Pepe price reignited the bullish sentiment among investors on Wednesday after charting a substantial rise on the charts. This instilled hope among a certain group of investors of witnessing profits again.

However, broader market conditions pose a roadblock in the meme coin’s path to achieving a new all-time high.

Investors’ $900 Million Target

Pepe’s price registered a 643% rally since the end of February to bring the price to an all-time high of $0.00001084, with the intra-day high hitting $0.00000996. These gains, however, were corrected over the last week until Wednesday’s rally, which reclaimed some of the losses.

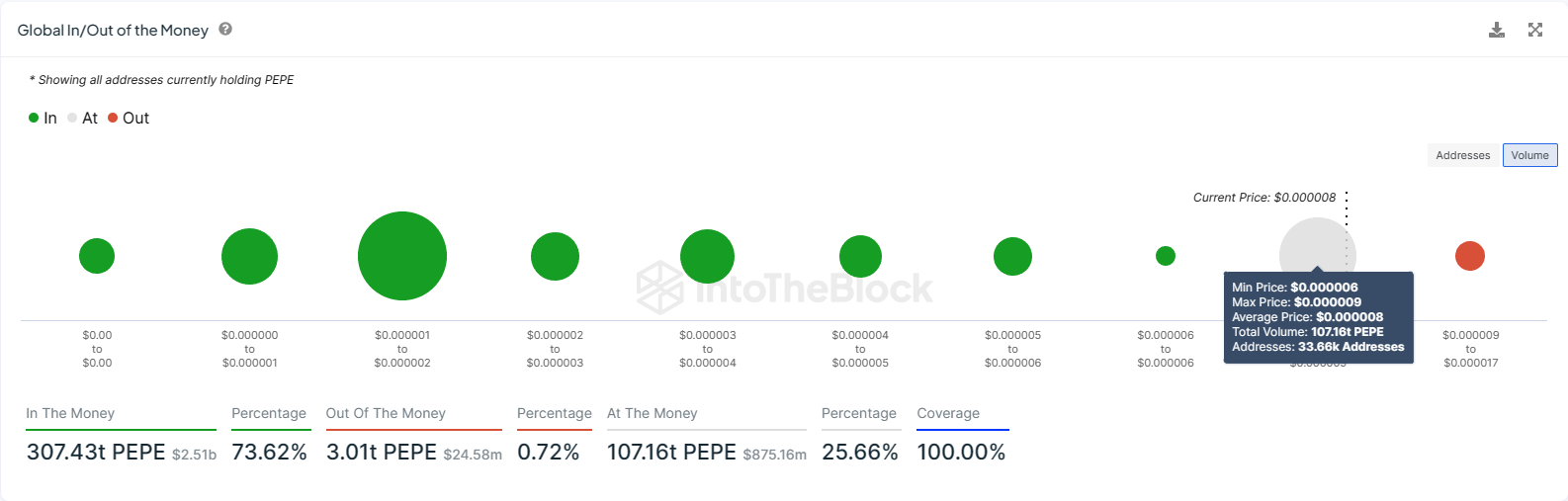

Trading at $0.00000835, the third biggest meme coin in the world is close to bringing immense profits to its investors. About 110 trillion PEPE worth close to $900 million is at the cusp of churning profits for its investors. The reason is that this supply was bought around the 20% range of the all-time high price.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

Investors who bought their supply in this range are referred to as “all-time higher.” At the moment, about 15,300 addresses form these all-time highers. These addresses represent 8.3% of all existing PEPE holding addresses, making their impact significant.

Since these 15,300 addresses hold about 25.7% of the entire circulating supply of PEPE, their move will likely sway the direction of Pepe’s price. Over the next few trading sessions, these investors will refrain from booking profits, which will drive the meme coin higher, potentially charting a new all-time high.

PEPE Price Prediction: New All-Time High Next?

Pepe price is currently above an important support level marked at $0.00000826, right above the 50-day Exponential Moving Average (EMA). Therefore, the cryptocurrency will have a shot at establishing a new all-time high, provided it does not fall through this support level.

However, what is to be noted is that PEPE is overbought at the moment. This is indicated by the CARNAC Elasticity Indicator (EI). Additionally, EI measures the percentage difference between the current price and an Exponential Moving Average (EMA), aiding traders in recognizing potential overbought and oversold scenarios.

Deviation above 50.0 indicates potential overbought conditions, while the same below -50.0 suggests oversold conditions. At the moment, EI is at 70.0, which indicates that the altcoin is currently in overbought territory. This might result in the saturation of bullish sentiment down the line, triggering profit-taking among other investors.

Consequently, invalidating the bullish thesis could lead to a larger price correction for PEPE, potentially returning to daily support at $0.00000630.