OpenSea, a non-fungible token (NFT) marketplace, faces a significant challenge with its daily trading volume in ETH NFTs.

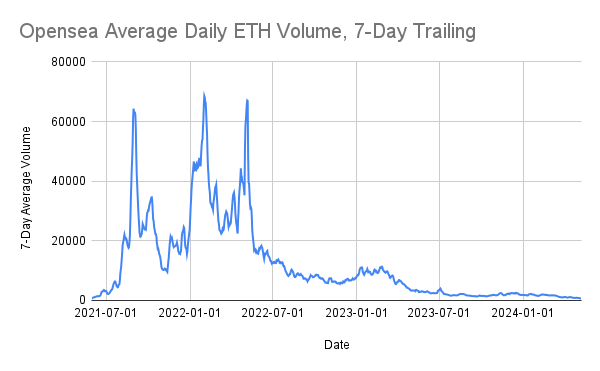

This volume has dropped to its lowest point since May 2021, with figures currently hovering around 600 ETH per day.

OpenSea NFT Volume Hits Record Low Since May 2021

OpenSea hit a record for the lowest monthly sales volume since the initial NFT bull market surge. Analysis from a Dune Analytics dashboard shows that OpenSea’s NFT sales for April ended at just $97 million.

”The volume is down 99.1% from the May, 2022 peak, when OS was doing 66,000 ETH of volume per day.” NFTstats.eth said.

The decline in OpenSea’s sales sharply contrasts with Blur’s rapid ascent in the NFT market. As a new entrant, Blur has dramatically increased its market share during the same period. While OpenSea struggles, Blur has seized 78.7% of all NFT transactions in the past week, leaving OpenSea with just 21.3% of the market volume.

Read more: Top 9 OpenSea Alternatives in 2024

Its user base is sharply declining, directly impacting its transaction volumes. This April, the number of active users dropped to 74,113—an 8.19% decrease from March’s 80,727 active users. This reduction in active participants has led to a significant decrease in transaction volumes, with only 110,000 NFTs traded over the last 25 days, marking the lowest monthly total since June 2021.

In a bid to reclaim market dominance, OpenSea cut its transaction fees to zero in April. Meanwhile, following an aggressive airdrop of 12% of its BLUR tokens to traders on February 14, Blur has held more than 70% of Ethereum’s daily NFT trading volume.

As an analyst on Dune Analytics noted, the shift in market dynamics is partly due to Blur offering better liquidity conditions, often with lower floor prices and higher bid prices. Blur’s promise of another airdrop of 10% of its token supply, aimed at rewarding user loyalty, has strengthened this competitive advantage.

As OpenSea strives to regain its footing, the ongoing battle with Blur underscores the importance of innovative strategies and user incentives in the highly competitive and rapidly evolving NFT space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.