Polygon (MATIC) price is closing in on initiating a recovery after the altcoin fell to the lowest point since November 2023.

The leash of recovery is held with the investors who could make or break the potential rally for MATIC.

Polygon Sees Bullish Cues

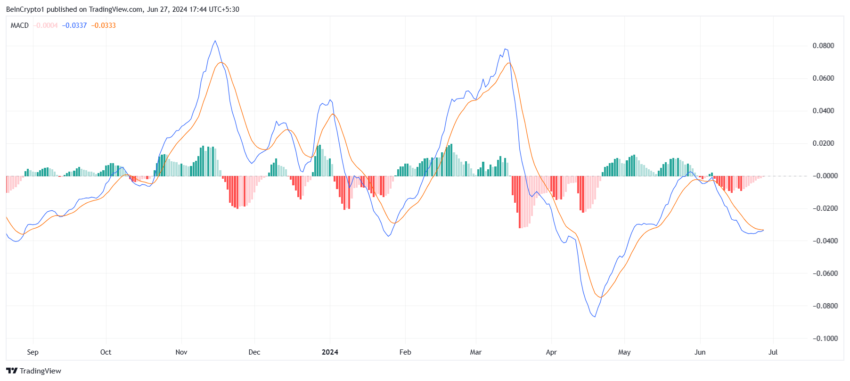

The MATIC price could benefit from the positive signals visible on the network, such as the Moving Average Convergence Divergence (MACD) indicator, which signals that MATIC is on the verge of a bullish crossover.

Traders widely use this technical indicator to identify potential shifts in market momentum. When the MACD line crosses above the signal line, it often suggests that the asset is poised for a positive price movement.

A bullish crossover in the MACD is typically seen as a strong signal for recovery. For MATIC, this could mean that the recent downtrend is coming to an end, and a period of upward momentum may be beginning. Investors often look for such signals to make informed decisions about entering the market, potentially leading to increased buying activity and further supporting the price recovery.

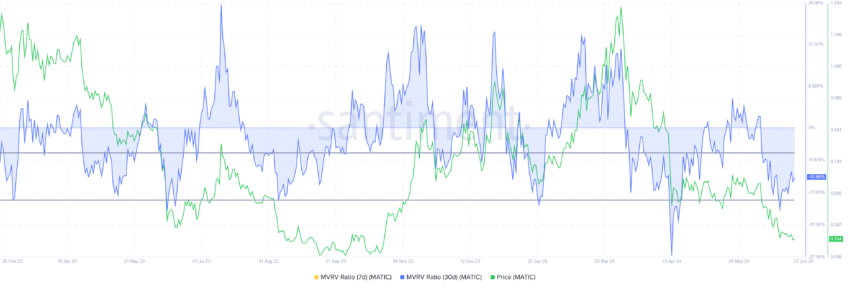

Additionally, the Market Value to Realized Value (MVRV) ratio, which assesses investor profit and loss, also highlights a bullish opportunity for investors.

Currently, Polygon’s 30-day MVRV stands at -10%, indicating losses, which may lead to buying pressure. Historically, MATIC MVRV between -5% and -15% usually signals the start of recovery rallies, marking an opportunity zone for accumulation.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

Thus, if MATIC investors opt to jump into the altcoin at this point, it could aid the recovery.

MATIC Price Prediction: Must Bounce Back

The MATIC price, trading at $0.55, is at a nine-month low, falling closer to the critical support of $0.53. The chances of a bounce back from this level are high, as the aforementioned factors lean in favor of a recovery.

The ideal target for MATIC price is reentering the consolidation zone of $0.75 and $0.64. These limits kept the altcoin contained for nearly two months, and the same could happen upon recovery.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

On the other hand, if the bullish outcome does not pan out as expected, the Polygon native token could fall below $0.53. As a result, the bullish thesis could be invalidated. As a result, the MATIC price could drop to $0.45, the next key support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.