A significant crypto whale moved $3.8 million worth of PENDLE tokens to Binance earlier today.

This transaction involved 1.1 million PENDLE tokens, according to Lookonchain. The whale retains 1 million PENDLE, valued at approximately $3.5 million.

PENDLE Whale Activity’s Market Impact

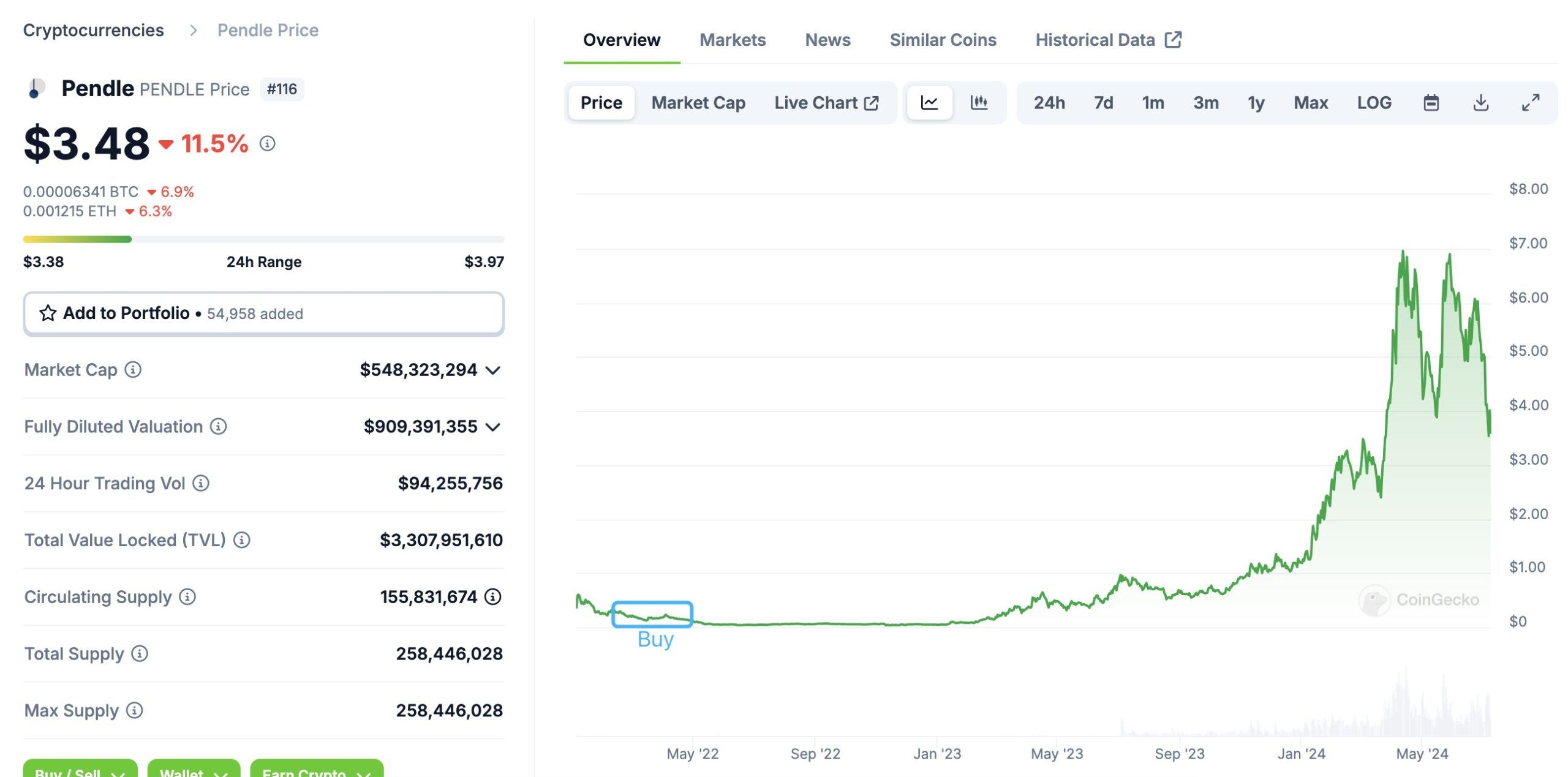

This whale’s activity extends beyond recent transfers. Between February 9 and April 27, 2023, the whale accumulated 3.44 million PENDLE tokens from centralized and decentralized exchanges. The average purchase price during this period was $0.32 per token.

These transactions imply the whale plans to sell a portion of their holdings. Large sales by whales can impact market prices and sentiment. Other market participants watch these movements closely, anticipating possible price shifts.

Read more: Ethereum Restaking: What Is It And How Does It Work?

With PENDLE’s current market price, the whale’s investment strategy has paid off significantly. PENDLE has seen substantial growth over the past year. From $0.92 last year, it reached an all-time high of $7.50 in April 2024. However, at the time of writing, PENDLE’s price has stabilized, trading at $3.54 currently.

Nonetheless, this growth has made PENDLE a topic of interest among investors. Crypto trader Daan Crypto commented on PENDLE’s recent performance.

“PENDLE has been giving up a lot of its gains recently. From one of the strongest performers to one of the weakest. I’m watching the reaction at these lows and might get interested if we can hold on to these May lows. For now, no position,” Daan Crypto wrote.

Pendle Finance, the Ethereum-based yield trading protocol behind PENDLE, uses a unique approach to yield farming. Pendle allows users to trade tokens while earning substantial yields by dividing assets into Principal Tokens and Yield Tokens. This model has boosted Pendle’s popularity within the DeFi space.

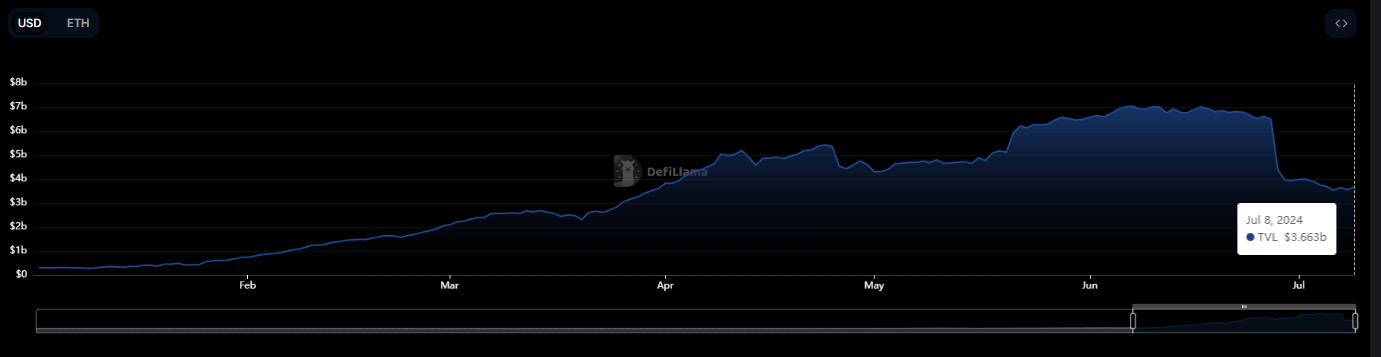

Recent developments in Pendle Finance have been interesting. Last Thursday, Pendle’s total value locked (TVL) dropped 40% as several markets expired. Since Wednesday, users have withdrawn nearly $3 billion, primarily in liquid restaking tokens.

Several markets, including Ether.Fi (eETH) and Renzo’s (ezETH) expired recently, leading to withdrawals. Investors could roll their tokens into new markets, but the incentives were less appealing.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Despite this, Pendle’s TVL stands at an impressive $3.66 billion, marking a 1,141% increase year-to-date. Pendle’s exponential growth has prompted notable industry figures, including BitMEX’s co-founder Arthur Hayes, to dub the project “the future of DeFi.”