Optimism (OP) price has shown signs of a bullish trend as it continues to move within an ascending triangle pattern, which often signals upward price movement. The Layer 2 chain has recently gained attention with its fifth airdrop, distributing 10.3 million OP tokens.

This event has the potential to fast-track the bullish outlook for OP, offering a chance for a significant price rally.

Optimism Investors Turn Bullish

Over the last 24 hours, Optimism completed its fifth airdrop. It distributed over 10.3 million OP tokens worth over $15 million to more than 54,000 addresses.

This airdrop brings greater attention to the platform. Hence, some investors view it as a bullish event. While there are concerns that the increase in token supply could negatively affect the price, this impact is unlikely in the short term since many investors are choosing to hold rather than sell.

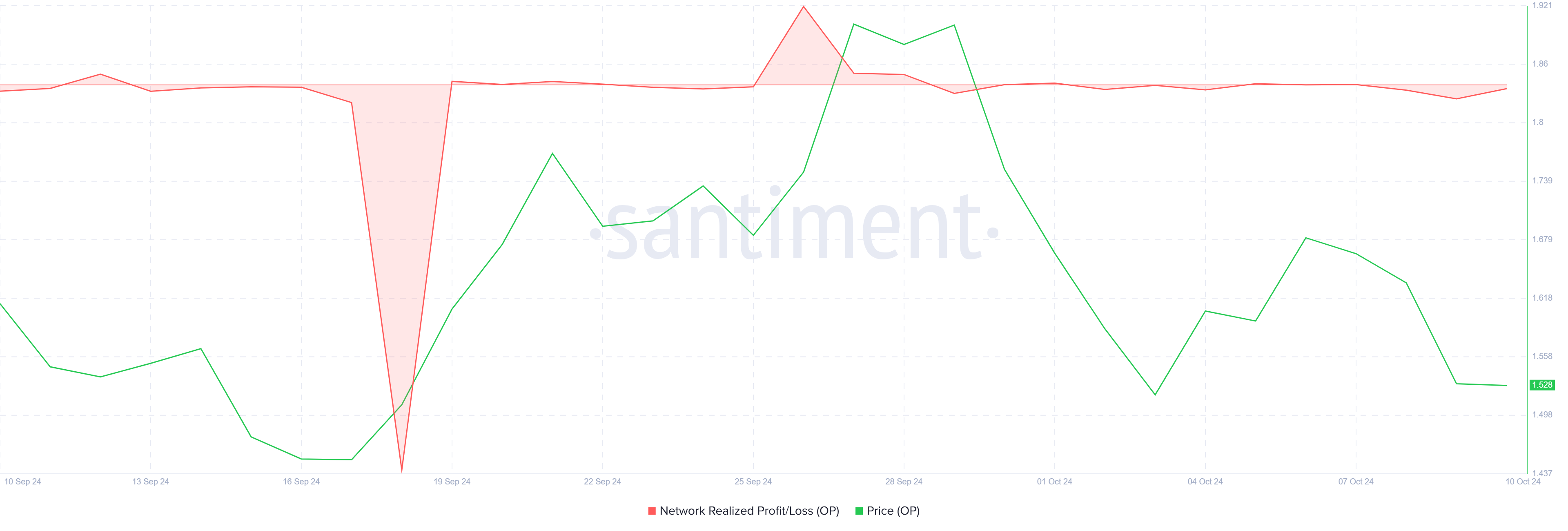

The Realized Profit/Loss metric is exhibiting no spikes at the moment. Spikes above the zero line are a sign of profit-taking among investors, and the lack of the same shows resilience. OP holders will likely maintain this stance as they await a rise in price.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

The airdrop has generated positive market sentiment, reinforcing optimism for the token’s future performance. With investors recognizing the potential for higher profits, the likelihood of mass sell-offs remains low, allowing the price to stabilize and possibly rise further. The event has also expanded the reach of the project, potentially bringing in new participants.

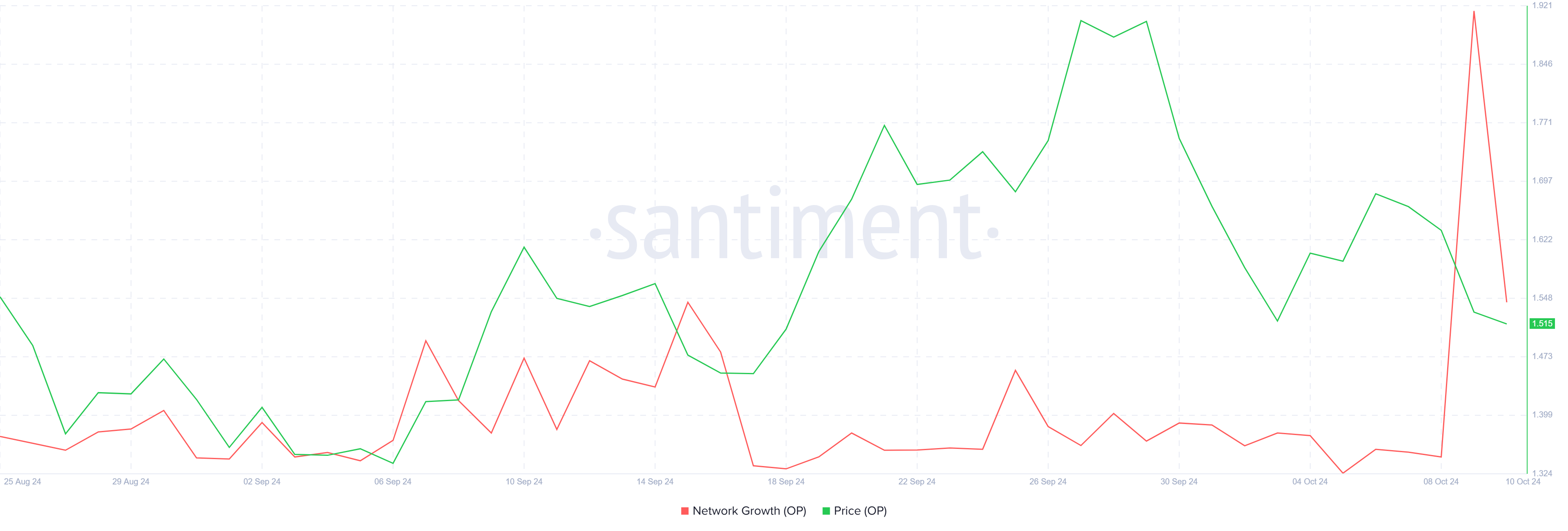

On the macro front, the network growth metric, which tracks the creation of new addresses, indicates strong momentum for Optimism. Following the airdrop, network growth surged by 611% in a single day, highlighting the influx of new users and heightened interest in the platform. This metric is a reliable indicator of a project’s long-term potential, and for Optimism, this surge suggests that the network is gaining significant traction.

The increase in network activity reflects the airdrop’s success and points to potential inflows of new capital into the ecosystem. Consequently, these developments could provide the necessary momentum to support a price rally, benefiting long-term investors and reinforcing the bullish outlook.

OP Price Prediction: Rising High

Currently, Optimism’s price is trading at $1.51, and the lower trend line of the ascending triangle pattern is being tested. This setup presents a bullish opportunity, as the altcoin could bounce from the lower trend line. Consequently, OP would be challenging resistance barriers at $1.74 and $1.87, setting the stage for a potential breakout.

The pattern offers a possible 64% rally, with the target price at $3.17. For this rally to be confirmed, OP would need to rise beyond $2.00 and flip it into support. Finally, a breach of this key level would indicate stronger upward momentum and solidify the bullish case.

Read more: What Is Optimism?

However, if Optimism’s price fails to break past the $1.87 resistance, the breakout could be delayed, which could invalidate the bullish thesis. In that scenario, OP may fall back down, postponing the anticipated rally and raising concerns among investors.