PEPE’s price did not have a week as spectacular as other altcoins; however, it did manage to flip $0.00001000 into support again.

Nevertheless, investors expect more from the meme coin as it is nearing a critical support level that holds a considerable profit.

PEPE Investors Can Bank on the Potential

While the PEPE price has not noticed a sharp rise in the last few days, it is currently attempting to flip a key resistance line into support. This could push the meme coin to $0.00001400, which would translate to massive profits.

According to the Global In/Out of the Money (GIOM) indicator, about 28.47 trillion PEPE worth more than $350 million was bought between $0.00001200 and $0.00001400. This supply will become profitable once PEPE closes above this price, which is also the next resistance level for the meme coin.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

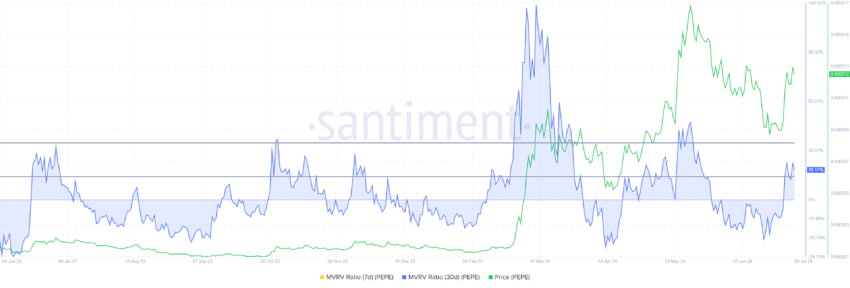

However, the crypto asset could find it difficult to gather support from investors, as signaled by the Market Value to Realized Value (MVRV) ratio. The MVRV ratio evaluates investor profit and loss.

At present, PEPE’s 30-day MVRV is at 18%, signaling profitability and potential selling pressure. Historically, PEPE tends to correct when the MVRV ranges from 14% to 34%, often referred to as the danger zone.

At this point, investors are more prone to selling their holdings to book profits or offset losses. This results in a price drawdown, which PEPE could face.

PEPE Price Prediction: Mixed Sentiments, Mixed Results

PEPE, trading at $0.00001227, has been attempting to flip the three-month-old uptrend line back into an uptrend. The drop noted at the beginning of July resulted in the meme coin losing this support.

However, reclaiming it could send it beyond $0.00001400, the next crucial resistance level. Flipping it into support would not only make the aforementioned supply profitable but also open the door to further rise.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

Nevertheless, resistance from the threat of selling could keep it from breaching $0.00001400. This also threatens potential consolidation under this price or a drop below the support of $0.00001146. Losing the latter would invalidate the bullish thesis, sending PEPE back to $0.00001000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.