Revolut is reportedly set to temporarily suspend some of its cryptocurrency services for business customers in the UK.

This decision comes in response to the Financial Conduct Authority’s (FCA) announcement of new rules for crypto assets, slated for implementation in the new year.

Revolut Halts Crypto Services to Align with New Regulations

According to a recent report, starting from January 3, 2024, UK customers using Revolut Business will no longer be able to purchase crypto through the platform.

Despite the temporary suspension, business customers can still hold and sell their current crypto holdings. However, these adjustments will not impact Revolut’s retail customers.

Revolut reportedly emphasized that the temporary suspension is aimed at allowing the company sufficient time to adapt its services. Additionally, to comply with the FCA’s new requirements. The FCA’s new crypto requirements were released in October.

The requirements mandate that firms offering crypto services exercise caution in promoting the asset class to customers. Furthermore, on November 3, BeInCrypto reported that the FCA issued a 32-page handbook to help firms adhere to the new promotional rules for crypto.

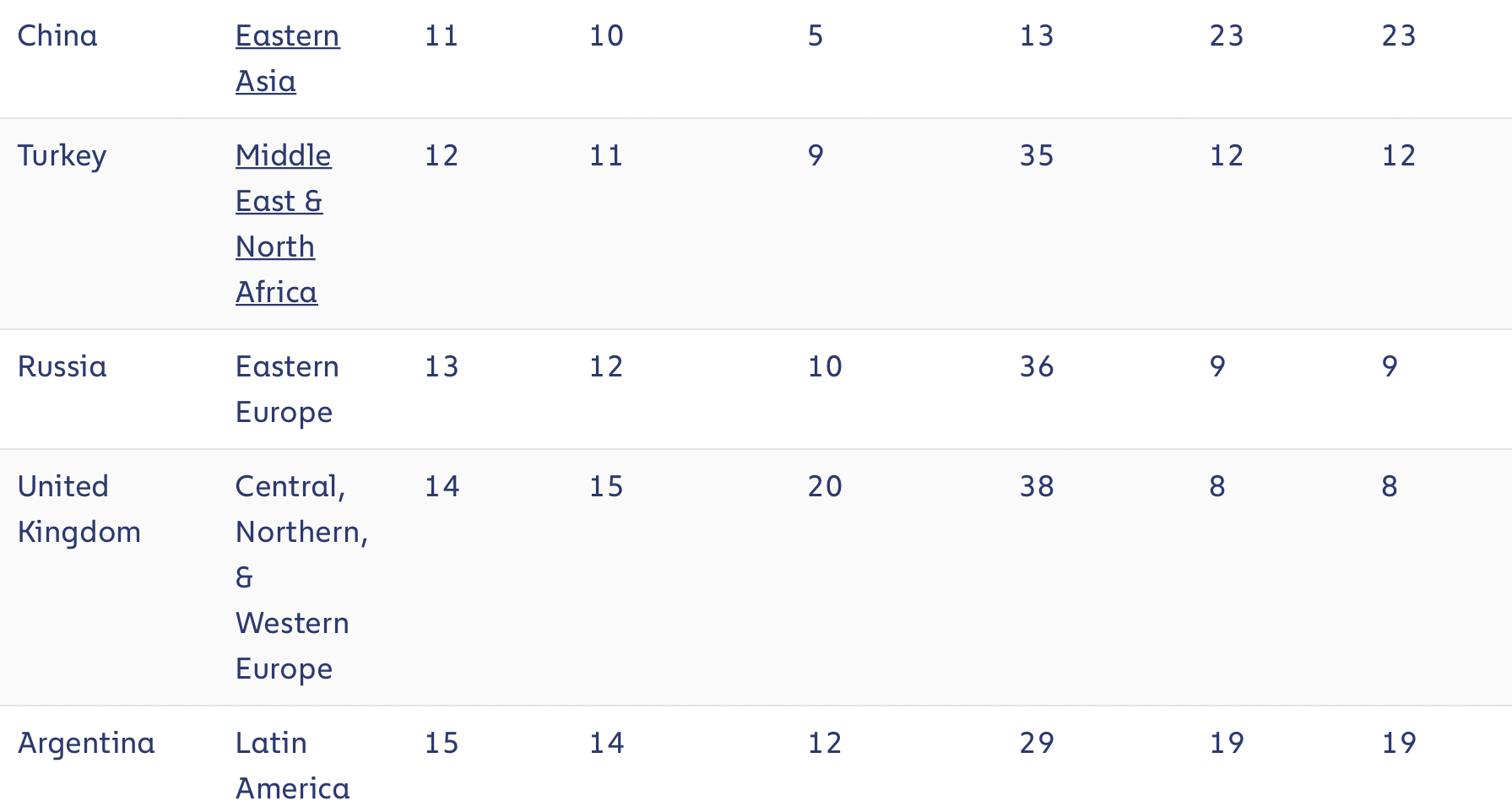

The UK has seen a steady rise in crypto adoption, securing the fourteenth position on Chainalysis’ global crypto adoption index.

Read more: How To Buy Bitcoin With Revolut: A Step-by-Step Guide

FCA Gives Leniency For Crypto Firms To Adapt

However, among the key regulatory changes is the introduction of a 24-hour “cooling off period.” Additionally, a prohibition on incentives like “refer a friend” bonuses.

Meanwhile, the FCA has set a deadline of January 8, 2024 for registered crypto firms to fully comply. Furthermore, this allows companies a transitional period to implement necessary features that may require additional technical development.

Revolut’s response to regulatory changes highlights the dynamic nature needed to stay in the crypto market and the importance of ensuring compliance to safeguard the interests of investors.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?