Onyxcoin (XCN) has dropped 40% in the last 30 days, yet it remains one of the best-performing altcoins of 2025. Despite the correction, technical indicators suggest that selling momentum is weakening, and a potential trend shift could be forming.

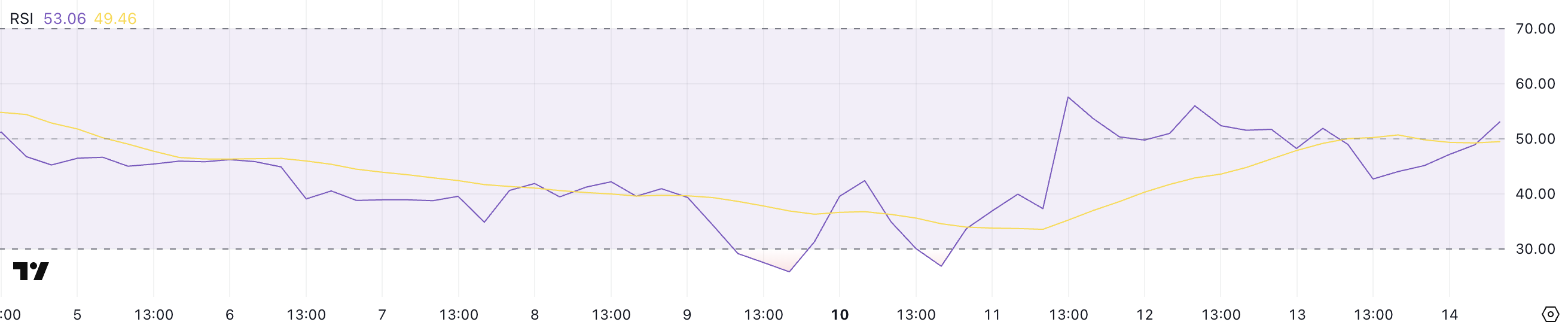

The Relative Strength Index (RSI) has climbed to 53, reflecting increasing buying interest. Whether XCN can capitalize on this momentum and break above $0.020 or face renewed selling pressure near support levels will define its next move.

XCN RSI Is Up, But Still Far From Overbought Levels

Onyxcoin Relative Strength Index (RSI) has surged to 53, rising sharply from 42.6 just a day ago. This increase suggests a shift in momentum, indicating that buying pressure is returning after a period of relative weakness.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Typically, values above 70 indicate overbought conditions, while values below 30 suggest oversold conditions. A reading around 50, as seen now, reflects a neutral stance where neither bulls nor bears have clear control.

The fact that XCN’s RSI has not crossed above 70 since January 26 suggests that despite recent strength, the asset has struggled to enter the overbought territory, which often signals strong bullish momentum.

With RSI now sitting at 53, Onyxcoin is in a zone where further upside is possible, but confirmation of a continued uptrend is needed. If RSI keeps rising toward 60, it could indicate increasing bullish momentum, potentially leading to a breakout attempt.

However, if it stalls or reverses, XCN could face renewed selling pressure, keeping it within a consolidation phase. The next move will depend on whether buyers can sustain the recent momentum and push the price into a stronger uptrend.

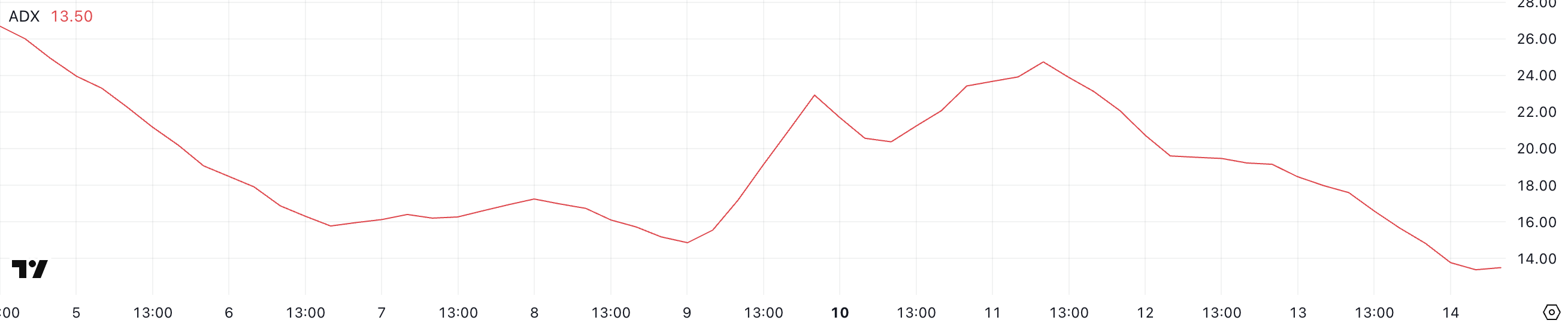

Onyxcoin ADX Shows The Downtrend Isn’t Strong Anymore

XCN Average Directional Index (ADX) has dropped to 13.5, down from 18.47 just a day ago, signaling a weakening trend strength.

The ADX is a key indicator used to measure the strength of a trend, regardless of its direction, on a scale from 0 to 100. Generally, values above 25 indicate a strong trend, while values below 20 suggest weak or indecisive market conditions.

A declining ADX, especially when below 20, implies that the current trend is losing momentum. This could lead to a period of consolidation or a potential reversal.

With XCN currently in a downtrend, the ADX at 13.5 suggests that bearish momentum is fading.

A low ADX in a downtrend often means that selling pressure is weakening. However, the price may continue to move sideways unless buying activity increases significantly rather than recovering sharply.

If ADX continues to drop, XCN could remain range-bound with no strong directional movement. However, if ADX starts rising again above 20 alongside an increase in bullish indicators, it could signal a potential breakout and a shift in market sentiment.

Can Onyxcoin Rise Above $0.020 Soon?

If bullish momentum builds, XCN could first test the resistance at $0.0149, a key level that needs to be broken for further gains. A successful breakout above this level could open the door for a move toward $0.0172, reinforcing buyer confidence in the altcoin.

If the uptrend strengthens, Onyxcoin could rally as high as $0.022, marking its first break above $0.02 since March 3.

On the downside, if selling pressure returns and the current downtrend strengthen, XCN could test the crucial $0.010 support level.

A breakdown below this point would be significant, as Onyxcoin has not traded below $0.010 since January 17.