Osmosis DAO is likely to adopt a fee-free Bitcoin Bridge, pending determination, as the ballot is still open.

An approval would bode well for BTC holders because it would mean more liquidity.

Osmosis DAO Holds Votes for ‘Fee-Free’ Bitcoin Bridge

Osmosis DAO may soon adopt a fee-free Bitcoin Bridge via the Nomic blockchain. This decentralized, non-custodial bridge connects Bitcoin to IBC-enabled chains like Osmosis. The Nomic Bitcoin Bridge introduces an nBTC native token within the Cosmos ecosystem, which can be transferred over IBC protocols and utilized throughout Cosmos.

“Nomic offers a decentralized, non-custodial Bitcoin bridge to IBC-enabled chains like Osmosis. nBTC, the Bitcoin-backed asset provided by Nomic, is live on Osmosis today, along with Interchain Deposits. This feature allows Osmosis users to deposit BTC directly within the Osmosis app to receive nBTC,” reads the proposal.

With this, the DAO, which governs the Cosmos-based decentralized exchange (DEX) and appchain Osmosis, is holding an ongoing vote for Proposal 795.

Read more: Osmosis Crypto Guide: A DEX for the Cosmos Ecosystem

The proposal outlines a Protocol Revenue sharing agreement and looks to replace bridging costs with a share on taker fees. Specifically, part of the taker fees generated by trading nBTC or its derivatives on the DAO will be shared with Nomic. This is as opposed to arbitrage trading against the value of native BTC.

Arbitrage trading is one of the most known outcomes of an imperfect, inefficient market model. It benefits those using price differences on identical financial instruments on different platforms.

Implications Of The Vote Passing

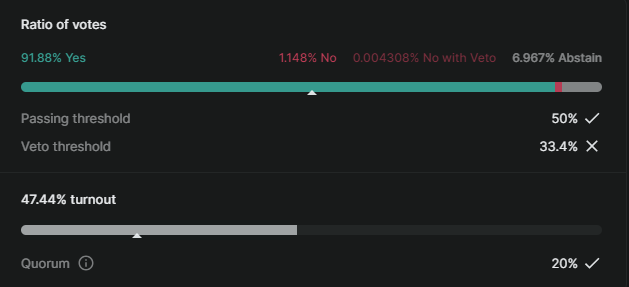

The proposal is likely to pass, with 91.88% of votes in favor amid a 47.44% voter turnout. If approved, the DAO will waive Bitcoin bridging fees for transactions originating or terminating on Osmosis.

At the same time, the Nomic blockchain will realize increased nBTC token adoption across Osmosis-based applications.

Read more: Cosmos: A Comprehensive Guide to What It Is and How It Works

For Osmosis users, this lot will enjoy a low-cost decentralized bridge to Bitcoin, which will also increase BTC liquidity in the Osmosis ecosystem. As it stands, there is no other decentralized means to bring BTC to Osmosis.

“This proposal, if passed, is a significant milestone in DAO-to-DAO deals. It provides a new ‘rev share’ business model for bridges, one that is uniquely possible with appchains,” Osmosis co-founder Sunny Aggarwal wrote in the Osmosis forum.

Notably, Osmosis and Nomic Governance will determine how much nBTC taker fees go to their blockchains. Once the two chains become active, the proposal will remain valid for the first six months before it is due for re-evaluation.

If both blockchain governances approve the mechanism, it will be implemented during a future software upgrade. However, it’s acceptable that one chain approves it first, in which case they will liaise to ensure that the start date of both mechanisms is synchronized.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.