PEPE price has been struggling to find stability since the beginning of August. However, recent price action shows renewed bullish momentum, offering hope for the meme coin.

PEPE is now attempting to rise higher, potentially benefiting from the exit of some short-term holders.

Pepe Short-Term Holders Decline

Short-term holders of PEPE have significantly declined in number, with their count dropping by 21% from 23,000 to 18,000 since the start of the month. These investors, known for holding assets for less than a month and selling quickly, have posed a threat in the past.

However. the disappearance of short-term holders bodes well for PEPE’s price stability. With fewer short-term investors in play, the risk of a sudden sell-off is minimal, giving the meme coin a better chance of breaking through key resistance levels.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

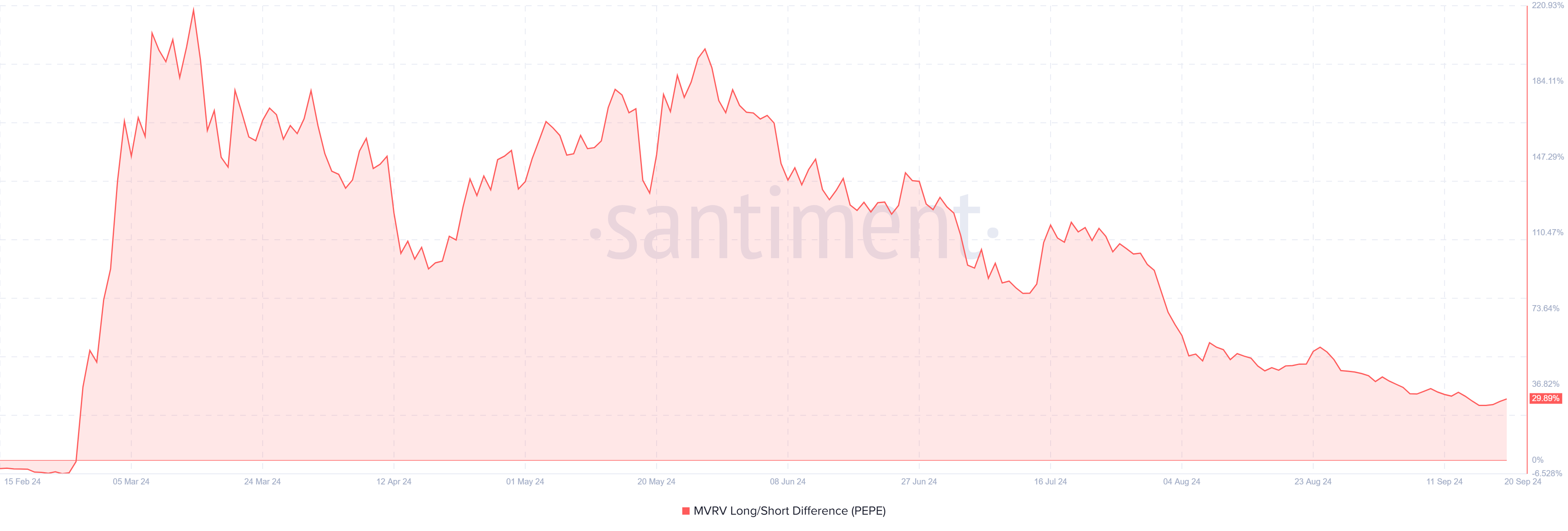

The MVRV long/short difference suggests long-term PEPE holders are in profit. This indicator measures whether the long-term or short-term holders are in profit, signaling in favor of the former. At 30%, the indicator exhibits that LTH is highly profitable, and since these investors are known for their HODLing, they may not move to sell.

The profitability of long-term holders also reduces the likelihood of a sudden sell-off, ensuring that PEPE’s price remains more stable in the near future. This could offer the meme coin a clear path to climb toward new highs.

PEPE Price Prediction: Breaking Out

PEPE has seen a 25% price increase over the last two weeks, coinciding with the decline in short-term holders. Currently trading at $0.00000832, PEPE aims to flip the $0.00000986 level into support, which could lead to a rise to $0.00001000, marking a six-week high.

Breaking out of consolidation would likely result in short-term profits. Furthermore, since short-term holders no longer heavily influence price movements, their selling is not expected to have any meaningful impact.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

However, if the breach fails, as it has in the past, the PEPE price could fall back down. This could lead to a drop to $0.00000632, which would invalidate the bullish thesis and potentially even wipe out the recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.