OpenEden recently announced a partnership with Ripple to bring tokenized US Treasury bills (T-bills) to the XRP Ledger (XRPL).

This partnership will involve a substantial investment of $10 million from Ripple to OpenEden’s flagship tokenized product, TBILL.

DeFi Meets TradFi: Transforming T-Bills into Digital Assets

In its official statement, Markus Infanger, Senior Vice President of RippleX, highlighted the significant effects of real-world asset (RWA) tokenizations. He noted that institutions are more closely examining how to tokenize their RWAs.

“Ripple’s strategy is to focus on high-quality tokenized assets where there is a clear utility. This means assets underpinned by top-tier regulatory compliance, transparency via regular audits, and quality underlying real-world assets. OpenEden’s TBILL tokens meet these criteria,” Infanger explained in an interview with BeInCrypto.

Jeremy Ng, the co-founder of OpenEden, also expressed his excitement about this initiative. He explained that integrating tokenized treasury into the XRP Ledger marks an important phase in both companies’ journeys.

“Purchasers will be able to mint our TBILL tokens via stablecoins, including Ripple USD, when it launches later this year,” Ng added.

Read more: What is Tokenization on Blockchain?

In addition to OpenEden’s efforts, Ripple has partnered with Archax, the UK’s first Financial Conduct Authority-regulated digital asset exchange. Archax plans to tokenize hundreds of millions of dollars worth of RWAs on the XRPL over the coming year.

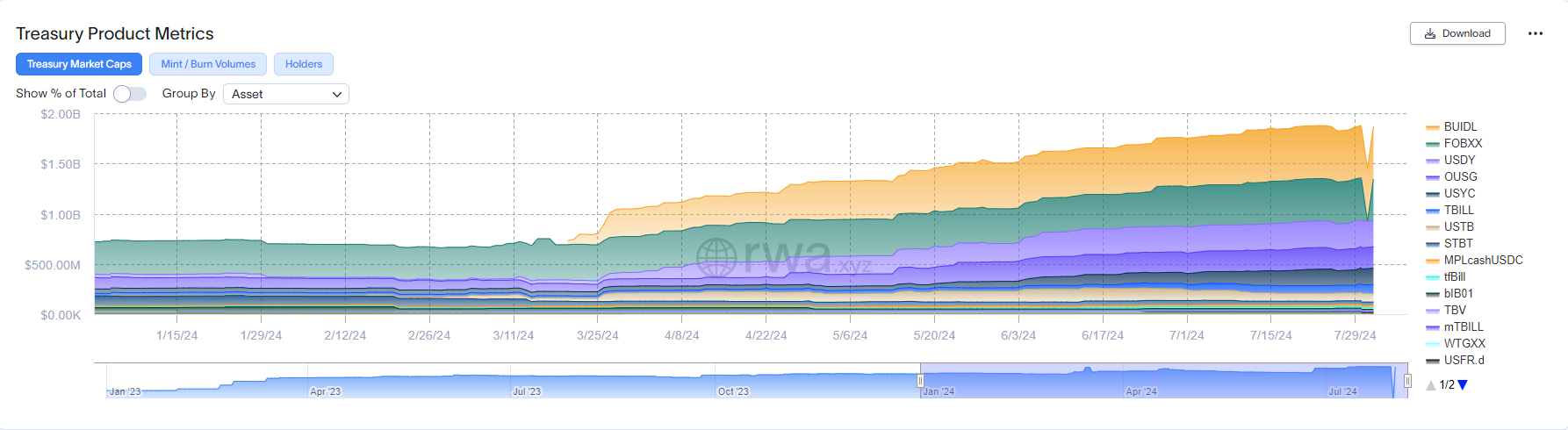

BeInCrypto reported in June that OpenEden’s TBILL tokens have also achieved an investment-grade “A” rating from Moody’s rating agency. Moreover, TBILL has earned a Capital Markets Services License from the Monetary Authority of Singapore (MAS). Data from RWA.xyz reveals that TBILL ranks sixth among other tokenized US Treasury products, with a market capitalization of $90.64 million as of August 1.

T-bills are short-term US government debt obligations backed by the Department of the Treasury. They represent a secure and highly liquid asset class. Tokenization gives investors seamless access to traditional RWAs through a decentralized platform.

The tokenized US Treasury market has seen remarkable growth in 2024. RWA.xyz data indicates the total value of this segment has expanded from $726.23 million to $1.88 billion year-to-date. BlackRock’s BUIDL and Franklin Templeton’s FOBXX are significant contributors, with market capitalizations of $522.81 million and $414.300 million, respectively.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Furthermore, analysts predict continued growth, with the market potentially reaching $3 billion by the end of 2024. Demand from decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) projects seeking stable, risk-free yields within the blockchain ecosystem will drive this growth. In the longer time frame, consulting firm McKinsey & Company also forecasts the tokenized financial assets market could reach $2 trillion by 2030.