Peter Schiff, an economist and well-known Bitcoin (BTC) critic, took to social media to voice his continued skepticism and deliver a scathing critique of the pioneer crypto’s meteoric rise.

The long-time gold proponent called the recent surge a “bubble” and warned of catastrophic consequences for investors and the economy.

Schiff Calls Bitcoin A Popular Delusion

Schiff’s criticism of Bitcoin has been longstanding. His latest remarks echo previous claims that cryptocurrency and blockchain are “popular delusions” driven by speculative fervor.

“Crypto and blockchain will likely go down as the biggest example of popular delusions and the madness of crowds in world history. The overall losses when the bubble finally pops will be staggering,” Schiff wrote on X (formerly Twitter).

He continued by warning that not just speculative buyers might suffer. In his opinion, the infrastructure and investments surrounding Bitcoin will crumble as well. This, Schiff says, would amount to what he sees as “the biggest misallocation of resources in human history.”

Schiff also suggested that Bitcoin’s collapse could tarnish the reputation of libertarian capitalism and the concept of sound money.

These comments sparked a renewed debate among his critics and Bitcoin enthusiasts, some of whom accuse him of secretly owning Bitcoin. Many believe that Schiff’s harsh criticism is merely a tactic to keep Bitcoin’s price down so he can buy in at a lower price.

“I get a kick out of Bitcoin fanatics who accuse me of secretly owning Bitcoin but refusing to publicly wear the ribbon. They are just so drunk on the Kool-Aid that they can’t accept that I legitimately disagree with their perspective,” Schiff recently responded to the allegations.

Schiff dismissed the speculation and asserted that he fundamentally disagreed with Bitcoin’s value. He views it as a bubble that will inevitably burst.

The animosity between Schiff and Bitcoin advocates is not new. He has consistently dismissed the cryptocurrency since its early days.

One user highlighted this point, accusing Schiff of predicting Bitcoin’s failure since it was priced at just $1. Schiff responded, saying, “No, when it was $1, I had no idea the bubble would ever get this big. Had I realized that back then, I would have loaded up on Bitcoin.”

This admission acknowledges the scale of Bitcoin’s price growth, though the economist continues to insist that the rise is unsustainable.

Schiff Quashes Hopes of US Bitcoin Reserve

Further, Schiff recently commented on the possibility of the US government establishing a Bitcoin reserve, as Donald Trump committed to. However, the Bitcoin critique argues that such a move would be disastrous. He notes that it would lead to a series of inflationary shocks that could destabilize the economy.

Peter Schiff’s hypothetical scenario outlines the US government purchasing one million Bitcoin, driving prices up and prompting long-term holders to cash out. According to Schiff, this would trigger a crash, compelling the government to print more money to stabilize Bitcoin’s price.

In turn, this would devalue the dollar. Schiff warns that this cycle could result in hyperinflation, rendering the dollar worthless. Ultimately, this would cause Bitcoin to collapse as well.

“That would cause the market to crash, forcing the US government to print even more dollars to buy more Bitcoin to prevent the price from crashing, thereby diminishing the value of its Bitcoin reserve. Of course, a reserve of something you can never sell and must continuously buy is worthless as a reserve. To maintain the pretense that its Bitcoin reserve has actual value, the US government would be forced to keep buying, destroying the value of the dollar in the process,” Schiff explained.

Schiff’s bleak vision of a potential Bitcoin reserve is rooted in his belief that Bitcoin lacks intrinsic value and is not a sustainable store of wealth. According to Schiff, a Bitcoin reserve would only exacerbate volatility in the market and lead to economic collapse. His apocalyptic forecast met with derision from prominent Bitcoin advocates, including MicroStrategy’s Michael Saylor, who responded to Schiff’s scenario.

“You finally made me laugh, Peter,” Saylor quipped.

The MicroStrategy executive’s jest captures the ongoing tension between Bitcoin supporters who view it as a revolutionary asset and skeptics who see it as a bubble primed to burst.

Despite the skepticism from critics like Schiff, Bitcoin’s trajectory has defied expectations over the years. It has grown from a fringe digital asset to a trillion-dollar market. Many investors and institutions like BlackRock now see it as a legitimate hedge against inflation and a decentralized alternative to traditional finance (TradFi).

Peter Schiff, however, maintains his stance that Bitcoin’s allure is based on hype rather than fundamental value. He warns that the fallout from its eventual collapse will leave a lasting impact on investors and society.

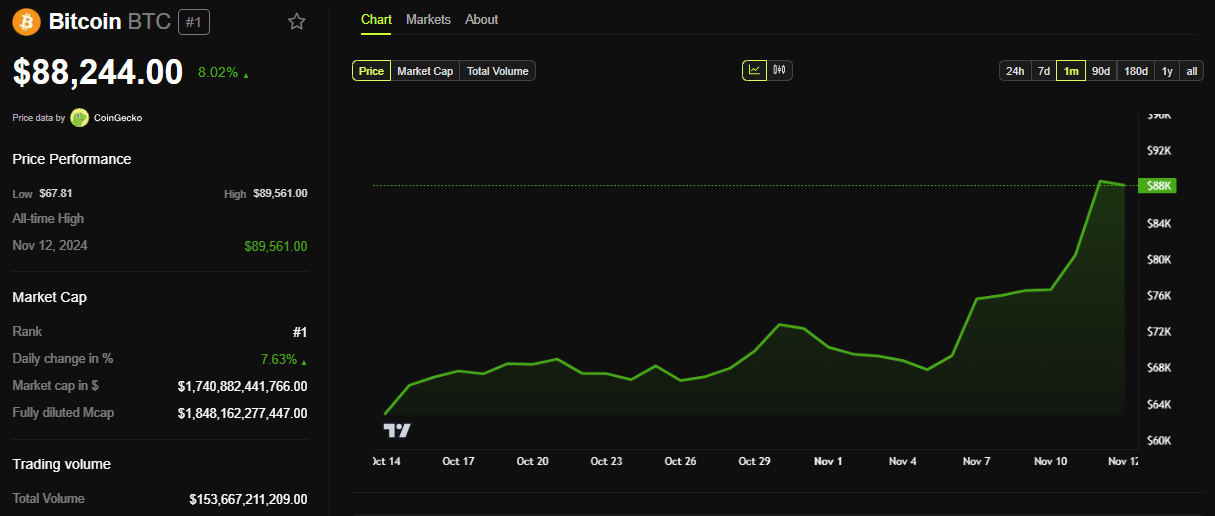

Meanwhile, Bitcoin’s value shows no signs of slowing down. It has been up by over 8% since Monday’s session opened. At the time of writing, BTC is trading for $88,244.