In today’s on-chain analysis, BeInCrypto looks at several fundamental indicators that highlight the health of the Bitcoin network: hash rate and mining difficulty ribbon.

In addition, the analysis points to the accelerating total transfer volume of BTC on-chain, which has reached a 5-year high. All this in the context of bullish price action for Bitcoin, which is rebounding strongly and resuming its rally towards a new all-time high.

SponsoredBitcoin resumes uptrend

Over the past two months, Bitcoin (BTC) has been consolidating in a range between the bottom at $40,596 and the peak at $52,708. Moreover, these areas are adjacent to the 0.382 and 0.618 Fib retracement levels for the entire downward movement from the ATH at 64,895 reached on April 14, 2021 (yellow line).

The consolidation range was broken out on 6 October and at the press time BTC is approaching $56,000. Therefore, a breakout above the peak on 6 September at $52,810 is a bullish signal that could lead to a continuation of the uptrend towards the new ATH. Currently, BTC is around 20% below this target.

The breakout above the previous peak goes hand in hand with bullish readings from rising technical indicators. However, it is worth noting that the resumption of the uptrend is occurring with steadily declining trading volume (blue line), the local peak of which came at the May 19 crash and bottom at $30,000. This means that we can expect a big move in the BTC price in the next few weeks or months.

Hash rate regains highs

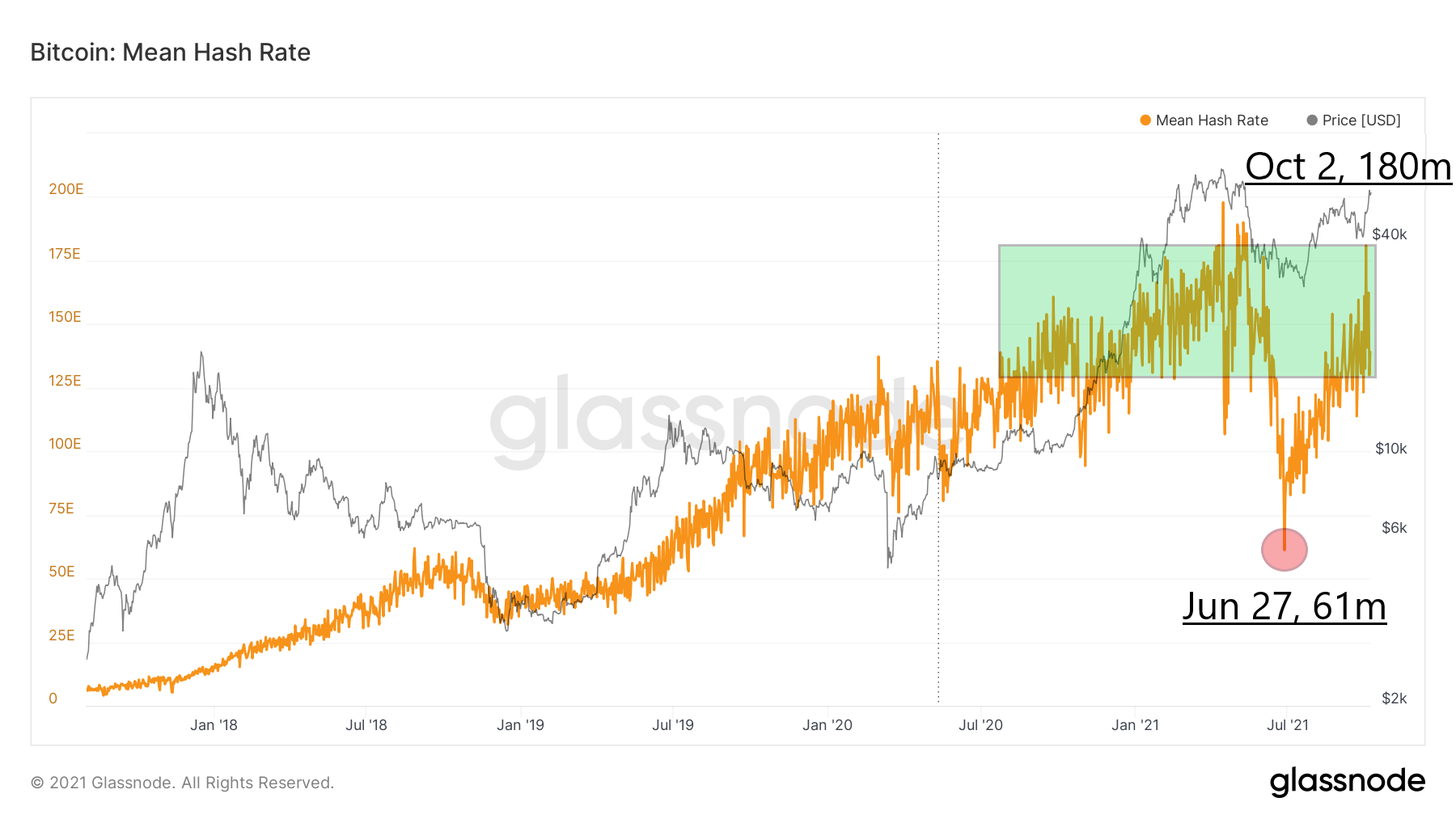

The Bitcoin network’s hash rate is one of its fundamental parameters. It is a measure not only of the network’s speed and performance, but also of its security. Hash rate estimates the average number of hashes per second that all BTC miners produce.

Since the beginning of the Bitcoin network, we have seen a steadily increasing value of the hash rate, which however undergoes occasional corrections. These are almost always correlated with corrections in the BTC price.

Sponsored SponsoredThe largest ever decline in hash rate was recorded in the April-June 2021 period, when Bitcoin fell from ATH to bottom in the area at $30,000. On 27 June, the hash rate was at 61 million Th/s – the lowest level since mid-2019 (red circle). A key factor in this decline was the FUD around China’s BTC mining ban.

However, the BTC network has once again proven its robustness and the hash rate has been growing dynamically since then. In recent days, its value has returned to the peaks reached in late 2020 and early 2021 (green rectangle). On October 2, it reached a number of 180 million Th/s, which is almost 3 times higher than the June low.

Market analyst @caprioleio commented in a tweet on this rapid recovery of the Bitcoin network with the following words:

“A year ago, 60% of the network was in China. In May, the Bitcoin network had its legs and arms cut off. They completely regrew in just 6 months.”

Sponsored“‘Great migration” of mining difficulty

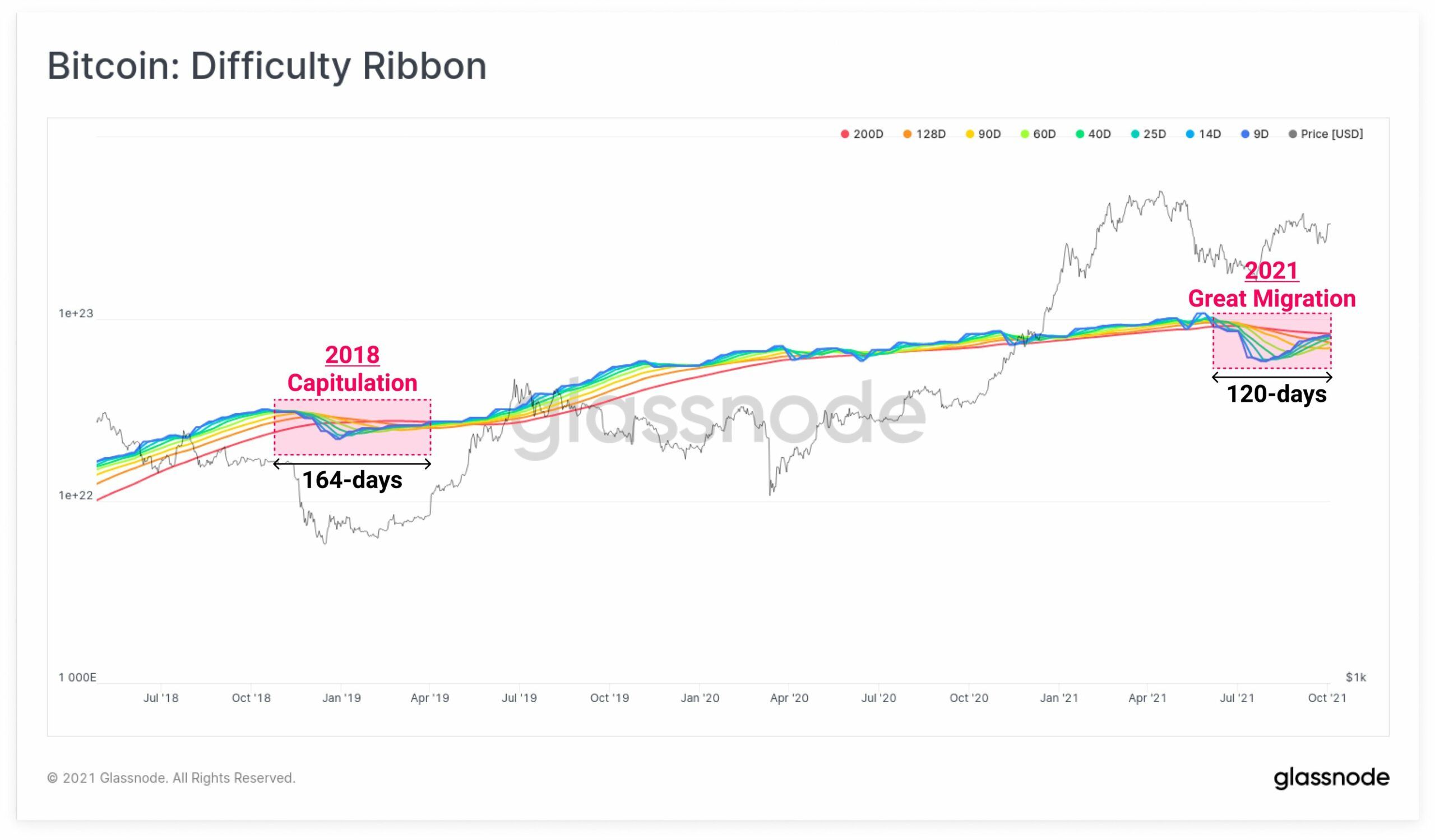

The Difficulty Ribbon indicator uses several moving averages (MA) of the difficulty of BTC mining. Their compression has historically been a good signal for buying Bitcoin. The creator of the indicator is Willy Woo.

In the context of a rebounding hash rate, on-chain analyst, @Negentropic_ tweeted a chart of the Difficulty Ribbon. He claims that the indicator “is soon to signal a positive recovery as more miners come back online”. He calls this process the “great migration”.

Moreover, the analyst adds that the drastic decline in the mining difficulty ribbon and hash rate of the Bitcoin network can be compared to a similar bear market event in 2018. Back then, a strong uptrend started after a positive signal from the ribbon indicator. It led BTC to a peak near $14,000 at the end of June 2019.

Sponsored SponsoredRecord on-chain transfers

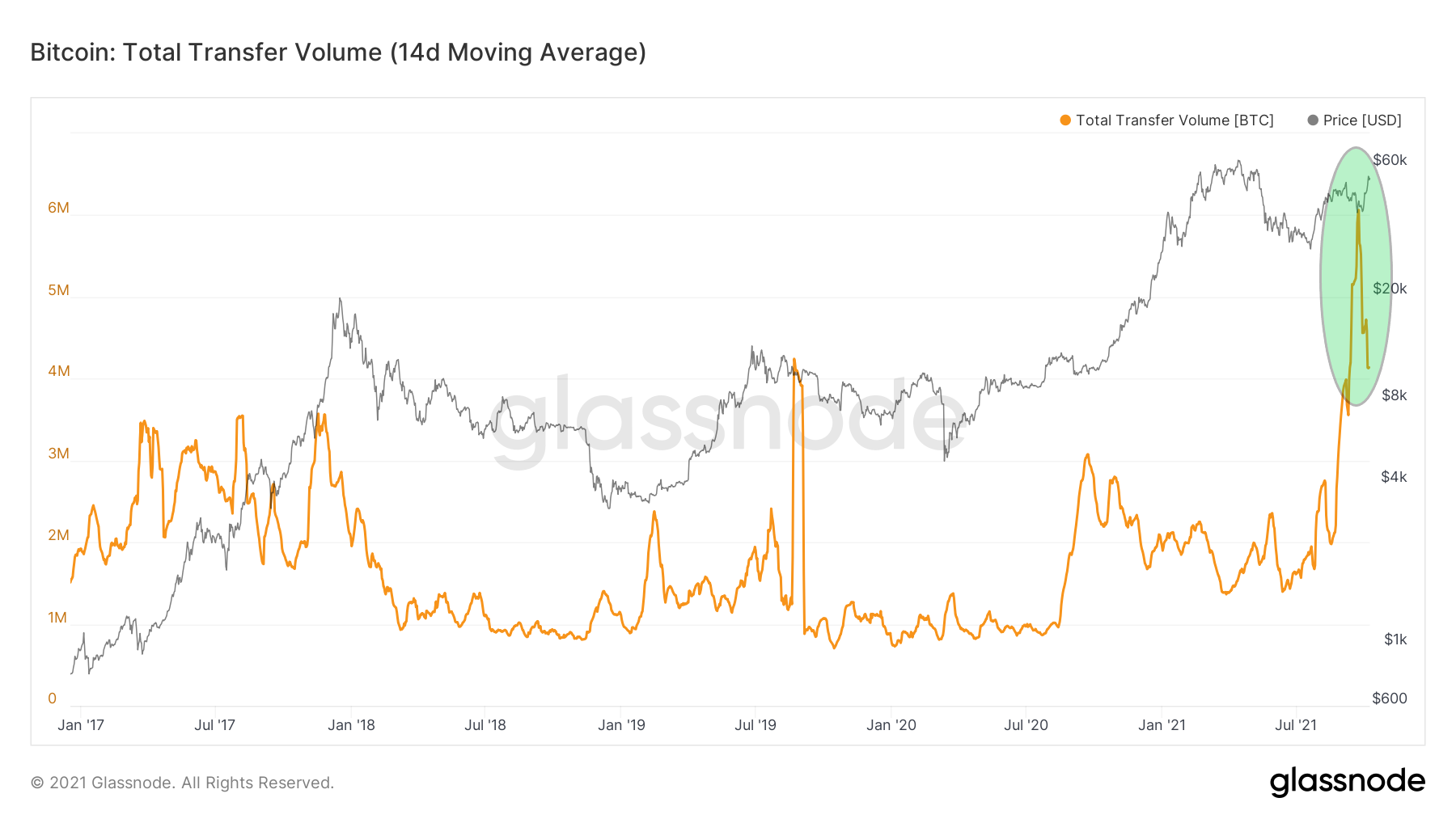

One more indicator looks interesting in the perspective of the rising price of Bitcoin and the hash rate of the network. It is the Total Transfer Volume recorded by on-chain data. The indicator counts the total number of coins that are successfully transferred over the network.

It turns out that since mid-September, this indicator has recorded a 5-year peak (green area), and the average amount of BTC transferred is about twice as much as in the best periods of the previous cycle.

What’s more, this is happening with declining trading volume on exchanges, as mentioned in the first section. On-chain analyst @mskvsk pointed this out in a recent tweet, commenting:

“Record amount of #Bitcoin have been moved last 2 weeks. Something’s brewing. Gun to head, ATH may happen sooner than we think.”

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!