Peter Schiff is back in shape again! The infamous Bitcoin critic has just proposed another argument in his countless attempts to devalue the largest cryptocurrency.

This time, Peter Schiff tries to use the alleged negative correlation between Bitcoin and gold to prove the worthlessness of the former. On his Twitter profile, which has 658k followers, he wrote yesterday:

“#Bitcoin is not digital #gold, it is digital fool’s gold. In fact, since the price of Bitcoin is negatively correlated to the price of gold, it is a digital anti-gold.”

The tweet appeared as a preview of the debate between Schiff and Richard Hearth, which is scheduled to take place today. The direct duel follows months of tension on crypto-Twitter between the two investors.

One of the most popular responses under Schiff’s tweet was a comment from cryptocurrency market analyst Benjamin Cowen. He wrote:

“Since #Bitcoin is up 100 million percent over the last decade, and as you yourself admit it is negatively correlated to the price of gold, what does that exactly say about the price of gold Peter?”

Peter Schiff and Bitcoin’s correlation with gold

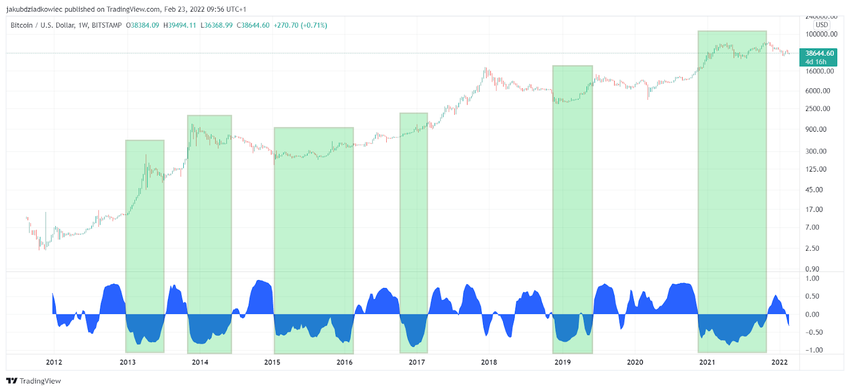

Leaving aside the sheer logical inconsistency of Peter Schiff’s argument – so well pointed out by Cowen – also the negative correlation with Bitcoin seems questionable. This can be seen in a weekly chart of the correlation coefficient between a chart of BTC/USD and GOLD/USD for the past 10 years.

It turns out that the correlation (blue chart) was sometimes positive (above 0) – the price of Bitcoin rose or fell with the price of gold – and sometimes negative (below 0) – the price of Bitcoin rose and gold fell or vice versa. Interestingly, during periods when the correlation was negative (green areas), the Bitcoin price most often experienced intense increases.

Conversely, when the correlation was positive, Bitcoin was in an extended sideways or downward trend. The exception is most of 2017, in which Bitcoin was surging strongly and the correlation with gold remained positive.

Gold makes no difference to the BTC chart

An even stronger argument against Peter Schiff’s opinion is provided by comparing the weekly chart of Bitcoin against the USD and the same chart in relation to the price of gold. It turns out that over the last 10 years, the long-term chart of BTC qualitatively looks almost the same against both the USD and gold.

If the above charts were not signed, it would indeed be difficult to find differences between them. This proves the fact that for the past decade, the price of gold has not provided any hedge against the USD. Moreover, gold was unlikely to generate a better return than Bitcoin, whose ROI was several orders of magnitude higher.

Summing up this phenomenon and at the same time proving the absurdity of Peter Schiff’s arguments, the aforementioned Cowen says in one of his recent YouTube videos:

“The valuation of gold over the last 10 years has been so negligible, that when you take the price of Bitcoin and divide it by gold, qualitatively it looks the same as if you valid it based on USD.”

What do you think about this subject? Write to us and tell us!