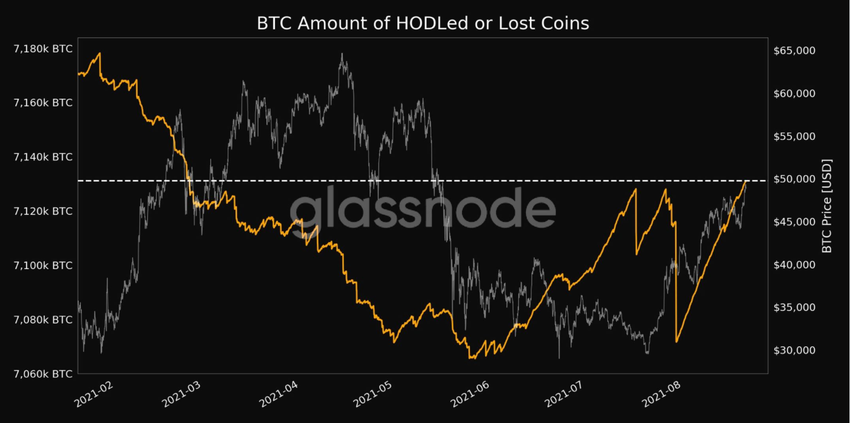

The total amount of lost or long term held bitcoin is said to now be close to 34% of the current supply of bitcoin.

On-chain market analysis company Glassnode shows that the total amount of long term bitcoin holders or potentially lost bitcoin has reached 33.96%. The total amount is 7,131,084 bitcoin held in these wallets.

The on-chain firm also recently highlighted that bitcoin exchange outflows have returned to a dominance of outflows through August as investors withdraw BTC. “The market has transitioned through a number of phases of exchange flow dominance over the last year, with outflow dominance last seen in late 2020,” the tweet stated.

Bitcoin struggles to break $50,000

Bitcoin has struggled to break past the $50,000 resistance mark, having managed to climb to $48,000. Not only did the month of August prove to be the highest level in the past five months for potentially lost or long-term holders, the surge in exchange outflows of bitcoin has proved favorable for the price of the crypto. Bitcoin has climbed over 19% in August alone. While the price has climbed more than 65% in the past 31 days alone.

Bitcoin ETFs

Investment management firms are still trying to push for a Bitcoin ETF to be approved. However, the U.S. Securities and Exchange Commission (SEC) have been dragging their feet regarding any ETF approvals.

Most recently, investment firm AdvisroyShares submitted an application for a bitcoin ETF. The firm joins a list of no less than 12 other firms that have all filed bitcoin ETFs. A number of them only came in the last few weeks; those from Galaxy Digital and asset management giant Invesco. Meanwhile, some of them who filed much earlier in the year, such as WisdomTree, still await a final decision from the SEC.