes. However, DAA had dropped by over 25% in a day, which could spell some trouble for the coin.

Nonetheless, Ripple’s network growth noted a massive rise, reaching a one-year-high last seen in Nov. 2021. A healthy rise in network growth could aid price action if bulls take control.

However, with the larger market mood still bearish, it would be interesting to see where network growth and vibrancy can take XRP price.

What Are Ripple Whales up To?

Ripple whales have had a rather peculiar market movement of late. Fresh data from WhaleStats highlights that around 90 million XRP coins had been transferred from unknown wallets to exchanges in the last 24 hours.

Three transactions over the last day have been made. In the first two transactions, XRP was sent from an unknown wallet to Bitstamp.

While the third transaction saw 30,000,000 XRP worth over $10.23 million transferred from an unknown wallet to Bittrex. Notably, a total of over $35 million in XRP was sent to exchanges, which could point towards from sort of selling or redistribution by whales.

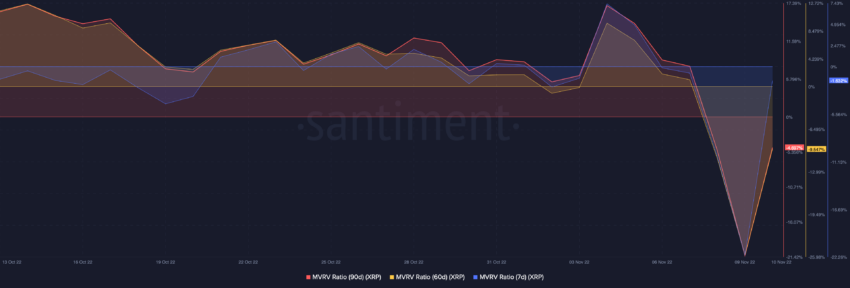

A look at the XRP long-term and short-term MVRV suggested some recovery from the lower levels, but it was still in the negative zone. News of recovery into the positive zone could have a positive impact on XRP price.

From an on-chain perspective, XRP price could be preparing for some bearishness looking at whale distribution. If bears stay in control of XRP price action, the coin can see a retest of the lower $0.3000 price level.

In case of a bullish price rise, the $0.4500 and $0.4700 marks would act as the next target.

Disclaimer: BeinCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.