Pantera Capital, a leading crypto-focused asset manager with assets worth $5.2 billion, is on a strategic path to buy $250 million worth of Solana tokens.

This significant acquisition is sourced from the assets of the now-defunct digital asset exchange, FTX, marking a noteworthy pivot in the industry. Pantera’s initiative comes when the market is ripe with opportunities, seizing deeply discounted tokens that promise a considerable return on investment.

Pantera Capital to Buy Millions in Solana Tokens

The firm has initiated the Pantera Solana Fund, targeting large investors to rally the required capital. According to marketing documents disclosed in February, this fund offers an “opportunity” to purchase Solana tokens at an attractive discount.

Prospective investors are enticed to buy Solana at 39% below its 30-day average price, pegging the purchase at a compelling $59.95. However, this opportunity comes with a commitment. Indeed, investors are bound to a vesting period extending up to four years. This strategic move reflects the fund’s long-term confidence in Solana’s potential.

This investment strategy is a testament to Pantera Capital’s analytical acumen in identifying and capitalizing on market inefficiencies. By acquiring a substantial amount of SOL tokens at a discounted rate, Pantera positions itself and its investors for substantial gains, contingent on the market’s recovery and Solana’s performance.

Read more: Solana (SOL) Price Prediction 2024 / 2025 / 2030

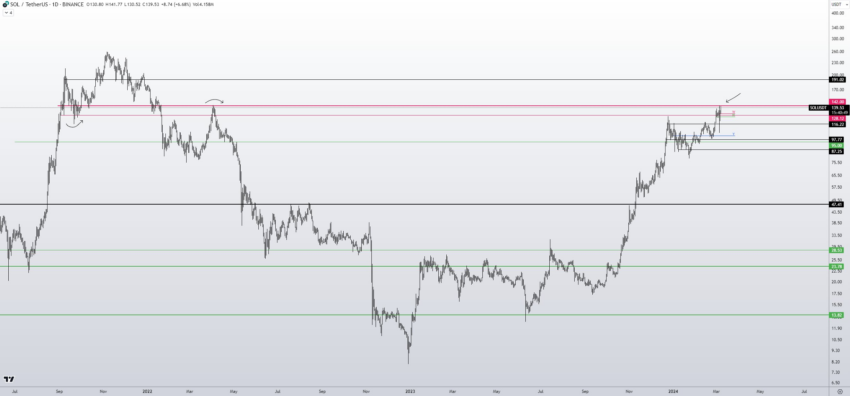

Crypto analysts have weighed in on the potential implications of this large-scale purchase. A notable commentary from the analyst known as Skew highlights the critical point at which Solana finds itself.

Skew remarked on the importance of Solana’s ability to surpass the $142 mark. This move would signal a bullish trend. It could also catapult SOL’s value to new heights, potentially reaching as high as $191.

“HTF inflection point for HTF trend & confirmation for giga uptrend signal. Clear and flip $142 would be very bullish, aka HH above $142. The next HL would be a gift to bid after that confirmation,” Skew said.

This analysis underscores the high-stakes scenario that Pantera Capital is navigating. It suggests a calculated bet on Solana’s market resilience and growth trajectory. Pantera’s initiative could set a precedent for how distressed assets are viewed and capitalized upon in the cryptocurrency market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.