In this article, BeInCrypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically those that relate to realized profits and losses.

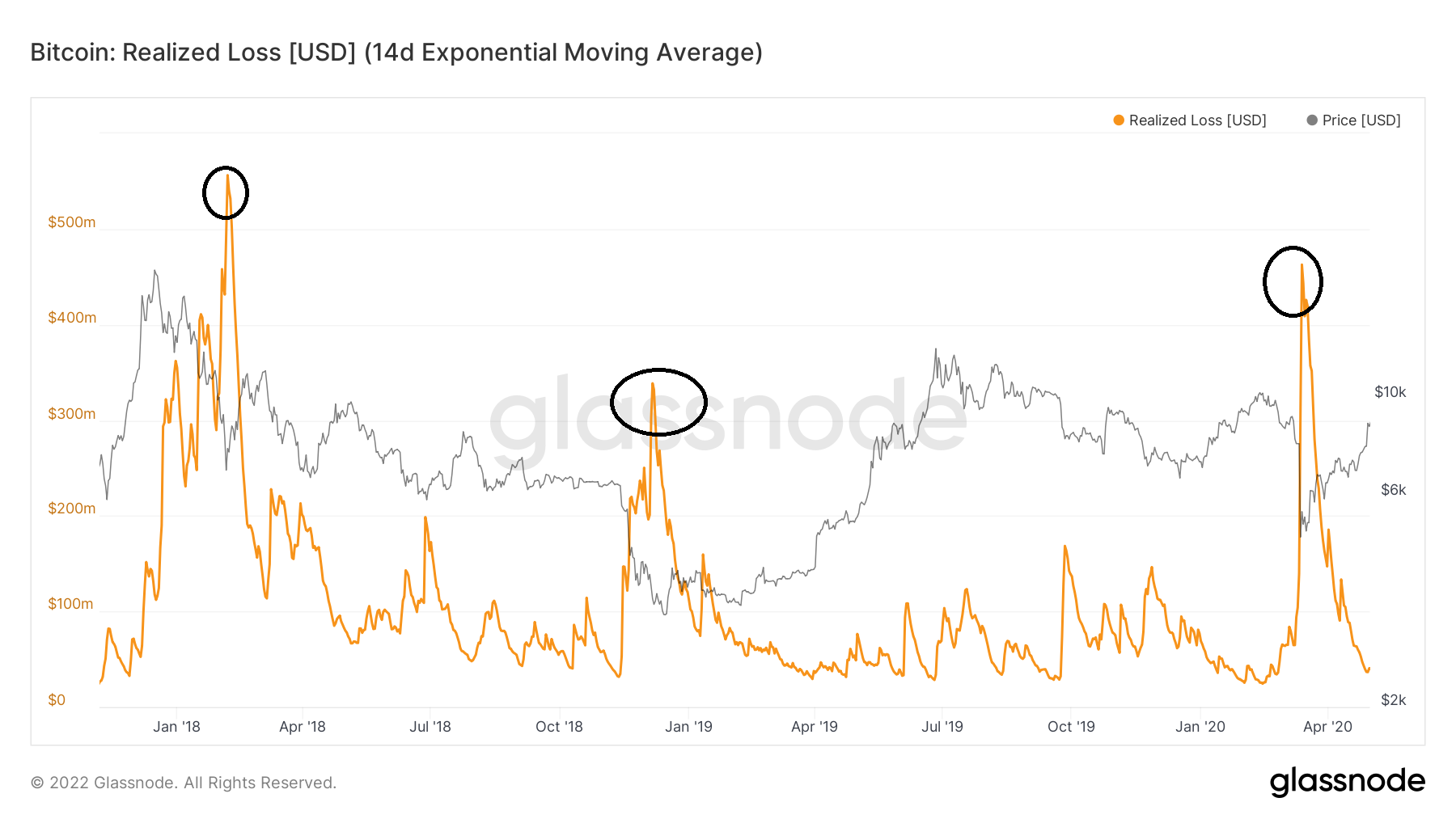

2018 – 2020 BTC realized losses

The realized loss indicator measures the total amount of losses (in USD) of all BTC moved in a specific day, whose price was lower than at the time they were bought. However, the indicator only takes into account coins that are sold at a loss. Therefore, those that are held at a loss are disregarded.

Realized losses usually peak during periods of capitulations. At these times, investors who bought the top give up on their investments and sell at a loss. Very often, this marks the bottom prior to the trend reversal.

In the 2018-2020 correction, realized losses for BTC spiked thrice (black circles):

- Feb 6, 2018 : Loss of $556 million

- Dec 6, 2018: Loss of $336 million

- March 13, 2020: Loss of $462 million

All three periods marked considerable bottoms prior to a significant price increase. This was especially evident on March 13, since that marked the absolute bottom prior to the initiation of the current upward movement.

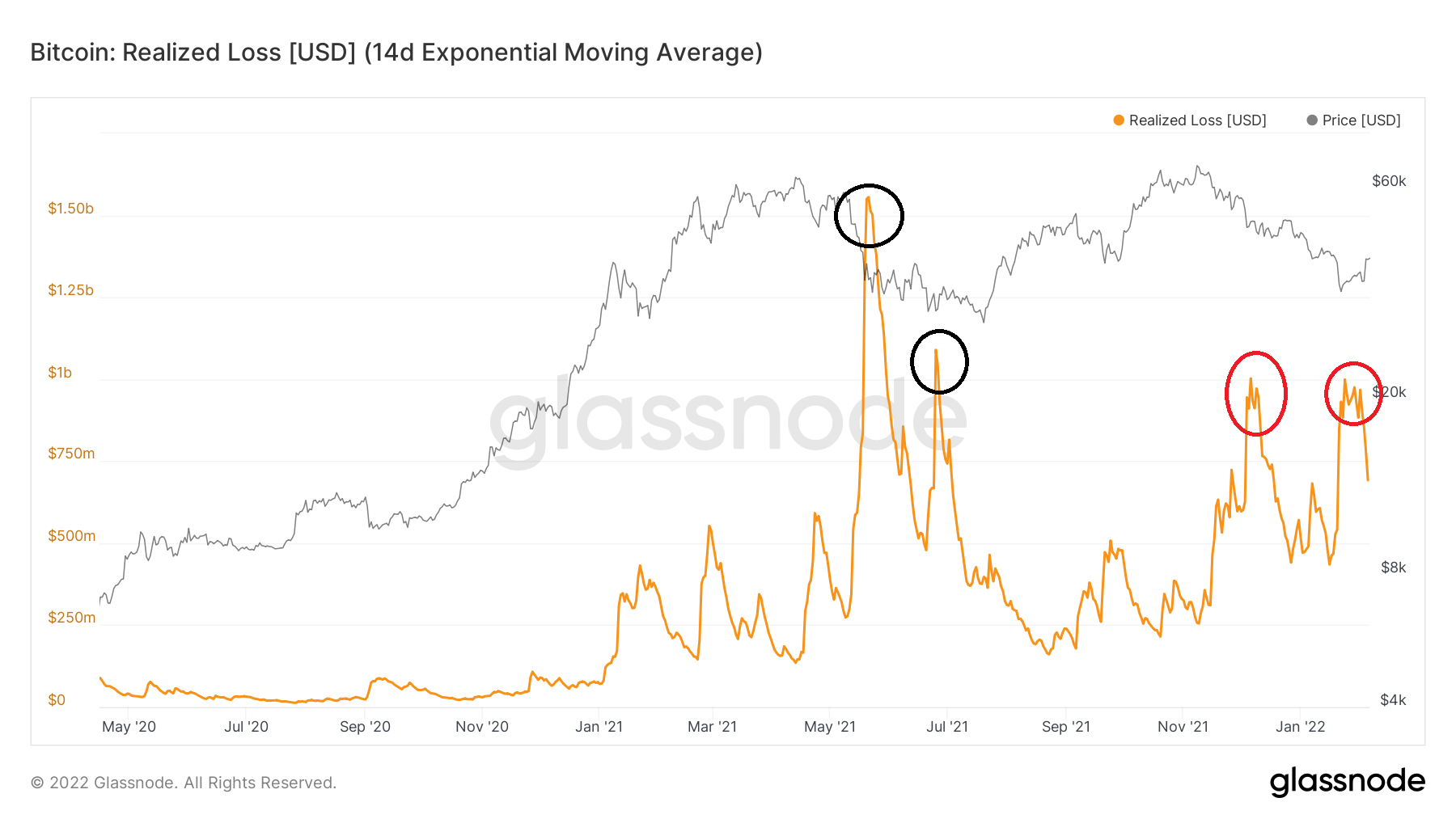

Current all-time high losses

Since the BTC price is now higher than it was in 2018-2020, it makes sense that realized losses are larger than they were before.

The current all-time high of realized losses was $1.549 Billion, reached on May 21. This did not mark the absolute bottom, which was reached on the second spike on June 25 (black circles).

Afterwards, realized losses have spiked twice more during the ongoing downward movement, more specifically on Dec 6 and Feb 3 (red circles).

Losses have decreased considerable since the second spike, after which the BTC price has been increasing. This means that the market is absorbing the sell side pressure, hence causing the increase in price. This is considered a bullish sign and could mean that the bottom is in or that it is very close.

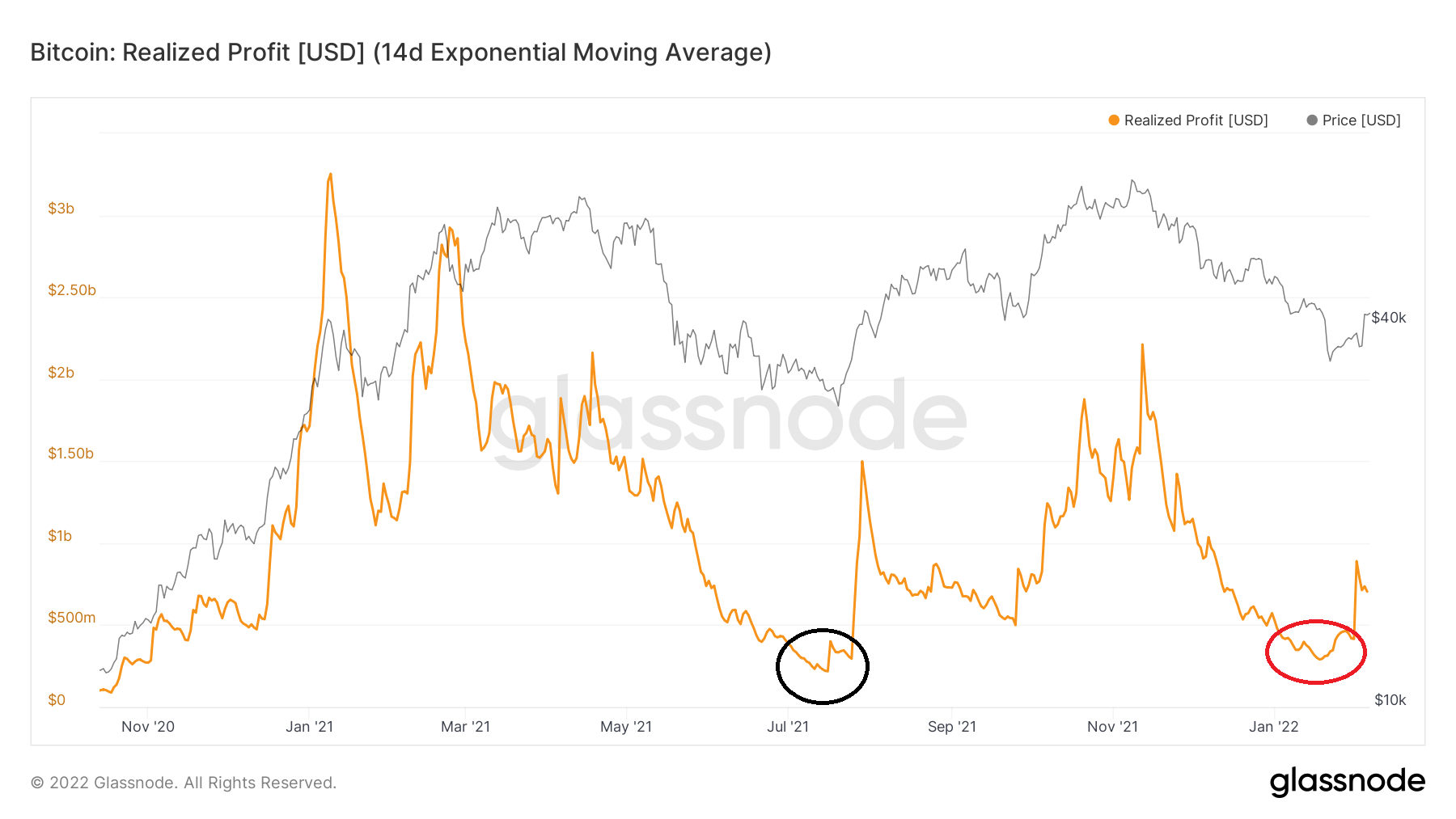

Realized BTC profits

A similar picture is given when looking at realized profits, which have been decreasing since the Nov 2021 all-time high BTC price.

On Jan 22, realized profits bottomed (red circle) at $290 Million.

With the exception of July 21 (black circle), when realized profits fell to $220 million, this was the lowest value since Nov 2020.

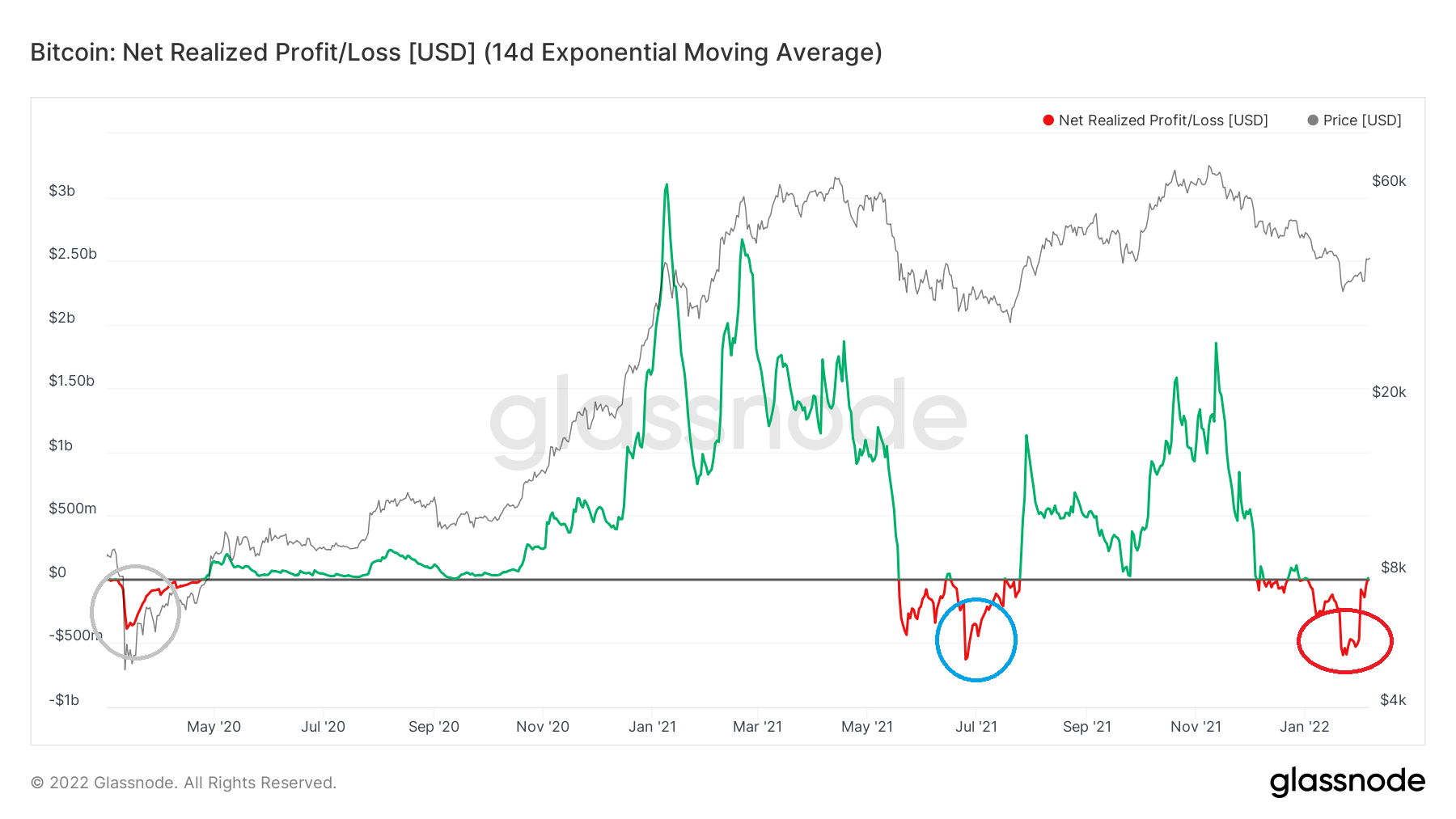

Net realized profit/loss

Finally, a look at the net realized profit/loss indicator, which combined the previous two indicators. It reached a bottom of $592 million on Jan 22 (red circle). It has been moving upwards since and is now nearly in positive territory.

Previously, the indicator bottomed on March 2020 (black circle) and June 2021 (blue circle). Both of these marked absolute bottoms, and the indicator reversed trend almost immediately afterwards.

Therefore, a continued increase into market profitability would go a long way in confirming that the BTC bottom is already in.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.