The number of crypto industry hacks, scams, and exploits decreased in 2023 compared to the previous year, according to blockchain security firm PeckShield. However, criminal activity during bear markets is usually lower than when crypto asset prices are skyrocketing.

On January 29, blockchain security firm PeckShield reported that crypto hacks and scams were down 27.8% in 2023 from 2022.

Crypto Hacks & Scams Down

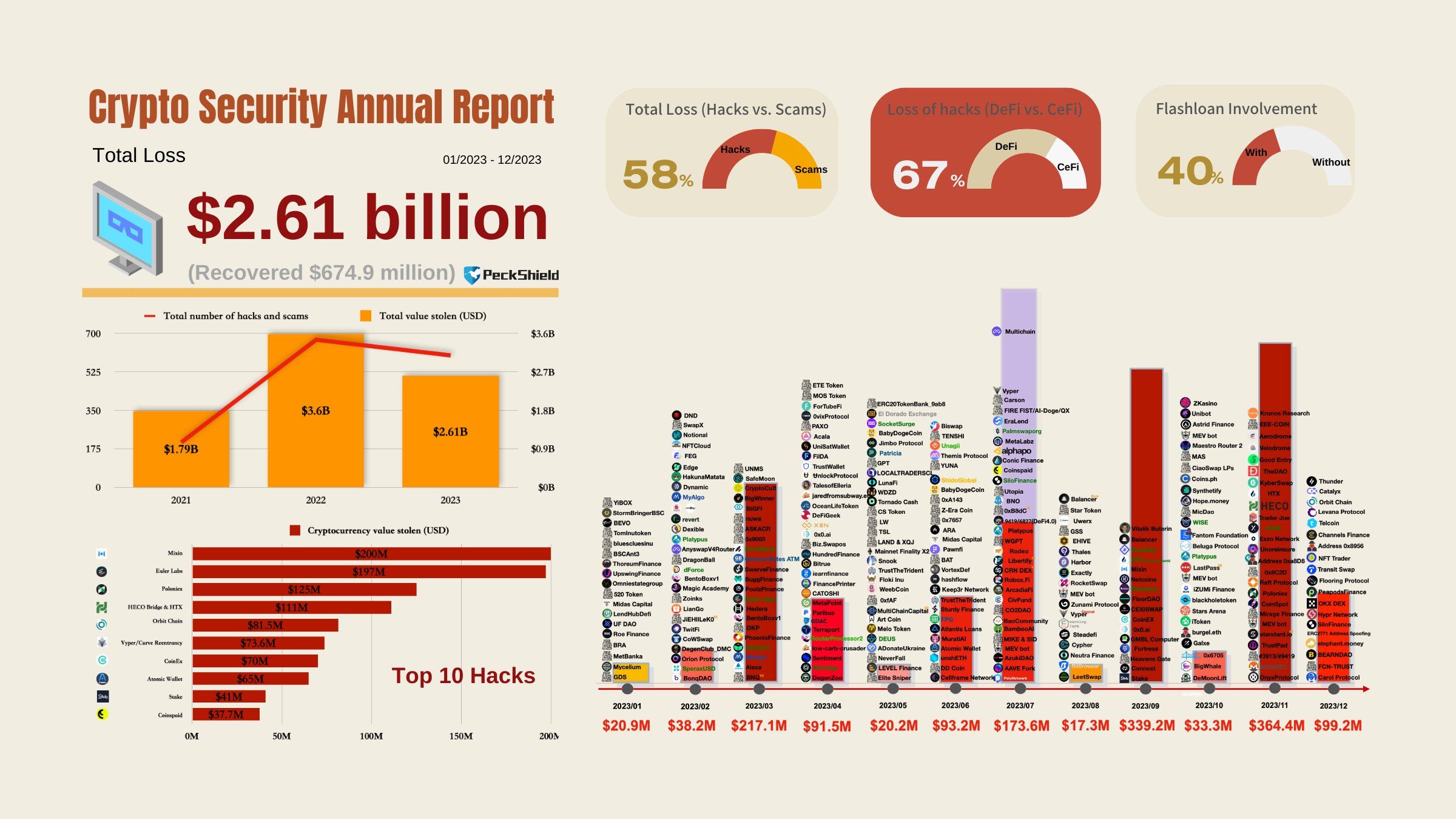

The firm noted that 2023 saw more than 600 major hacks in the crypto space, resulting in around $2.61 billion in losses,

Furthermore, $1.51 was lost to hacks (excluding Multichain unauthorized withdrawals), and $1.1 billion was lost to scams. DeFi protocols remained prime targets, accounting for 67% of the total stolen value. Additionally, 40% of the exploits in 2023 involved flash loan attacks.

2022 saw $3.6 billion lost to hacks and scams, while $1.79 billion was lost in 2021, it reported.

Moreover, recovery efforts have improved significantly over the previous year. Around $674.9 million was recovered following the incidents in 2023, compared to just $133 million recovered in 2022.

This marks a 400% increase in the amount of funds recovered from crypto hacks and scams. Protocols have been engaging in active negotiations with hackers, which led to the return of some stolen funds.

Read more: What Is a Rug Pull? A Guide to the Web3 Scam

PeckShield noted that DeFi protocols have been collaborating with centralized exchanges, Tether, and law enforcement to freeze stolen funds.

The $200 million Mixin Network exploit was the top hack of the year, followed by a $197 million loss from Euler Labs.

Excluding Multichain, November was the most active month for crypto hacks and losses, with $364.4 million. Hackers breached the Poloniex exchange in November, resulting in losses exceeding $100 million.

Exploits in 2024

Cybercriminals have been busy so far this year with at least 13 incidents involving hacks, scams, or other exploits, according to De.Fi’s Rekt database.

The largest it reported for January was the $16.3 million access control exploit of the Gamee GMEE token on January 22.

Other major exploits so far this year include a $4.3 million flash loan attack on Radiant Capital on January 2 and a similar $6.4 million attack on Gamma Strategies on January 4.

Socket Protocol lost $3.3 million in a bridge exploit on January 16, and Concentric Finance was exploited for $1.6 million on January 22.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.