The Polkadot (DOT) price is trading inside a corrective pattern. A breakout from it could trigger a 50% price increase.

The Polkadot price has fallen since reaching an all-time high price of $55.09 in Nov. 2021. The downward movement led to a low of $5.32 in Nov. 2022. The low was slightly below the $5.90 horizontal support area. However, the DOT price bounce afterward and is now trading inside the support area.

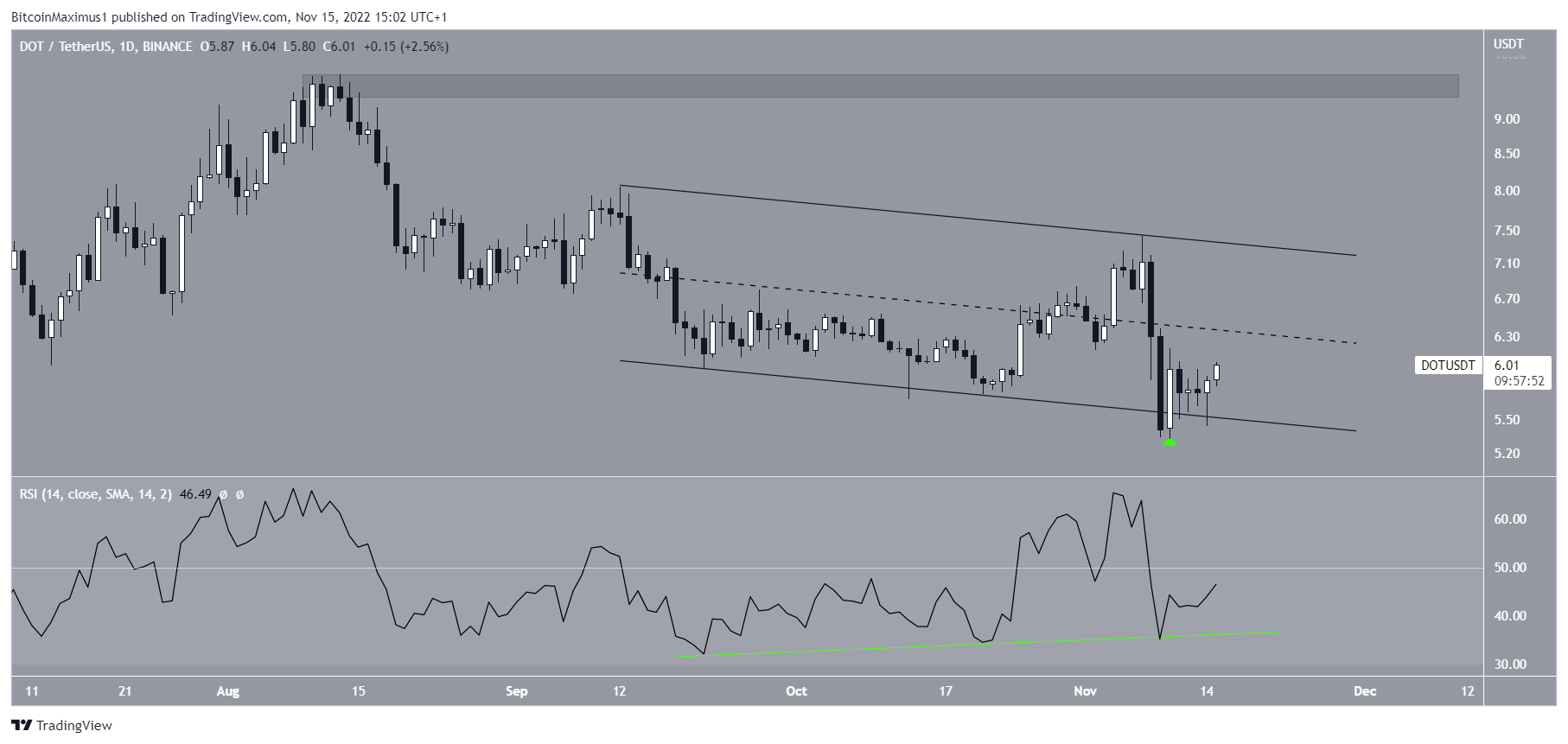

A bullish sign is the bullish divergence in the weekly RSI (green line). If the divergence holds, it could initiate an upward movement toward $9.30.

On the other hand, a weekly close below the $5.90 support area could be the catalyst for a decrease toward $4.

Polkadot Price Prediction: Bullish Above $7.10?

It bounced on the support line of the channel on Nov. 9 and began the current increase.

After a retracement, the DOT price has increased over the past 24 hours. The highest price reached was $6.04. If the upward movement continues, the closest resistance is at $6.20, created by the middle of the channel.

The daily RSI (green line) supports this increase, since it has generated a bullish divergence.

The resistance line of the channel is at $7.10. If the DOT price breaks out above it, it could accelerate its rate of increase to the next resistance at $9.50.

Conversely, a breakdown from the channel would be bearish and send the DOT price to $4.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.