ONDO is facing notable downside pressure. It has been down over 5% in the last 24 hours and corrected more than 19% over the past 30 days. With its market cap now sitting around $2.5 billion, the coin is way below competitors like Chainlink and Mantra in terms of market cap.

Recent technical indicators and whale behavior suggest that the current weakness may not be over, despite a slight recovery in momentum.

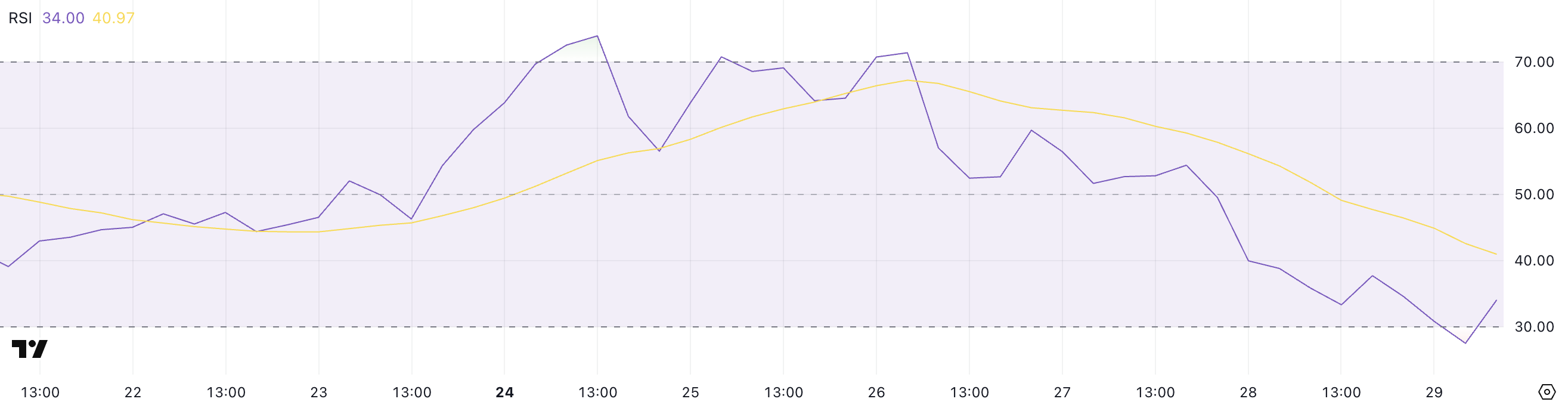

ONDO RSI Is Recovering From Oversold Levels

ONDO’s Relative Strength Index (RSI) is currently sitting at 34 after rebounding slightly from an earlier dip to 27.5. Just two days ago, the RSI was at 54.39, indicating how quickly momentum has shifted.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It ranges from 0 to 100.

Readings below 30 are typically considered oversold, suggesting the asset may be undervalued and due for a bounce, while readings above 70 are viewed as overbought, indicating potential for a pullback.

With ONDO’s RSI now at 34, it has technically exited oversold territory but remains near the lower end of the scale. This suggests that while the sharpest selling pressure may have eased, the market is still fragile ,and sentiment remains cautious.

If the RSI continues to recover and climbs above 40 or 50, it could signal a shift toward more bullish momentum.

However, if selling resumes and RSI falls back below 30, it would indicate renewed downside risk and potential for further price declines.

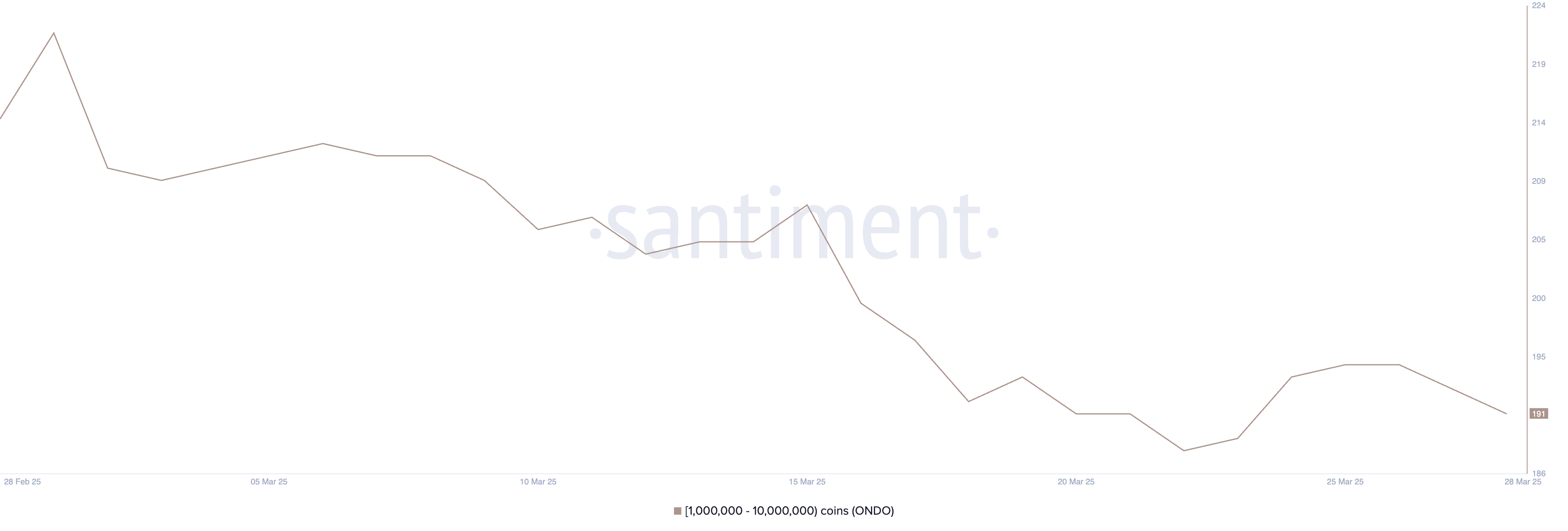

Whales Recently Stopped Their Accumulation

The number of ONDO whales—addresses holding between 1 million and 10 million ONDO—fluctuated in late March, initially increasing from 188 to 195 between March 22 and March 26 before declining to 191 in recent days.

This whale activity pattern is significant as these large holders often influence market sentiment and price movements, with their accumulation or distribution phases potentially foreshadowing broader market trends.

Tracking whale addresses provides valuable insights into how influential investors are positioning themselves, which can help predict potential price action.

The failure of Whale addresses to maintain the breakout above 195 and the subsequent return to 191 could signal bearish sentiment among larger investors.

This retreat might indicate that whales are taking profits or reducing exposure, which could create downward price pressure on ONDO in the short term.

When large holders begin to reduce their positions after a period of accumulation, it often precedes price corrections, suggesting that ONDO may experience resistance in maintaining upward momentum until whale confidence returns and accumulation resumes.

Will ONDO Fall Below $0.70 For The First Time Since November?

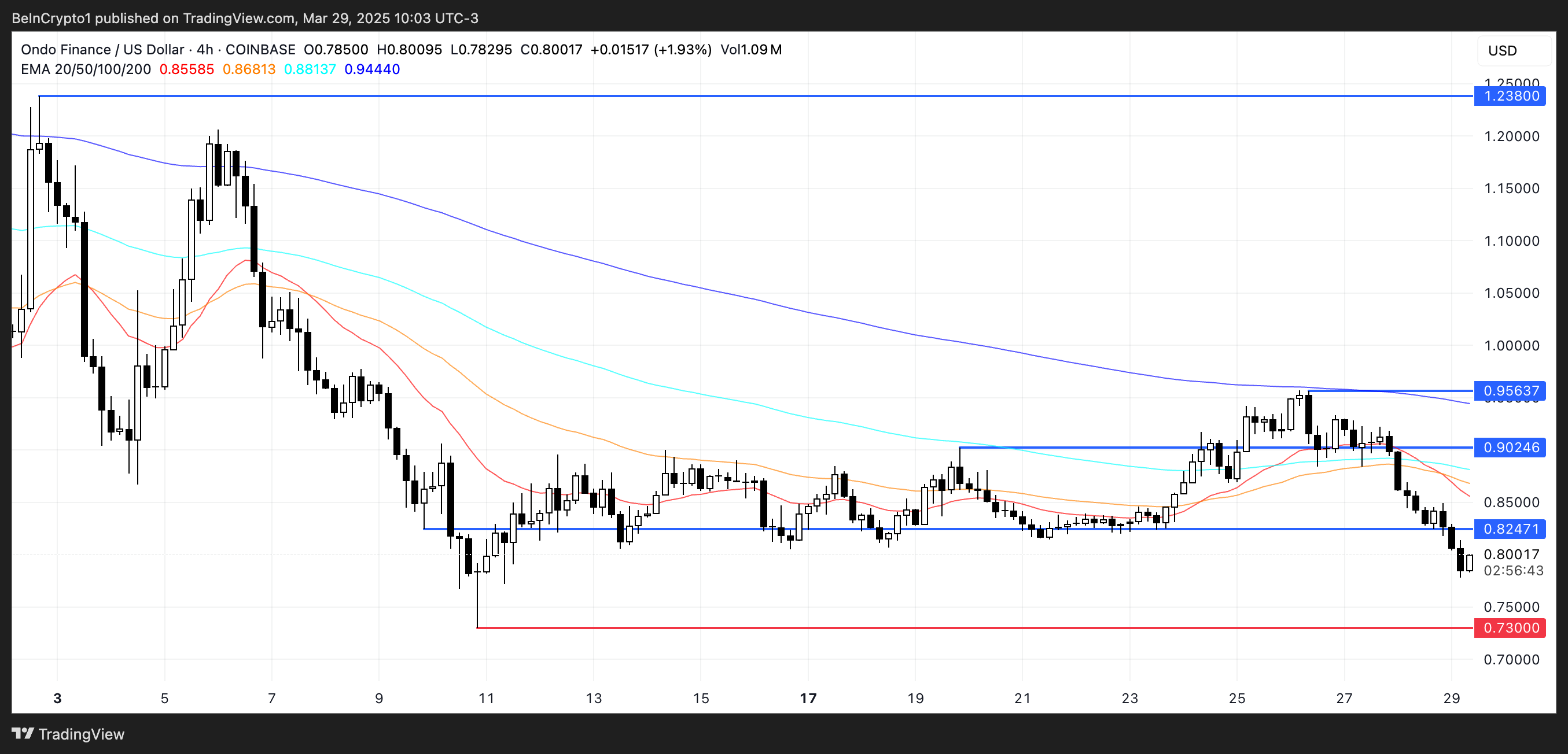

ONDO’s Exponential Moving Average (EMA) lines are currently aligned in a bearish formation, suggesting the ongoing downtrend may persist. If this weakness continues, ONDO could drop to test the key support level at $0.73.

A break below that would be significant, potentially sending the price under $0.70 for the first time since November 2024.

The token has been struggling to keep pace with other Real World Asset (RWA) coins like Mantra, and this underperformance adds further pressure to ONDO’s short-term outlook.

However, if sentiment shifts and ONDO manages to reverse its trend, the first key level to watch is the resistance at $0.82.

A breakout above this level could trigger a broader recovery, with price targets at $0.90 and $0.95.

If the RWA sector as a whole regains momentum, ONDO could even rise above the $1 mark and aim for the next major resistance at $1.23.