The tokenized US Treasury market is gearing up for significant growth. Analyst Tom Wan from 21.co predicts that this segment could reach $3 billion by the end of 2024.

This growth is fueled by a strategic shift towards real-world asset (RWA) tokenization within the decentralized finance (DeFi) ecosystem.

Arbitrum and MakerDAO Lead the Charge in Tokenized Treasury Allocations

According to Wan, decentralized autonomous organizations (DAOs) and DeFi projects seeking diversification and stability in their treasuries will largely drive this anticipated surge. By integrating tokenized US Treasuries, these entities aim to access risk-free yields while staying within the blockchain ecosystem.

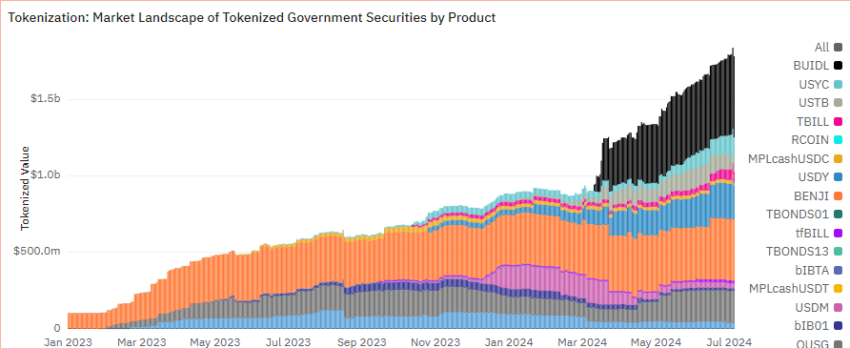

“With the maturity of tokenized US Treasuries, over 15 products on [Ethereum Virtual Machine] EVM chains, and close to $2 billion [assets under management] AUM, DAO is starting to include yield-bearing products like BUIDL, USTB, USDY, and USDM in its treasury. We would definitely see this trend continue in the long run,” he wrote on his X (Twitter).

Read more: What is Tokenization on Blockchain?

Eugene Ng, co-founder of OpenEden, commented on this prediction. While he acknowledged that the projection sounds ambitious, he thinks it is still achievable.

“Given a 30-day compounded growth rate of 16% and about 5 months left to go until the end of the year, we can expect nearly $4 billion in TVL! So the $3 billion projection isn’t wildly optimistic by any measure. If anything, it is moderately conservative,” Ng explained to BeInCrypto.

Recent moves by prominent DAOs to allocate substantial funds into tokenized treasuries exemplify this trend. In June, the Arbitrum STEP Committee recommended diversifying 35 million ARB tokens ($27 million) from the Arbitrum DAO Treasury into six selected tokenized treasury products. These products include Ondo Finance’s USDY, BlackRock’s BUIDL, Superstate’s USTB, Mountain USDM, OpenEden’s TBILL, and Backed Finance’s bIB01.

Additionally, MakerDAO proposed the Spark Tokenization Grand Prix competition last week, set to commence on August 12, 2024. The competition aims to onboard up to $1 billion of tokenized assets, focusing on short-term US Treasury Bills and similar products.

This year, the tokenized US treasury market has experienced unprecedented growth. 21.co’s data reveals an increase from $592.63 million to $1.78 billion year-to-date in the tokenized treasury market value. This 200% growth showcases the market’s potential as DeFi projects and DAOs increasingly turn to tokenized US Treasuries.

Looking ahead, Ng identified institutional flows and market demand for yield as two major factors affecting the tokenized treasury market in the coming months. He also noted the strong demand for higher-yielding, secure assets in a high interest-rate environment. Tokenized treasury bills, offering competitive returns backed by government securities, are poised to attract significant capital.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Despite the potential, Ng cautioned that future rate cuts from the Federal Reserve could dampen this growth. He also highlighted other challenges in the tokenized treasury market, specifically related to regulations and distribution.

“Tokenized treasuries are securities, and staying compliant with securities laws that were written for a pre-internet era while being innovative in driving adoption is a continuous challenge. […] While the structure of tokenized assets is important, at the end of the day, distribution is king. That’s why we’re building a strong pipeline of distribution partners to improve the accessibility, liquidity, and utility of tokenized T-bills for use cases like payments, payroll, institutional cash management, or as collateral for various DeFi platforms,” he elaborated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.