Web3 gaming had a rocky April as virtual land plummeted and on-chain gaming activity fell by 10%. Although, perhaps it is not such a surprise considering the recent obsession with meme coins.

So far, blockchain gaming has had a relatively positive year, at least compared to 2022. However, according to the latest DappRadar report on Web3 gaming, things could be going a little better.

Web3 Gaming Resilience

DappRadar, a blockchain analytics firm, tracked a 10% decrease in on-chain gaming activity during April, with a recorded average of 672,000 daily unique active wallets (UAW). However, games maintained their dominance, accounting for 38% of the on-chain activity.

SponsoredIn even worse news, virtual world trading fell through the floor in April, with trading volume declining by 74% from March to $41.4 million and 16,149 land sales.

Metaverse Land Dwindles

DappRadar attributes these declines—in part—to the recent change in focus and liquidity toward meme coins. If true, it would demonstrate how relatively small and insular the communities around digital assets are.

According to their analysis, traders were selling off their virtual land to join the meme craze, which saw many traders make huge returns. Increased chain activity pushed up transactions, further reducing the liquidity of low-value NFTs and virtual land.

Admittedly, seen in context, the virtual world trading volume for April ($41 million) was roughly the same as for January. However, sales counts did decline when compared to January—from 25,200 to 16,100. February and April saw a significant spike. Seen in perspective, April has been a reversion to the mean.

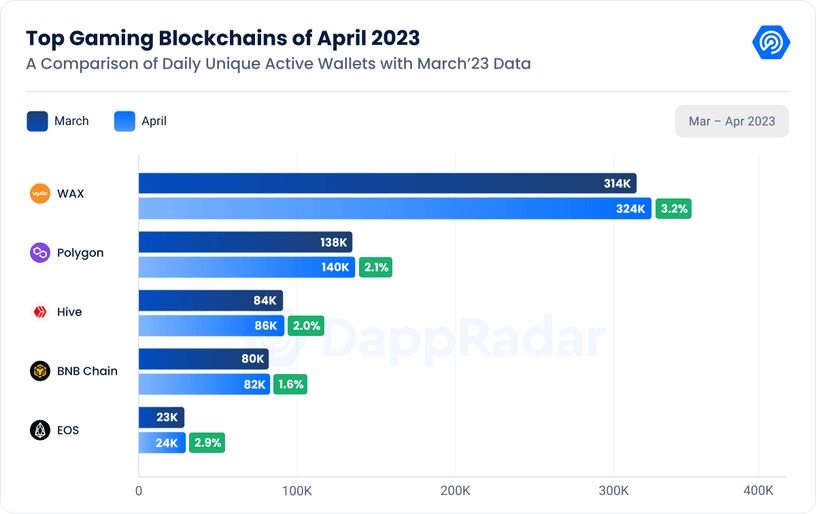

On the other hand, gaming blockchains saw modest growth over the previous month. Polygon, BNB Chain, Hive, and EOS all saw single-digit increases in daily unique active wallets (dUAW). WAX came out top with 3.2% growth compared to March.

Despite the general decline in the metaverse, The Sandbox thrived in April 2023 with an 18.83% increase in trading volume, surpassing $1 million. This success was driven by the Mega City 3 Land Sale, offering over 250 plots and special assets NFTs for premium purchases.

Virtual land sales have long been the target of derision from observers and analysts. Their value has generally declined alongside falling interest in the metaverse.

In February 2022, during the metaverse hype, someone paid $450,000 to be Snoop Dogg’s neighbor in The Sandbox. It would be hard to imagine digital real estate commanding similar prices today.