OpenSea, once the largest marketplace for digital collectibles, is preparing to launch its own native token, SEA, by the first quarter of 2026.

The plan follows a surge in platform activity after OpenSea expanded beyond NFTs to enable trading across all digital assets.

OpenSea Readies SEA Token Rollout

On October 17, OpenSea co-founder Devin Finzer said the new token will be the cornerstone of the platform’s evolving identity. He explained that it represents OpenSea’s vision for a more open and liquid onchain economy.

“Integrating SEA into OpenSea will be the opportunity to show the world our vision. It will shine a spotlight on everything we’re building,” Finzer said.

According to Finzer, half of SEA’s supply will go to the community, with a majority distributed through an initial claim process. Longtime users and participants in OpenSea’s loyalty programs will be prioritized.

The company also plans to allocate 50% of its launch revenue toward buying back SEA tokens, reinforcing liquidity and value alignment with users.

Moreover, SEA will include staking capabilities, allowing holders to earn rewards while supporting network growth.

“SEA isn’t the destination, but it’s a crucial moment everyone will be watching. You only get one TGE. While the Foundation is wrapping up the final details, we’re getting OpenSea ready,” Finzer added.

NFT Marketplace Evolves to The ‘Trade Everything’ App

Meanwhile, OpenSea’s token initiative is part of a broader transformation to make the platform “trade everything.”

The company is also developing a mobile app, perpetual futures trading, and cross-chain abstraction tools. Each feature is designed to make onchain trading as seamless as using a centralized exchange.

Finzer said OpenSea’s early years were about bringing artists, collectors, and gamers into Web3 through NFTs.

He explained that the next phase gives users a single venue to manage and trade multiple asset types without relying on custodial intermediaries.

“[Our users] shouldn’t need to navigate a maze of chains, bridges, wallets, and protocols in order to use onchain liquidity, wondering whether your balance is on Solana, an Ethereum L2, or somewhere else. [They] should just be able to trade everything in one place, seamlessly,” the OpenSea CEO stated.

Notably, the shift is already yielding positive results for the legacy NFT platform.

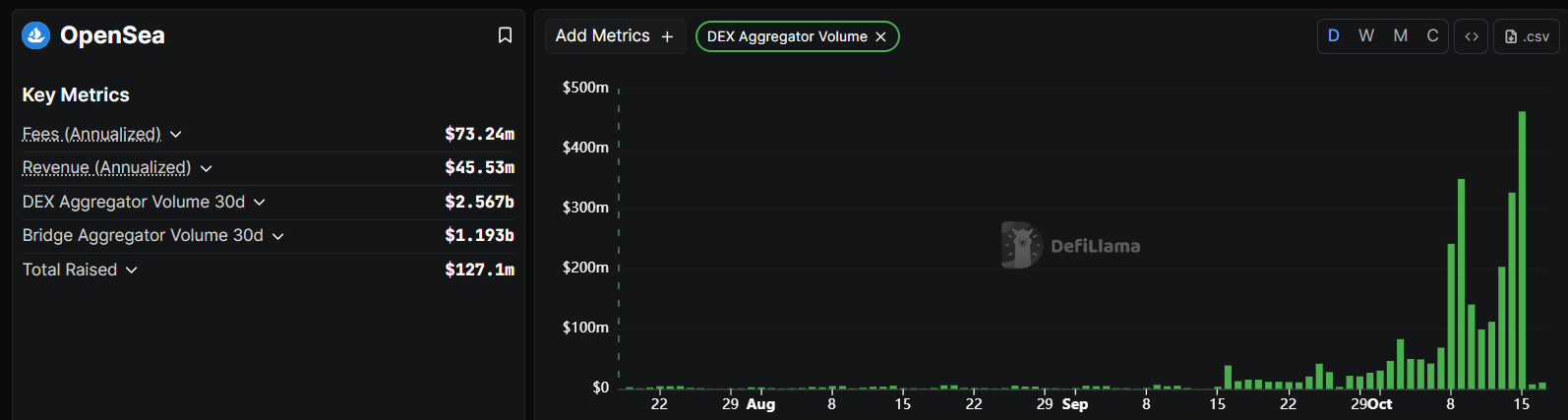

Indeed, OpenSea processed over $2.6 billion in total trading volume this month, with more than 90% coming from token trades.

Data from DeFiLlama shows that on October 15, the platform recorded its highest single-day decentralized trading volume of about $462.7 million. This makes it one of the fast-rising DEX platforms in the competitive DeFi space.

These numbers signal a comeback for a platform once overshadowed by newer players. With SEA’s debut on the horizon, OpenSea is positioning itself as a core liquidity layer for the broader onchain economy rather than just an NFT venue.