Up to 98% of Ethereum (ETH) trade volume on large crypto exchanges is artificially inflated. The results were published in a paper by Blockchain Research Lab. But which exchanges are trustworthy?

Analysis of trades turned up surprising amounts of so-called “wash trading.” Wash trading occurs when trades do not materially move the net value of an asset but do inflate its trading volume.

The paper places exchanges into three groups: ones with honest volume, ones with possibly inflated volume, and ones with clear evidence of inflated volume.

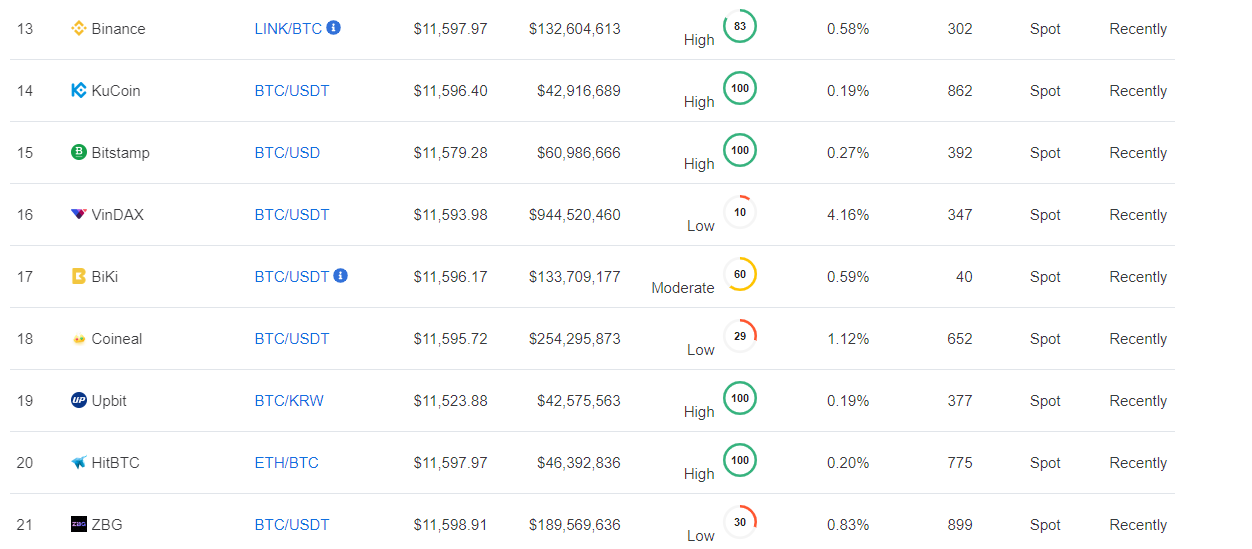

Larger trade volumes rank exchanges higher on the list for sites like CoinGecko and CoinMarketCap. The higher rank brings in more traffic. CoinMarketCap uses its own algorithm to address the validity and reliability of posted trade volumes and liquidity.

Some exchanges could have bad actors posting fake orders on their books. If these accounts are indeed owned by the exchange, they increase liquidity and depth artificially.

https://twitter.com/lab_blockchain/status/1296436430814810114?s=20

A Who’s Who of Who Lies

The first category researchers determined were the honest exchanges. These included Bitfinex, Bistamp, Bittrex, Kraken, and Poloniex. The second category, the ones with inconclusive evidence, were the giants Binance and HitBC, as well as the smaller, less-established exchanges like KuCoin and YoBit. The third category, the ones with obviously inflated trade volume, included FCoin, Huobi, and OKEx. The researches used data from the honest group to scrutinize the exchanges with fraudulent volumes. Blockchain Research Lab relied on indicators, such as posted trade volume, balances on the exchanges, the number of wallets, and web-traffic to determine how much volume originated from wash trading. They used trade volumes for BTC, ETH, XRP, USDT, and USD to make their determinations. The average daily volume for BTC/USD for exchanges from the first “honest” group was about $42 million. The second group accounted for a much larger $170 million, and the manipulated exchanges claimed a volume of almost $490 million.

Another Game in Town

These analysts are not the first to reach such conclusions. In July, CoinMetrics posted its own research, rating the likely validity of official trade volumes. In this document, the firm determined only about a dozen exchanges published reliable volumes. Last year, Forbes magazines wrote that up to 95% of Bitcoin trading was wash trading. Gavin Brown, a Senior Lecturer in Financial Economics at Manchester Metropolitan University, told Forbes:Most exchanges are unregulated. So they are incentivized to fake trading volumes without any legal repercussions.In addition to these metrics, stable coins make up at least $11 billion of the total crypto market. Accounts can easily rotate stablecoins back and forth to produce higher volumes. Some exchanges hold trading competitions in which users are rewarded for higher trade volumes, regardless of prices. The same freedoms that allow crypto traders to avoid regulators also come with their own risks. The specter of fake trading volume requires users to do their due diligence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Harry Leeds

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

READ FULL BIO

Sponsored

Sponsored